July 19, 2017

When Doves Fly

Chair Yellen didn’t waste any time reassuring markets last week that the FED, despite their wherewithal to hike rates and shrink balance sheets, will remain mostly accommodative. She mentioned specifically that “the federal funds rate may not have to rise all that much further to get to a neutral policy stance.” Neutral, this term, always annoys us because it seems very relative. Neutral to what? Historical? Do we not live in unprecedented times or is QE just a normal everyday expected monetary operation now? Wasn’t it supposed to be temporary? Now some 9 years later still awash in some $200 billion in global central bank QE per month, the fed has decided that it’s time to move to a more “neutral” policy stance. Don’t even!

Chair Yellen didn’t waste any time reassuring markets last week that the FED, despite their wherewithal to hike rates and shrink balance sheets, will remain mostly accommodative. She mentioned specifically that “the federal funds rate may not have to rise all that much further to get to a neutral policy stance.” Neutral, this term, always annoys us because it seems very relative. Neutral to what? Historical? Do we not live in unprecedented times or is QE just a normal everyday expected monetary operation now? Wasn’t it supposed to be temporary? Now some 9 years later still awash in some $200 billion in global central bank QE per month, the fed has decided that it’s time to move to a more “neutral” policy stance. Don’t even!

The fed is a master at double speak as it says in one sentence the neutral rate can be much lower than expected, yet in another, states balance sheet reduction could come sooner rather than later. Once again this reminds us of some parlay pushing Las Vegas odds maker pushing out the favorite to 60% of his customers, while pushing the dog on the other 40% and saving his five-star lock for the truly delusional desperate gamblers.

See the fed knows you can’t please all the people all the time but you can frame their perception into hearing what they only want to hear. We believe in the psyche world this is called the “confirmation bias.” When given information counter to one’s beliefs one often reinterprets it to confirm what they already thought in the first place. So, it seems like the fed tosses a bone to everyone all the time hoping that nobody ever really notices that in the short run, its willing to sacrifice integrity and in the long run, none are the wiser. As Yellen confirmed something our readers are already aware of, when it comes to interest rates, every decade ends with a lower rate than where it started. This has been the case for nearly 3 decades now and we believe this decade will be no different. We aren’t geniuses to recognize this pattern, nor are we fools to try to call an end to the bond bull cycle. Yellen herself confirmed that she, “still expects the neutral rate to rise somewhat over time but remain below levels that prevailed in previous decades."

We categorize our thought process as merely stoic fundamentalists littered with the cognitive awareness of reality. Pure realists, knowing full well the fact that the sheer mathematics of our debt system can only be achieved with lower long-term interest rates. Now this can certainly change and the dynamics of one countries ability to repay debt, can be called into question. However, until that time comes, well call us crazy, but interest rates will continue to magnet the zero bound. What one central bank tightens, the other alleviates thru monetization. It’s this continued cycle of global central bank largesse that perpetuates this linear rise in asset prices. The fed is trying desperately to alleviate the ever-widening disparity, yet this will prove to be an unenviable task. As we said last week, the genie is out of the bottle and she isn’t too keen on going back in anytime soon. They know it and we know it and we are well assured the equity buying and bond issuing entities know it. Look at these 10yr borrowing rates, Italy 2.18%, Spain 1.52%, even Greece is near 5%. Where dear reader does one think these rates would be if actual supply/demand and risk metrics were used? Not to mention if global central banks couldn’t print $14 Trillion in 8 years. It is in this twisting and distorting of financial mechanics that many are confused by.

We hope we have shed some light on their operations and how it is central banks continue to prop up global financial markets. Where many have called equities, and bonds a bubble we have merely stated the obvious, central banks are not Zero-Sum players and they aren’t confined or shall we say restricted like true private enterprise. Our system is based on debt and all fiat money is debt, but in the central banks case, their nothing more than a Las Vegas or Cayman Island bookie stripping the Vig out of each and every bond and note they buy. But hey what choice does everyone have? Not much, so it is with that, we so fervently try to peel back the onion for you so you understand the markets as we understand them. We don’t claim to be the know all, but we sure like proposing some perplexing questions and thought-provoking insights. Hey, we are humble, so if you disagree with something or want to know more, than feel free to reach out.

We continue to hear that the CTA community has been taking it on the chin lately and we figured the double-talking fed isn’t helping. A lot of trend following or risk parity type CTAs have struggled because these markets are free floating on the sea of fed speak and that is never easy. Couple that with the illiquidity from the non-balance sheet holding HFT crowd and you have a recipe for rips both up and down. Where does one place their stops, right? Well rest assure the well paid HFT players know where your stops are and they will get you. We have read that CTAs are a bit long the equity space and short the US dollar, two themes we tend to agree with somewhat. Rest assure the resiliency of those positions will be tested.

One of the ways Capital Trading Group differentiates itself is that we dig deep into each managers trade construction to better align our customers with the appropriate risk reward profile. We pride ourselves in our manager selection process and we have an ongoing and continued vetting process so that our clients are in complete alignment with the type of risk profile and alpha generation our managers put in place to take advantage of their given trade. We continue to think correlations among asset classes will remain dynamic and perhaps experience a bout of flip flopping which can make for a difficult trading assumption. We however, unlike a growing cabal of active management naysayers believe that these markets are adult swim only and will continue to experience bouts of increased vol. The passive investment clamoring crowd is flying high on nothing more than a central bank induced hopium drip, which like all good things eventually comes to an end.

Technically we have seen a few breakouts extended, especially in the case of the Euro and Equities. The Euro and the SP500 busted out to new year highs while the dollar sunk to new lows. US fixed income in the long end saw a nice reversal of the lower trend but last Friday’s euphoria of higher prices was met with staunch selling, most likely profit taking and front end yield curve buys at the expense of the long end. The US yield curve was steeper as the short end clearly outperformed on the heels of Yellen letting the doves fly. Anyway, let’s get to a few charts.

However, the long end has started reasserting itself in the 2s30 shown here:

As far as 10yr yields go 2.30% continues to be our magnet:

The SP500 market continues its march as the new mantra seems to be rate hikes are the new easing:

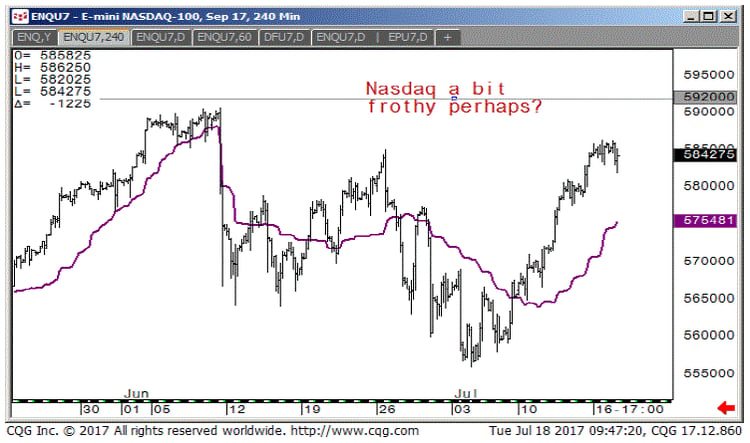

The Nasdaq has spent much of July moving higher after an initial sell off and now looks to be turning down again, so maybe better value lies ahead, the VWAP targets 5760 area below:

Nasdaq heavily supported by the FAANGs, in particular, Netflix, but lack of new highs in this metric is somewhat problematic:

When we look at our reflation analog chart of the SP500 and US Bond Future we can see that equity prices are dragging bond prices up with it. It remains to be seen whether they both will fall in unison and if so how long before they totally diverge and what’s bad for equities is good for bonds or what’s bad for bonds is good for equities. For now the divergence since the election still exists, but we would suspect this gap to close sometime in the future:

Moving over to the Euro, it’s testing 3-year highs in what primarily in the past has been a great short location. We think this time is setting up differently and that a break of 117-00 should bring an even more fervent CTA trend chasing crowd nevertheless for any Euro bears out there this location coupled with a tight 117 stop may present the best risk reward in quite some time:

As for the Yen a weaker overall dollar has aided its climb, not to mention cross pair trading no doubt has benefitted it as well. The following technical set up should drive the price further as a consolidated triangle has formed and a break of either direction should open a newer more sustainable trend:

Ok that’s it for now, we leave you with our usual weekly settles. As you can

see the Crypto arena took a bit of a breather this week as an impending deadline for a hard fork in Bitcoin looms. For those that have no idea what we are talking about, please do your research. We view the Crypto currency block chain developments as quite intriguing and you should delve into doing a bit of background on the subject in general. We continue to hear bubble talk but we also know that any new tech in its infancy is often chock full of naysayers and trash talkers. We expect the arena to continue to see volatility as players

come and go, but we view the overall potential as highly opportunistic. The Nasdaq continues to be the shining star, while Crude, which did gain some this week, is still this year’s whipping boy. Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.