August 30, 2017

Broken Record

Another Jackson Hole Symposium has come and gone. We are still in utter disbelief how many investors pin their hopes on actually learning something by deciphering speeches by Federal Reserve Governors. This year's speech, brought us a few new concerns out of the Fed, in particular their concern about regulations having an effect on market liquidity as well as the impact from "High Frequency" Algorithmic traders. There was the usual talk of "excessive optimism" in the markets, remember way back when in 1996 when the Fed Chair Alan Greenspan gave his infamous "irrational exuberance" speech. As you can see not much has changed, even in the twenty years hence, the concerns are still the same, a broken record if you will. Which brings us to the ultimate conclusion, if the Fed truly can't control things then why do they even bother massaging the markets? If the concerns are still, markets over heating or in rarer times, underperforming, why doesn't the Fed just let the natural forces of market clearing mechanisms do their thing?

By manipulating the cost of credit, by counterfeiting fiat currency and swapping it for real private assets, aren't they merely distorting the very fundamental signals that the C-Suite needs in order to make healthy productive capital and investment decisions? This is why so many are reluctant to buy into all of this asset price appreciation. Can we blame them for their hesitation? I think not, rather we understand your apprehensions and believe us they are well warranted. However dear reader, rest assure, the Global Central Re-Investment Banks (GCRIBs) hey can we coin that, can buy tremendous amounts of time.

We have talked at length of this very topic of buying time and that is truly the Fed's ultimate tool. We have had conversation after conversation with very intelligent investors, heads of business and they all seem to have bought into the Fed's ability to keep the party going. Yet they do so with a bit of trepidation, for they know not of the source of their lack of conviction, but know truly some things just don't add up. When you have massive amounts of stimulus, yes it will show up in asset price appreciation all things considered, yet what hides behind the curtain of all this QE and irrational monetary policy is a debt pile that continues to grow and grow unabated. Soon the fiscal debt bomb will be upon us once again here in the US and what will congress do? Does it even matter? Has it all just become one big DC circus show? Damn we have a lot of questions…In any case it is in our best interests to keep your wits in order, so that you are the most informed, the most up to date on the things that really matter. Yes we often write and speak in conscious and intended cynicism, especially when we speak of our GCRIBs, but we can't help ourselves, it's getting more and more outlandish as time goes on, and we think you need to know.

We are in full understanding of why it is the GCRIBs do what they do, they have too, they have no choice, there is no turning back. We get all that, but you dear reader must be made aware of the consequences of such actions. Many intelligent investors, Jeremy Grantham at GMO, John Hussman of Hussman Funds, do a very good job of reminding us how much value the GCRIBs have sacrificed from the future in order to realize it today. It’s a lot and value players know that there are times when things are cheap and offer a lot of future upside, and there are times when valuations are expensive and the risk of allocating capital may guarantee a negative return. It is in this very distortion, the one that cannot readily be seen or even easily quantified that many astute players are beginning to shed greater light upon. It is in these negative future returns, these risk imbalances, that concern us the most. This negative valuation outlook is a severe problem, especially when the size of the debt loads we have continue to compound higher. So what is one to do? We can't just sit on the sidelines and do nothing, we have to get in, we have to obtain yield, even if the risk doesn't warrant it, the Fed has left us no choice. Unfortunately this is somewhat true. The Fed and the GCRIBs control our markets and shape our investment choices, what do you think the intention of ZIRP was? It was to get you to invest your money in equities, to take risk, to punish savers, to punish thrift!

All is not lost, there is hope but you have to be patient, you have to be particular and as hard as it is, you have to think outside the box. We know all the rage is passive investing right now, but we can assure you, this will not last. The markets have been in a linear up trend for too many to remember what a bear market even looks like and thus consistency breeds complacency and we are afraid, too many have fallen for that trap. Don't be like the many, stand out and stand up and realize that if you can't actively manage your future, then someone else should, it's far too important! That is why we write the way we do, that is why we provide you with analysis that is alternative to the main stream, in hopes that you realize this game, this industry, is not very forgiving and that you must cultivate it like your perennial gardens.

The entire financial economic landscape is being manipulated and natural forces are being supplanted by tremendous amounts of financial engineering and coordination. Natural forces of supply and demand are being distorted by massive amounts of liquidity. This is leading to false investment signals that continue to drive speculative over investments and we know that this type of behavior always ends badly and that the day of reckoning does indeed always come. We have been lucky in equity land that the narratives of negativity only last a day or two, hell we think it's just mere hours sometimes. Look at what happened on Monday, North Korea decides to launch a missile right at 4pm CST. This happens to be when most if not all the global futures markets were closed. One market that was open however, was the US Treasury Cash market and here is how the US 10yr Note looked the second traders got wind of this missile launch:

A nice 13 tick run up in just a few minutes, with no where to hedge, with nowhere else to lay off risk, the US 10yr was the obvious recipient of investor angst and HFT speculative fervor.

Ok now this may sound a bit of conspiracy, but the timing is certainly suspect. Now that NK knows how the market handles its indiscretions, perhaps it has ulterior motives for doing such things. We have been trying to contemplate using game theory, exactly what NK has to gain from this recent surge in alleged show of strength. On one hand it could be appeasing the people of NK, showing country pride and power or two it could be using such antics to actually make some serious money. Think of it this way, if you are NK, you could simply accumulate a tremendous amount of puts, outright shorts and other options to profit from a lower equity market, as well as go long US bonds in a similar fashion, knowing full well any act like this will cause a particular set of outcomes. Call us crazy, but it really is that easy for NK to make a few extra bucks. Now is it worth it, are they doing that? Who knows, but it makes the case for a plausible explanation, and certainly makes more sense than flexing muscles and hoping for a provocation. Anyways, we wish we had advanced knowledge of such things, sure would make trading a whole lot easier!

