May 1, 2018

Shouldn't We Be Concerned About Electrical Magnetic Frequency Radiation?!

We must start out this week’s letter, with what may be the most historic moment thus far in terms of president Trump’s tenure as president. There is no doubt in our minds that the United States played a very key role in North Korea’s Kim Jong Un and South Korea’s Moon Jae-in’s meeting at the DMZ in Korea this week. With what is an absolute historic moment as North Korea’s leader set foot over the demarcation line and onto the South Korean side for the very first time. They are currently discussing the prospects of peace and denuclearization, which has probably taken the entire world by surprise. This is an absolute historic moment and we are hopeful that peace does indeed prevail. If the deal is successful we are confident that many will be clamoring for POTUS to win the Nobel Peace Prize.

We must start out this week’s letter, with what may be the most historic moment thus far in terms of president Trump’s tenure as president. There is no doubt in our minds that the United States played a very key role in North Korea’s Kim Jong Un and South Korea’s Moon Jae-in’s meeting at the DMZ in Korea this week. With what is an absolute historic moment as North Korea’s leader set foot over the demarcation line and onto the South Korean side for the very first time. They are currently discussing the prospects of peace and denuclearization, which has probably taken the entire world by surprise. This is an absolute historic moment and we are hopeful that peace does indeed prevail. If the deal is successful we are confident that many will be clamoring for POTUS to win the Nobel Peace Prize.

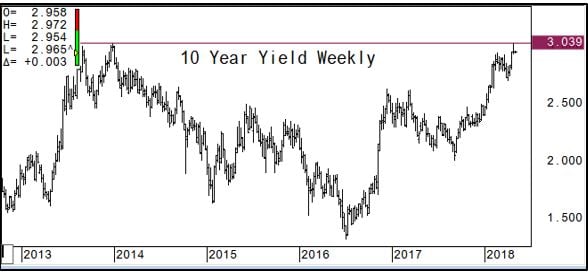

Are rising debt levels in the United States and the corresponding rising interest rates part of the #MAGA policy or merely just a byproduct of it? Many economists would consider rising rates a necessary adjustment to our rising levels of debt because rising debt levels are generally perceived as making one’s creditworthiness “riskier.” We suppose that theory does hold true, but we must also consider the fact that this comparison is done knowing full well that it will make US treasuries no longer the “risk free” asset benchmark they once were.

Now we know that in economics or at least in the kind of economics whereby free central bank monetary spigots are not constantly left open, that a higher debt level does often mean more risk. This however doesn’t allow for much flexibility and we would rather assess things from a more comparative lens. What do we mean? Well is Spain at more risk of paying back its debt or is the U.S? Consider this, the Spanish 10yr rate is 1.28% compare that with a 2.96% US rate. You get our point, what this tells us is that there are very large bets being placed that US rates continue to rise and maybe some of that is dollar related, maybe investors need to be compensated for currency loss or dollar weakening.

We know the bets banking on higher rates is huge and the contrarians we are think that a wash out needs to occur before rates can continue their ascent. Seems too easy to just sell U.S. 10-year rates, is kinda what we are saying. Going back to the #MAGA movement, maybe higher rates are all a part of making the dollar stronger again, is it safe to assume that eventually the singularity exists by which investors will flock to U.S. debt or where risky assets just don’t make sense at a given level of 10-year yield? We aren’t saying we know where that magic level is, rather that the FED seems hell bent on finding that out! With short term rates up exponentially over the last year, we would suspect that 3-month T-bills are becoming increasingly the investment of choice and levels suggest that this term premium suggests short term market risk is high! So, to all our traders out there, if the equity market does plunge, we would suspect the yield curve to spike not flatten and spike considerably.

We know the bets banking on higher rates is huge and the contrarians we are think that a wash out needs to occur before rates can continue their ascent. Seems too easy to just sell U.S. 10-year rates, is kinda what we are saying. Going back to the #MAGA movement, maybe higher rates are all a part of making the dollar stronger again, is it safe to assume that eventually the singularity exists by which investors will flock to U.S. debt or where risky assets just don’t make sense at a given level of 10-year yield? We aren’t saying we know where that magic level is, rather that the FED seems hell bent on finding that out! With short term rates up exponentially over the last year, we would suspect that 3-month T-bills are becoming increasingly the investment of choice and levels suggest that this term premium suggests short term market risk is high! So, to all our traders out there, if the equity market does plunge, we would suspect the yield curve to spike not flatten and spike considerably.

Speaking of yield curve spikes, last week Zerohedge noted that someone put on a massive $4.7 million DV01 futures trade, buying US Five Year notes and selling US Ten Year notes (.638 ratio) and simultaneously selling German 5-year BOBL and German 10-year BUND futures (.446 ratio) This trade is a bet that the US yield curve will steepen and that the German 5-year will underperform the German 10-year. The way we see it is this is a bet on BUBA (The ECB), that they finally remove QE and cause a spike in German short-term rates. We suspect the player expects that move NOT to transcend overseas into the U.S. yield curve market. Either way it seems like a safer way to bet on continued higher rates globally as opposed to just the U.S.

Speaking of Germany, the ECB met last week and did absolutely nothing, same statement and everything, way to work for your counterfeiting money!

Facebook reported a quarterly per share profit of $1.69 up from $1.04 a year ago and revenue rose 50% to $11.97 billion. Net income was up a huge 63% to $5 billion up from $3.06 a year ago (WSJ)

Sprint and T-Mobile finally announced an all stock deal merger last week. WSJ reports that 9.75 Sprint shares will be exchanged for each T-Mobile share. Using closing prices from the 27th, this deal values Sprint at $59 billion and a combined company enterprise value of $146 billion. Deutsche Telecom will own 42% and SoftBank Group 27% (DT is the parent company of T-Mobile) We love all the talk of T-Mobiles push for 5G and the benefit to the consumer. What we don’t get is that nobody and we mean nobody is studying the radiation effects of all this EMF (Electrical Magnetic Frequency Radiation) we are putting it on every street corner, in every building, in all our schools and nobody is concerned about the amount of radiation is being emitted.

Everyone talks about cancer as such an epidemic, and we toss billions into organizations that raise money for its awareness. When is the last time you donated to a nonprofit that studies the effects of radiation emission from wireless transmitters? Yet we are to believe the consumer is going to benefit…yea right benefit alright by being slowly fried. For those that think this isn’t a real concern, think cigarettes circa 1940 and how they and the companies that made and distributed them are viewed today!

In other more positive news, US GDP grew at 2.3% in Q1 higher than the expected 1.8%, to $17.4 trillion. This did give a boost to the US Dollar, which has run up off its lows. Perhaps the higher rates are drawing some in, but we feel that it’s more a product of too many US Dollar short bets. BofA analysts are pushing a short Euro trade, so that is helping the dollar as well. It was also reported that Share repurchases were up 43% compared to last year, so if anyone was wondering what holds up the market, well, that should give you a little bit of a clue.

On the flipside of those buybacks, the Investment Company Institute reported last week that US based equity mutual funds and ETFs saw $2.4 billion in outflows for the week ending April 18th. That follows a $41 billion record outflow in February which was the largest such move since Jan of 2008 (WSJ)

Twitter posts its second consecutive quarterly rise as revenue rose 21% yoy to $664.9 million which translated into $61 million in profits and 8 cents a share WSJ reports

Amazon posted huge numbers with net income rising 125% yoy to $1.63 billion, which amounted to a $3.27 per share number nearly 1.6x higher than the expected $1.27. Operating income was up a whopping 92% yoy to $1.9 billion which was nearly double their guidance number, AWS sales up 49% to $5.4 billion and subscription services were up 60% to $3.1 billion…All these great results, but the people should know that Amazon paid exactly “ZERO” income tax for 2017.

Sony Corp reported its highest ever operating profit of $6.7 billion on the back of its video game business (Playstation) both in console but even more so in subscription-based services. Sony is also seeing increased sensor business related to the camera’s in smartphones. Sensors continue to offer huge potential and Sony is making great progress there.

Freddie Mac launches 3% down no income restriction mortgages, yes, we have truly learned nothing, we have seemingly come full circle from those 2007 highs. No really you can read about it Here

Avengers: Infinity War broke the weekend box office record raking in $83 million on Saturday and a whopping $250 million weekend total.

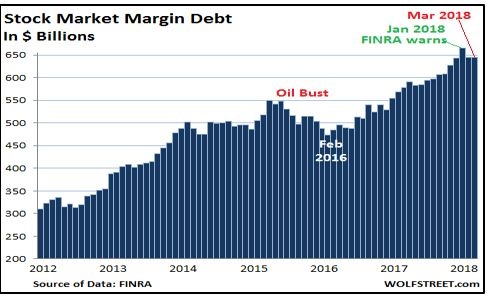

We saw a great chart on stock market margin debt, what were we thinking, you ask? Well equities never fall so no worries, smooth sailing, right? No honestly, we were thinking it was a chart of sustainability, cough, cough, anyway you can see the trend:

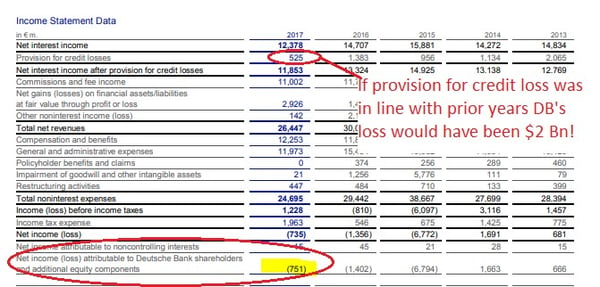

We read a report from Deutsche Bank this week about the likely hood of the US having a debt crisis, although we couldn’t disagree that much, they were highlighting investors to watch the auctions to see how foreign demand is, if it starts to fall off, rates may have to rise further to attract sufficient buyers. While we are on DBank, we analyzed their income statement and we thought it odd that their provision for credit losses was lower than previous years. We felt this was not consistent with the outlook, given the current economic expansion is already past historical norms, but what do we know. Anyway, we figured their loss for 2017 would be over $2 billion if it just kept consistent with prior year’s loss provisions. Here is a chart for your referencing pleasure:

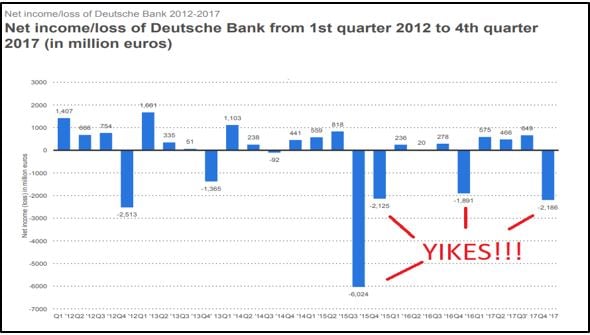

DBank has also had a consistent track record the last few years of dumping all over their prior quarter’s earnings, let’s look:

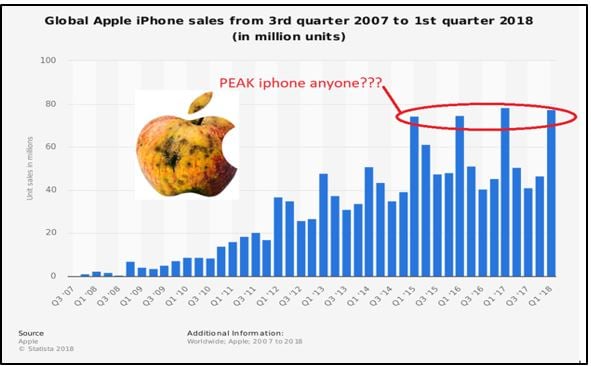

Another company we have been hard cider on is Apple, but these charts are too telling and when you rely on one product, well, we hope you elaborate your offerings:

Ok that’s it for the news, let’s get to the fun technical, we caught a few late charts so let’s look at those first. With Israeli PM Netanyahu stating he has docs that prove Iran is secretly pursuing nukes, Crude oil had a field day on the news jumping $2 off the lows. $70 is key and we suspect any trade above will run stops:

As for the SP500 2655 beckons and as a technical level should bring out the buyers:

Charts from the weekend, include this one of the Dow showing 24428 as key resistance:

As for the U.S. Government 10-year yield chart 3.04 is huge and a close below 2.92 may suggest a short-term top is in:

The U.S. Dollar has significant resistance at 91.90/92.40 area and we would suspect heavy sellers at first:

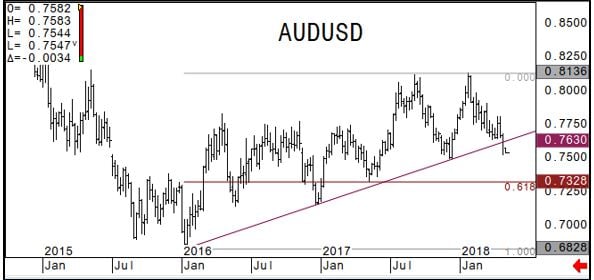

On the Aussie Dollar, now that 76.30 has been broken, 73.28 seems logical, but only for a range trade extension:

As for Copper its being wedged by the 200 day and the 4-month resistance trendline, 3.07 should provide a fake out sale and renewed surge toward 3.17:

Finally, Gold is nearing the all-important $1313, we expect buyers to defend this area:

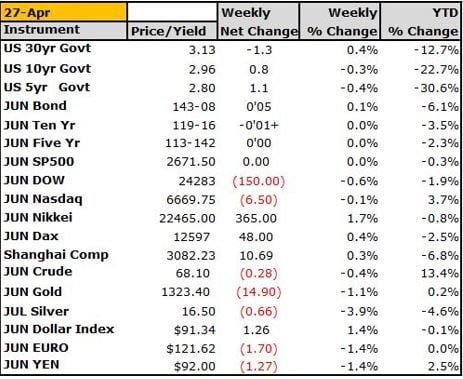

We leave you with the weekly settlement prices, as you can see, Crude continues to be black gold and the U.S. rate complex the laggards by far. Ok, hope you enjoy the week, maybe here in Chicago we can finally bust out the shorts and short sleeves. It’s kind of funny around our neighborhood, it’s like everyone comes out from hibernation and you get people walking around the streets, playing outside, conversing, a constant reminder that no matter how much things go digital, nothing compares with having a drink outside with your friends, family or neighbors. Somehow, we wish more time was spent enjoying others and their stories and attending to the basic human need of interaction, cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market iliquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.