October 25, 2017

The Real Reason Spain Can't Afford Catalonia to Leave

As usual we comb the globe in search of pertinent information that you may otherwise, never have been exposed to. Information that we can read and decipher in order to bring you the type of research you have come to expect from us, out of the box and certainly out of the ordinary. Anyway this first batch is from a recent piece from Amundi Asset Mgmt, a subsidiary created by Credit Agricole and Soc Gen. This recent piece they put out highlights, how important the ECB has been in soaking up European government debt and thus artificially keeping rates extremely low. This mechanism has become the defacto methodology of choice by our QE frenzied central banks. We have talked at length in prior letters how this drives down long term interest rates, drives up the nominal price of assets and in turn allows for otherwise defunct and broke corporations and governments themselves to refinance their way back to solvency. You see we didn't use the term health, because the solutions the central banks have used is anything but a cure, but rather a placebo to mask the true and inherent problem, DEBT. As many have stated before, only Keynesians think you can solve a debt problem with more debt and obviously since all fiat money is also nothing more than debt, well, you really aren't fixing anything then are you?

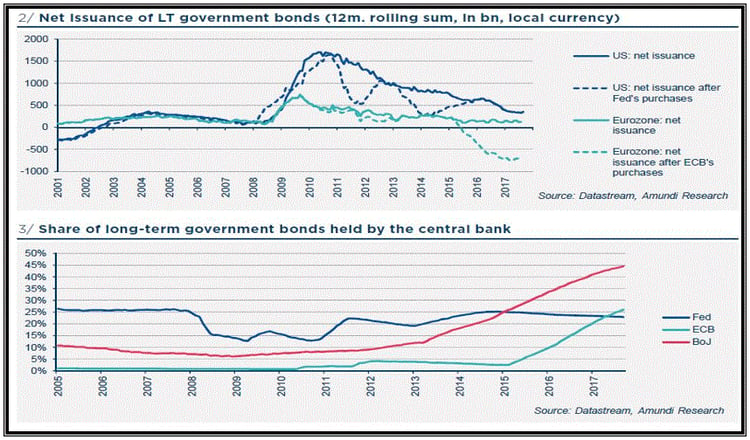

Anyway, Amundi shows in The top chart just how much the ECB has taken down, in terms of net issuance, you can see that it has bought above and beyond to the tune of €681bn Euros worth, meaning its taking down not only the current issues but €681bn of long term bonds outstanding as well. This is something the FED never did, in fact if you look at chart below entitled "Share of long-term" you will see the FED merely brought their QE purchases back in line with the prior percentage ownership, which was near 25%. You can also see how much the BOJ has ramped up since 2013 as well as how much the ECB has ramped up since 2015. So when you try to figure out whether or not the FED and its small incremental hikes, or its balance sheet reductions are going to have a large impact on things, just remember there are two other central banks willing to take the other side:

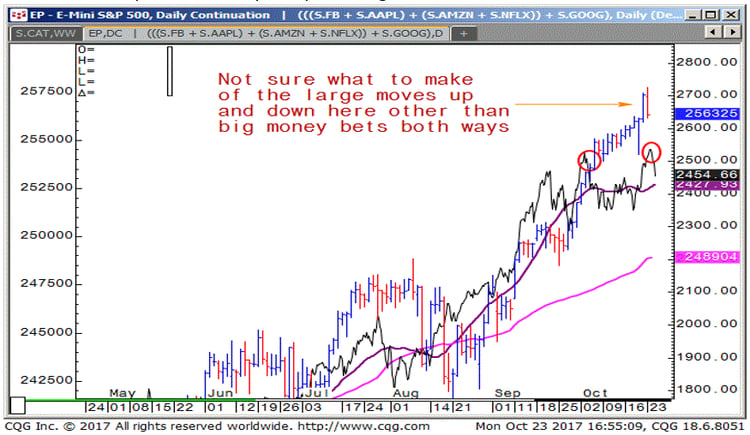

With all this stimulus still being provided, this next chart should not surprise many, in fact considering the huge outperformance of the US equity market comparatively to the rest of the globe, you begin to see where all the excess capital from our foreign central bank counterparts are being funneled:

We hate to insinuate that fact that large institutions seem to be selling out to the retail (always late to the party) here in this last leg up and further price gains which are obviously supported by the other central banks, however, how long can this relationship last?

Will the FED continue to raise and tighten short term funding? We feel the price action has been a bit erratic and we can probably attribute this to a lot of large players selling out to weaker retail hands, to only be bought from even stronger handed central banks. This charade has been going on for some time and we question not only the validity, but the longevity of such a process.

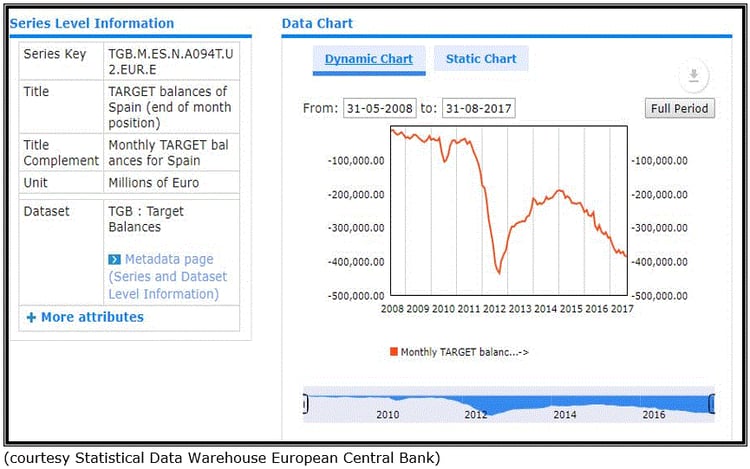

Over the weekend, we had the privilege of speaking with a Catalonian/Spanish national. He was very quick to point out the fact that his region merely wants a peaceful resolution and that for all intents and purposes, they will most likely pay their way to freedom. I said good thing because BUBA (Bundesbank, ECB) will eventually want their money back. Here is the chart of Spain's liability via Target2, which sits around €381Bn:

So as to the real reason Spain can't afford Catalonia to leave, well there you go? The next few weeks will be interesting and we feel that this maybe one of those black swan type events, which 99% of Americans, and probably Europeans have no idea about!

Speaking of the SP500 and its recent bout of range extensions, the following chart showcases this pretty well. We put it up against the FAANGs as well to show you a potential double and maybe even a triple top forming:

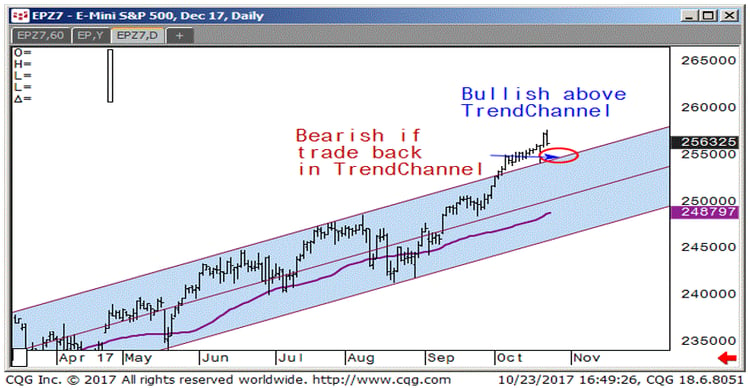

One thing is clear here in SP500 land, the prior trend channel has been breached and only a trade back into it will negate this recent break out, so we will keep a close eye on that:

All the talk lately about yield curve compression and over valuation in the long end. Even the likes of one of our favorite bond players, Mr. J Gundlach has recently stated his distaste for the future prospect of the bond market, well especially the European market. Hey we can't blame him, when Spain enjoys the same rate as the US in terms of 10yr notes, well we hate to say it, but he's right. Here is the thing though, we all know the demand is artificial, but that doesn't mean it's not effective. Fighting central banks has been a losing proposition, that is, till it's not. Even for the venerable Gundlach, he knows his adversaries well and even he must remain humble. Anyway here is a look at the current chart of the US 10yr yields. We feel a double top is possible with the all important 2.40% level being the catalyst for a further probe higher in yields if breached, or a roll back down to 2.20% may be in order:

We also received an interesting technical chart from our favorite analyst Dave at Keystone, if you don't get his stuff, well, you should. Anyway, he is big on pair trades and correlations and thus his chart paints a very nice picture, at least we think it does and thus you should take notice if this trend line gives way. The chart is a long of both the SP500 and 30Yr bond, or reflation trade we like to call it:

Ok let's move over the Bitcoin where it has been under attack from many lame stream pundits and the likes of Jaime Dimon and especially those governments who, know full damn well, their fiat constructs are at risk (As if the debt levels haven't already sealed their fates). We thought Adam Ludwin of Chain had the best response to Jaime Dimon. It’s a must read for all our readers and we can only highlight a few points Adam laid out:

*Crypto currencies are a "NEW ASSET CLASS" that enable decentralized applications

In fact he made the following observation to better outline what he means:

-Corporate equities serve COMPANIES

-Government bonds serve NATIONS, STATES AND MUNICIPALITIES

-Mortgages serve PROPERTY OWNERS

and finally Crypto Currencies serve DECENTRALIZED APPLICATIONS

His full article can be found Here

Many fellow camp members were quite inquisitive and we summed up Bitcoin as this, "it exists everywhere and nowhere!" Yea it’s a bit Matrix like, but hey they got the point. We said it’s a call option on the future degradation of fiat currencies as well as and more importantly on a technology whom we have only begun to scratch the surface as to its uses. They kept asking why it was so expensive and we said, price in fiat is insignificant. We said think about never converting it to fiat, but keeping it as is, to only realize the value when the right time comes. It costs $5500 now and our downside is known, what's really exciting is thinking about where it will be 5 or 10 years from now and what it will look like and where the utilization may lie. We would rather people ask, why are so many willing to pay nearly $6k for one. We said the validity of Bitcoin and the effectiveness lies in the adaptation by the broader market place, we said it got to $100 billion, there's no reason it can't get to $1 Trillion in market cap. Anyway the dialogue was constructive and we stated our facts and will leave the masses to determine what is right for them, you know where we stand. All we know is the globalists hate, even despise the word "DECENTRALIZED", which makes us love it even more!

Ok that's it, as usual we leave you with the weekly settles where some very interesting levels are being tested. Most notably that 2.4% level in US 10yr yields, 2575 in the SP500 and $6000 in Bitcoin. As always we strive to bring you the most up to date information and will relay it and convey it as we see it. Thank you for staying the course and we hope you continue to enjoy our weekly note, we hope it inspires you to research further, to dig deeper, to enhance your investing prowess and expand your knowledge base. Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.