April 25, 2018

In The Midst Of Chaos There Is Also Opportunity

Well, folks we finally had temps reach near 60 degrees in Chicago, a sign that maybe the cold wintry claws of winter are finally losing their grip. Chicago is a beautiful vibrant multicultural city and summers here are awesome along the expansive Lake Michigan shoreline. The winters however can be brutal, but it seems they seem to define our gritty Chicago nature.

However, it seems that if summer is getting shorter and shorter, maybe the sun has something to do with it. We have been hearing about the sun now moving into a “Maunder Minimum,” named such by John Eddy a solar scientist in 1976 and after E.W. Maunder an English scientist who first noticed a decrease in solar activity in the late 1800’s.[1] This decrease in solar activity will lead the climate here on Earth to cool, not heat as all the “global warming” crowd has been so adamantly insistent upon. Why are we discussing this? Why does this matter? Because from the long-term viewpoint, we want our readers to know that the climate effects commodities and energy and thus a major driver of resources in the coming years. We have already heard Jeff Gundlach’s bullish opinion on commodities and we have highlighted it for quite some time now.

We think this topic of weather volatility and cooling will have a profound effect upon global productivity and resources, so we firmly believe our readers should begin to look at commodity driven investments whether it be in futures, ETFs or other various funds. Speaking of Gundlach, in his monthly webcast to clients last July, he spoke highly of commodities and his bullish outlook for the sector.

We think this topic of weather volatility and cooling will have a profound effect upon global productivity and resources, so we firmly believe our readers should begin to look at commodity driven investments whether it be in futures, ETFs or other various funds. Speaking of Gundlach, in his monthly webcast to clients last July, he spoke highly of commodities and his bullish outlook for the sector.

For those that don’t know, when titans like this speak of a position they like, you can bet your bottom dollar that they are already in. So, when you look at the following chart, please note the lows in June of 2017 and follow the movement from July onward. We have long considered Jeff Gundlach the EF Hutton of the modern age, we feel you should too. (For those of you too young to remember the EF Hutton commercials from the 70’s and 80’s, we have one Here) Ok let’s look at a daily chart of the PowerShares DB Commodity Index Tracking Fund (DBC):

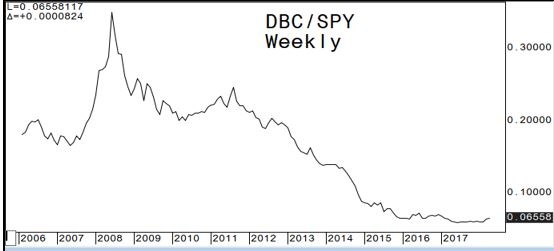

Obviously, this is a longer-term viewpoint and in no way suggests a straight up decade long linear driven central bank style equity run up. Commodities are fickle things, subject to a plethora of supply, demand aggregates, so realize that longer term we are bullish, but shorter term, better locations to get in, may be had. Dave Wienke over at Keystone Charts gave us a few goodies to analyze, so here are his charts on the DBC:

The chart we really liked, considering we are in the alternative asset space, was the following chart which depicts the DBC vs the SPY or equity complex, it is interesting to note that despite the run up in equities, the DBC has not lost ground and we suspect the next move is setting up quite bullishly for the DBC and other commodity driven funds as well:

So, this type of analysis is indicative of the thought process we strive to convey to our readers. We try to correlate things in the short term to have a viewpoint far into the future. This type of analysis is at the very foundation of how we approach the global market place. We deem it a fundamental construct that is imperative to refining our investment and trading thesis and one by which is necessary to achieve long term success. We abide by the mantra that if you don’t know where you are headed, you may not ever get there, it’s a bit esoteric, but you get the gist of what we are saying. For further clarification we quote Sun Tzu from The Art of War, a must read for any trader, “In the midst of chaos, there is also opportunity.”

Moving on to other news before we check the technical charts of other markets, this week Wells Fargo announced the largest settlement levied by that Liz Warren pet project known as the Consumer Financial Protection Bureau as well as the OCC. The fine was marked at $1 billion, which is nothing more than a slap on the wrist, once again nobody goes to jail, just another subsidized fine for the bank so beloved by Warren Buffett himself. Who cares about duping customers or opening millions of fraudulent accounts, sounds like too big to fail, is too big to punish now also.

WSJ reporting that the Trump tax cut boosted major banks earnings collectively by more than $2.5 billion (subsidy) in Q1 alone, Goldman was an outlier as trading income grew by 23%, and who says volatility isn’t good!