The futures markets reopened at 5PM CST and the obvious move was for equity futures to fall and bond futures to rise, which they did, for most of Asia and Europe and even into the open of the NY session. However per the usual MO, the equity markets started turning around right on the NY open, in almost perfect FU fashion to all those that panicked and thought that the GCRIBs didn't have your back. Norway's SWF is approaching nearly $1 Trillion US dollars, a tremendous amount of capital. They hold nearly 65.1% of its assets in global equities. So you see dear reader, its these types of players that can come in and swoop assets up like its nothing, an NK missile is no match for these guys, in fact they probably welcome the volatility to buy on the cheap! In seven months the SNB (Swiss National Bank) bank $20 billion worth of global equities, putting their total to $84 billion! So a lot of time is being bought, this we are certain of!

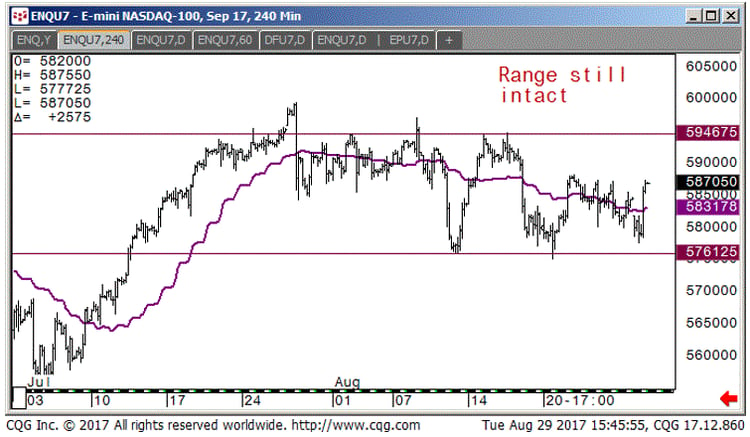

So given the North Korea action, the markets over reaction and in anticipation of this month's Non Farm Payroll report let's see how the charts stack up. First up lets go to equity land where the reversal of fortunes is most notable, here is the Nasdaq Future which continues to bounce within the last months range:

Next up is the SP500, as you can see every subsequent sell off has been followed by consistent buy programs:

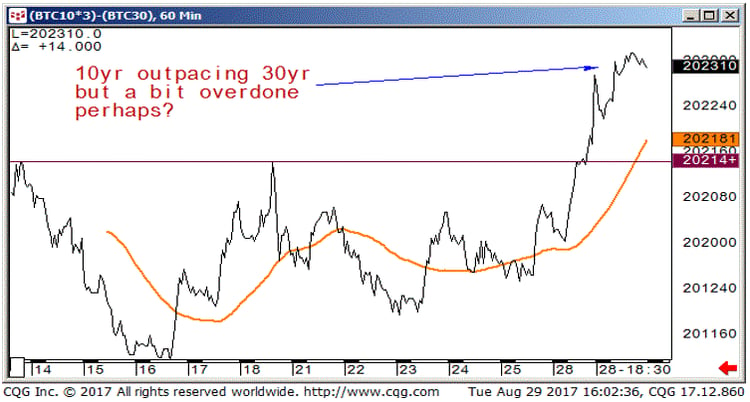

Moving over to the US 10s30 yield curve, where it was obvious the 10yr sector was a big beneficiary of the action. As you can see it popped up after taking out the 3 higher tops denoted by the horizontal line. These blow off tops are usually followed by some profit taking, but will see if it transpires:

Moving to the US 10yr yield chart there is a potential double bottom forming which may portend to predict a stronger NFP report this Friday, which would send yields higher:

Silver is having a good run here butting up against a downward trend line which should give us a better handle upon direction, either breaking above or rolling back over:

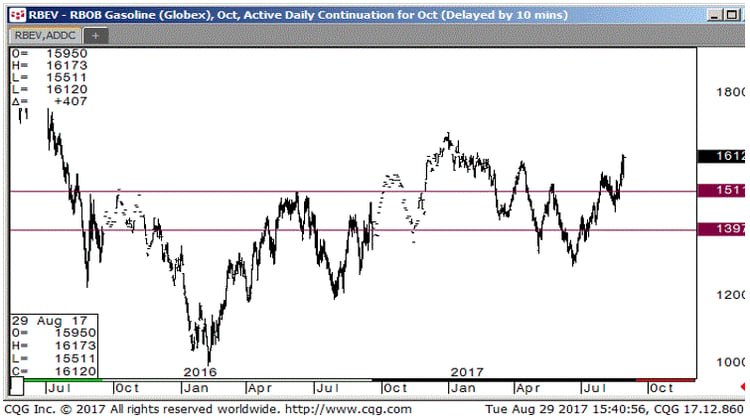

Our final chart is Gasoline Futures or RBOB. The hurricane that hit Houston has caused the contract to race to new highs as refinerys may not be able to generate enough supply and remain below general output levels for some time. Our thoughts and prayers go out to those that have been directly affected by this natural disaster that continues to pound the area with rain. The front month contract is approaching 2017 highs:

Ok we thank you once again for allowing us to infiltrate your minds. We hope you enjoyed this week's edition. We will continue to bring you alternative viewpoints and we hope you continue along with us. The markets and the world in general seem to be moving at warp speed and sometimes we feel that by taking the time to write down our thoughts and put together a cohesive informative piece, allows us the flexibility to make order from all this chaos. Till next time, and as always we leave you with the settle prices from last Friday, Bitcoin continues to impress and is up some 356% this year and don't look now, but Gold is approaching the all important $1300. We feel a consistent settle above there may propel it to new highs again: