May 23, 2018

The Risk Radar Should Be Ringing!

Welcome everyone to another edition of the weekly global macro roundup. I struggled a bit this week with my thesis as it seems as if there is a plethora of narratives to choose from.

As my long-time readers know, I just don’t write to write, it has to have meaning, has to have substance and above all else engagement for you, the reader. So, I decided that I would touch briefly on various things and not go too far into any singular issue.

What I want to do first if give you the trading, investment and economic thoughts and then move onto a few other topics that I think are important for you guys to dig further into on your own.

Many studies have shown that by actively engaging in reading and research, you build a cognitive process and this process aides in the development of memory and understanding. That is why I encourage you to be inspired by what I write in hopes you end up doing a bit more reading on the very topics I bring up. Anyway, let’s get to it…

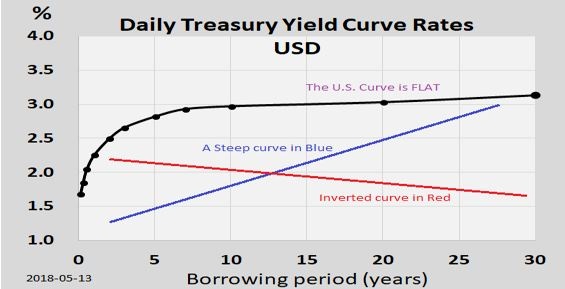

Ok, what’s been circling around the financial sphere’s lately? What seems very obvious to me is that there has been an extreme focus upon the flattening of the U.S. yield curve. As a long time, fixed income basis arb, this outcome is purely fundamental from a hawkish and tightening Federal Reserve.

Yield Curve flattening, which is nothing more than short rates moving faster than long rates for a given interest rate shift and is usually attributed to an expected higher interest rate environment. Now this doesn’t mean the yield curve can’t flatten if interest rates fall, they certainly can, but generally they are of the bear market form.

What do we mean by bear market in interest rates? It means that the prices of bonds are falling and the corresponding interest rate is rising, price and rate are inverse. I have chosen the following chart to display this visually:

The black line represents the current U.S. Treasury yield curve and it is obviously flat, which should seem strange to any investor because it doesn’t make sense to loan someone money for a longer period of time and receive the same interest rate does it?

No, it doesn’t and it shouldn’t, but many forces are in play, wait till we go inverted that will really blow your mind! The blue line represents a “normal” yield curve where the interest rate (%) rises as time (years) rises. This makes more sense, right? Then the red line is clearly an “inverted” yield curve, the alleged holy grail predictor of recessionary times.

I am not sold on that idea of its predictability, rather I believe the inverted curve to be a highly central bank driven construct that is less deterministic and more intrinsic based purely on raising the cost of funding in a highly leveraged system.

So, for me it’s more backward looking than forward. Meaning recessions form because money becomes tight and capital is withdrawn and was exacerbated by the artificial support of interest rates by central banks in the first place.

Any novice can look at the slope of the red line and say, that doesn’t make sense, why would the demand for  an interest rates be greater for a shorter period of time? I could simply borrow money at the long end and sell the higher rate at the shorter end and lock in profit! Yes, you could and you would then be an expert bond arb like myself, however, it is not that easy trust me, but the fundamentals of that arbitrage are what eventually brings it back into line!

an interest rates be greater for a shorter period of time? I could simply borrow money at the long end and sell the higher rate at the shorter end and lock in profit! Yes, you could and you would then be an expert bond arb like myself, however, it is not that easy trust me, but the fundamentals of that arbitrage are what eventually brings it back into line!

One thing that most people don’t think of is, counterparty risk, at least they don’t think of it till it’s too late. What risk does the U.S. treasury bond have…plenty and there are reasons why peripheral EU countries pay less for borrowing money then our very own “safety net” U.S. treasury bond!

Those fundamentals however are for another day, a day in the future I am sure, but this should peak your interest as to why and how the cost of money truly affects things. You have been sold the fact that lower interest rates are good for you, they lower the cost of money.

What they haven’t told you is the very fact that investments that come from borrowing are exponentially different from investments that are made with savings.

As a saver would you rather earn 8% on your 1-year T-bill or be able to borrow more money at 1%? The answer should be quite obvious if it isn’t and if it isn’t we highly suggest you continue to watch the U.S. debt pile up and then ask yourself, can the U.S. taxpayer continue to expand their debt obligations while interest rates rise?

Every investor I talk to knows equities, but they rarely follow bonds, which is a mistake. In a debt and fiat monetary system, interest rates and their flip side credit determine aggregate nominal prices.

The system is designed to always increase in price or “inflate.” This phenomenon is most unfortunate for the majority, but extremely fortuitous for a select few.

The problem with a fiat monetary system is debt must constantly expand or else the aggregate price level will collapse.

I believe the price level collapses anyway purely by the weight of the debt that is accumulated. Not only will nominal asset prices fall, but in general the purchasing power of the consumer erodes as well.

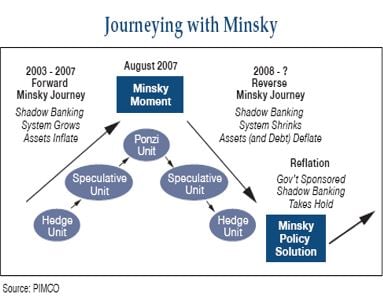

Austrian economists call this the “Minsky moment”, named after in my opinion one of the greatest American economists ever, Hyman Minsky.

Maybe I am partial to the fellow Chicagoan, or maybe it’s the fact he was highly critical of Keynes’ neoclassical interpretations, I’ll take either one as admission.