The Justice Debt approved the $62.5 billon Bayer acquisition of Monsanto, combining pharma, chemicals, pesticides and crop gene technology – So let us get this straight, we are combining drought resistant seeds, with pesticides to kill the bugs that eat the seeds, which then contaminates our food, which we eat, because they say its all safe, then provide the drugs for us when we get bowel pains and other diseases – yep makes sense, cover all the bases from table to deathbed…wait that’s too harsh.

The Federal Reserve is proposing to lower capital requirements for the GSIBs (man do they love their acronyms) or Globally Significant Banks – What they really mean is the Banks and their lobbyists are trying to figure out how to capture wider credit spreads so they have more loans to charge consumers more interest or in layman’s terms, INCREASE their profits via higher interest charges, while increasing their own internal LEVERAGE and RISK and when they fail again, its tax payer bailout time, can’t lose strategy!

Locally, according to CBRE local Chicago retail vacancy rates hit an 8-year high jumping to 11.4% up from 9.5% in Q1 – landlords always amaze us on their resiliency to lower rates, they’d rather sit vacant as per square foot charge sits at $18.66 a 10 year high according to Crain’s Business

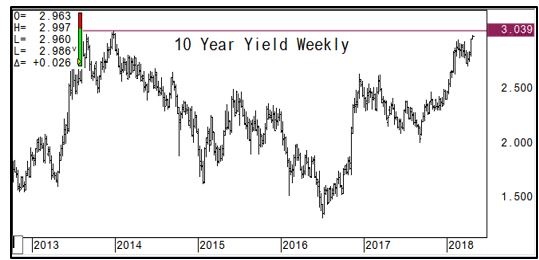

Ok let’s move onto the technical charts and we will focus on the US 10-year treasury note which is in spitting distance of the all eyes on level of 3%:

What we are looking for here is a spike above and rejection back below. We all know interest rates can’t rise too far, as the math would destroy the US from within and force nearly a trillion dollars in interest payments per year. So, we should expect the yield curve to bounce as the long rates rally, but to resume their flattening bias as the US yield curve marches closer and closer toward inversion.

The next chart is the yield spread between the US 10-year and US 2-year treasury notes. As the Federal Reserve continues to hike, which we believe to be just 2 more times this year and then done, this yield spread should continue to fall. Danielle DiMartino Booth and Mark Yusko were on Anthony Crudele’s podcast this past week and they agree with the 2 and done thesis. Anyway, here is the chart of the US 2s10 yield curve spread, which depicts the recent up move because of the long end sector selling off, but we expect the down trend to continue shortly:

As far as the long end, depicted by the US 30-year, we can see that 3.25% seems to be logical and would coincide nicely with a rejection of the 3% 10-year yield level:

Moving over to the US Equity index arena we can see the SP 500 future has backed away from the low 2700 area we targeted and is now rotating lower again 2607 is yuuggee:

We talked last week of the German Dax index possibly dragging US indexes higher as it reached for the 200-day moving average, well it did and it has since been rejected:

Apple Inc. has been hit hard lately as peak smart phone has found their price ceiling, we noted our bearish outlook on Apple back in Q4 2017 as fundamentals were not in line with the firm’s rosy expectations. We noted peak ceiling price would see insufficient demand as well as highlighted their sole reliance on the Iphone itself as its main income generator. Without new tech, we find Apple will continue to struggle. Yes, we know they have a ton of cash, on net probably around $200 billion, but considering their costs, R&D of $10 billion a quarter, it goes fast. Competition is fierce and only gets harder as you fail to innovate. The SNB (Swiss National Bank) owns 19.14 million shares and counting, so keep an eye out on this one, should get interesting…Let’s see if the Iphone 8 Red edition helps, we highly doubt it, but it looks cool, but will the followers, follow through with buying, we doubt it?

Here is the chart of Apple Inc., $147/150 seems logical here, but $125 ultimately:

Finally, our last chart is of Bitcoin, which has risen quite steadily and something we have alerted our readers to over the last 2 weeks. If you don’t read our CryptoCorner you should, because Crypto is going to be a force in terms of alternative asset classes and we will educate you on this subject. Ok here is the chart of Bitcoin which is up over 46% from its lows a few weeks ago trading $9393:

That’s it, we leave you with the weekly settlements from trade date Friday April 20th. You can see equities had a nice bounce and US treasuries were hit, Crude continues to shine up nearly 14% on the year, further advancing our commodity bull stance, cheers!

[1] https://www.nytimes.com/2009/06/18/us/18eddy.html?_r=0

commodities and his bullish outlook for the sector.

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market iliquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.