September 20, 2017

Utmost Disdain for Central Bank Manipulation

We have often joked for years now how the central banks have artificially supported markets. Prior to 2008 it was just a myth, this PPT or Plunge Protection Team, well now we don't even joke about it anymore as fiction has indeed become fact. The joke is so much ingrained in reality that now the commoner just accepts central bank intervention, no longer as an exception, but rather the rule. These developments for anyone that has actually participated in the free market, built something from nothing, worked and maybe failed, are nothing more than a big FU slap in the face. What the central banks are telegraphing now is, hey we don't care about hard work, we just care how much leverage and interest we can partake in. Hard work, that’s for fools!

We have often joked for years now how the central banks have artificially supported markets. Prior to 2008 it was just a myth, this PPT or Plunge Protection Team, well now we don't even joke about it anymore as fiction has indeed become fact. The joke is so much ingrained in reality that now the commoner just accepts central bank intervention, no longer as an exception, but rather the rule. These developments for anyone that has actually participated in the free market, built something from nothing, worked and maybe failed, are nothing more than a big FU slap in the face. What the central banks are telegraphing now is, hey we don't care about hard work, we just care how much leverage and interest we can partake in. Hard work, that’s for fools!

Obviously we say this with the utmost disdain for central bank manipulation, then again, speaking against such forces has become blasphemy. Who wants to hear whining about a 20% Nasdaq return, not me says the fool with his head buried in the central bank sand. We love the oasis central banks have provided and if you think it’s a mirage, well then, you are the greater fool. Don't be a hater because you lack the conviction to invest blindly with all disregard to actual free market fundamentals. This is the mentality that the age old fundamental and realist are up against. A herd that is so blinded by the actual outright real risk that they continue to invest uninhibited.

Risks what risks? Risk is so, oh yeah, passé! Consider the now constant influx by retail investors into passive ETF equities. Who needs professional management and all their fees when we can just park our cash in low fee index funds. What could possibly go wrong? We get a bigger bang for our investing buck, diversification and lower fees, why pay 2 and 20 when we don't have too.

Repetition has a funny way of forming habits, unfortunately good habits are ingrained in the exact same way as bad ones are. By constantly relying upon central banks ability to fund monetary and fiscal policy, governments have now become the real risk. Vix, etc and all the other fine tooled measurements are calculating market sentiment risk, but no where have we seen government risk accurately measured. Yea there are global CDS markets on specific countries debt, but how accurate are they and who actually trades it anyway for any real size? So how will this new paradigm change the face of investing and quantifying risk? We aren't really quite sure but there are a few themes that we know we can hang our hats on:

- Equity markets are no longer and haven't been driven by global macro fundamentals, rather they are driven slowly by trickle down cheap levered financing via CENTRAL BANK AND Sovereign Wealth Fund intervention.

- Government debt levels will continue to grow at an ever increasing rate which will put funding pressure directly onto the shoulders of native central banks. Risk is firmly in their hands and who will bail out the central banks when the time comes?

- Currencies or FX will continue to see volatility as native central banks tight rope varying interest rates and quantitative easing adjustments. The weak dollar is a theme we see growing in sentiment over the coming years.

- Balance sheet reduction is a myth and is predicated on two fronts, one, a lack of eligible bonds for central banks to purchase and second, it’s a stealth way to tighten without actually raising the Fed Funds rate.

- Global equity markets will continue to be driven by central bank and SWF flows as well as what we call margin compression via debt for equity swaps as well as inter market consolidations financed by an insatiable appetite for yield starved Private Equity.

The bottom line and what we decidedly take away from all of this is, no matter the large bearish fundamental base, the markets continue to be stretched like a rubber band just waiting to snap. We aren't as bearish as the fundamentalists, but we aren't idiots either. We know we can continue to ride the bullish wave as long as every native central bank plays ball. The minute one defects, well then, it will be time to readjust, but now is not that time! We will know when that time is, some bank will act in some surprising manner, maybe the FED raises, maybe they cut the balance sheet more than expected, maybe the ECB stops QE altogether, maybe the BOJ even raises rates, who knows, but we will let you know as best we can.

Anyhow, we have the Fed this upcoming week, it is highly anticipated the chair will begin or at least infer that the time has come for some balance sheet roll down. The market doesn't expect any surprises, nor do we, the FED has no clothes and so please don't pretend like they actually can do much, they can't. A rock and a hard place doesn't serve their predicament justice, that we are certain. We definitely do not envy their position, to say the least. So with that said, we expect curve flatteners to continue into Wed. as investors and specs pare down some positions. Bond yields have risen into this meeting and by the off chance that the FED hesitates at all, rest assure bonds will be well bid and yields will plummet as the US yield curve steepens once again. As always time will tell. So let's get to the charts for some insight as to where things sit pre-FOMC:

When we look at the US 5Yr vs 30Yr yield curve differential we can see that the front end or 5yr sector in this case has led the way down as investors anticipate the roll down in balance sheet to be borne by the front end:

Next up we see 10yr yields have been driven higher leading up to the meeting in what seems to be a position paring, but has seen a decent 20bp back up to 2.20%

The SP500 has been driven to new highs and have breached the all important 2500 plateau. We have talked how these levels seem to propel us higher into the next move. However we would be a bit reluctant to say this will be a linear drive as this level comes right on the heels of an FOMC meeting and thus we expect it to be fought over not just walked across with ease 2465/2525 seems logical:

As for the tech heavy Nasdaq future we believe this market has struggled to gain a decent and convincing foothold near new highs. The 6000 level continues to provide formidable resistance, it's also why we are reluctant to say the 2500 SP level will just give away without a decent two way fight!

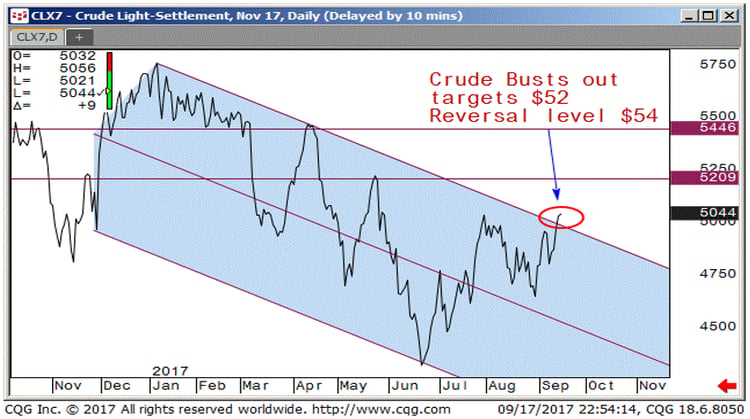

We also have oil on our radar as it now seems to be gaining some traction above $49. We figure CTA's may start to take notice and drive this higher, but resistance is heavy in the low $50's so expect a two way battle for some time:

Our last tech chart is good ole' Copper. After holding the Vwap at 294, the bulls still seem to be holding the control, for now:

Finally, we leave you with our weekly settles where the equity complexes show notable gains, hell even the Nikkei gained 3.5% on the week! Bitcoin continues to adjust to China's imposition, which is completely to the benefit of Japanese crypto exchanges. We love the crypto space and there are many exciting developments, which no country will be able to stop. Anyway with the FOMC on tap we are sure things will look quite different, but for now the ship is steady as she goes. Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.