It doesn’t take a genius to figure out that debt can only be sustainable if more and more is created, this type of system is the one we unfortunately adhere to. Will this change?

I believe so and the moment everyone is so desperately trying to avoid will eventually arise, it always does. Here is a great chart from PIMCO:

Perhaps the Central Banks should consult this French poet’s quote in order to learn something:

“A person often meets his destiny on the road he took to avoid it” -Fontaine

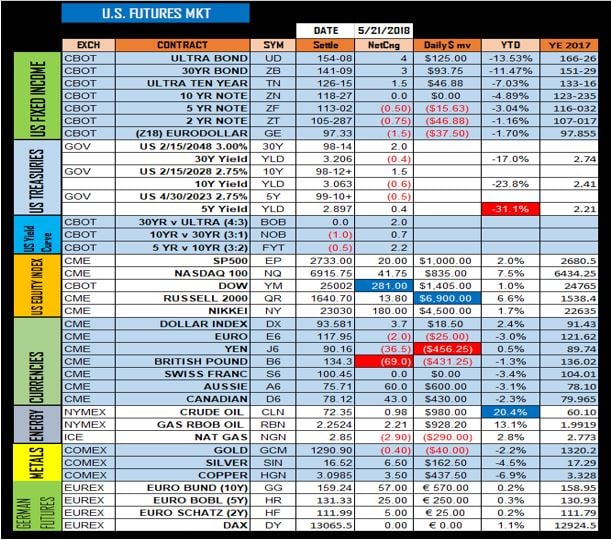

With all this in mind, it is no wonder the equity markets have gone nowhere since January. The Federal Reserve continues to raise not because they want to, but because they have to.

They will need room to maneuver for the coming recession and they know rates were way to low causing the elites and corporations to take full leveraged advantage.

The SP500 put in a high back on January 26th at 2872.87 and we haven’t even come close since. The SP500 trades near 2725, some 5% off the highs.

The longer the market fails to even take a clean shot at new highs the greater the odds of a stronger sell off, in fact another trade below 2650 should bring in a host of new sellers.

As far as fixed income, the U.S. treasury yields continue to push the upper limits. In fact, today marked the first time in 10 years the 2-year Treasury coupon came with a 2.5% interest rate.  Ten years is a very long time and if this doesn’t wake you up, then nothing will.

Ten years is a very long time and if this doesn’t wake you up, then nothing will.

Things have changed and the markets will not be able to fight this change much longer. Will this higher rate push continue? Possibly but it will have repercussions if it does, so as investors and traders, the risk radar should be ringing. Then again, everyone’s tolerances are different, but I know one thing is constant across the investing spectrum and that is NOBODY LIKES LOSING MONEY!

With the U.S. 10-year trading around 3% I still feel this general area is a magnet and expect further trade around it

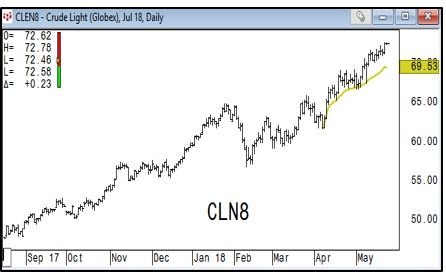

Moving on to other markets, Crude Oil continues to shine, up some 20% this year and continuing its ascent, despite a stronger dollar lately. Here is a nice chart from my friend at keystone charts:

Speaking of the dollar’s strength, I feel like the move is a bit long in the tooth here for the short run and some consolidation to lower is in order. This resistance does correlate with some short-term support in the Euro around the 117-35 level. Here is another chart from Keystone showing clear resistance near the 94.13 level

Moving right along, let’s touch on a few of the more deeper subjects being pressed right now and ones in which you should definitely research and dig into further. The #Qanon movement is gaining mainstream admission and it continues to be under conspiracy like scrutiny.

I however know that there is more to this story then meets the eye and if you haven’t heard of it, you will, but we think you should definitely pay attention.

Anyway, some background to it, is that there is some deep seeded intelligence jockeying going on in the intelligence community and the Qanon movement seems to point toward the deep state vs Trump and his draining the swamp movement. I don’t want to get into it too much as you are a much better judge of your beliefs than I, but rather know it’s going on and gaining traction.

Another subject we need to continually watch is the ongoing tensions in Syria. With Israel picking up steam in the region targeting sites within Syria, constant monitoring should be considered.

As long-time readers know, I don’t watch western media for news, rather I choose sources on the ground within areas of interest, most notably found on Youtube, GAB and Reddit to name a few, if you want suggestions I will gladly provide sources.

Youtube is becoming highly censored however, so even they are falling prey to this narrative shaping bias, unfortunately.

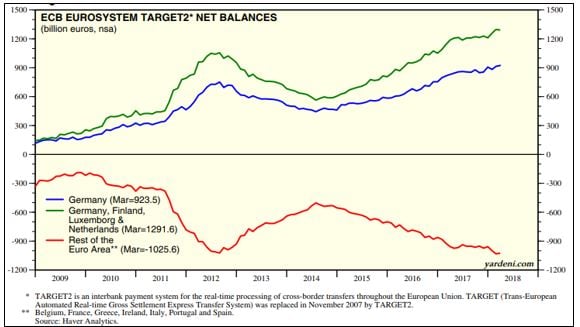

I also believe we are starting to see the beginning stages of the breakdown in peripheral EU countries ability to sustain their debt obligations.

Despite constant QE and something I have warned about in the past, eventually BUBA will want their money back in some form or another.

Oh, sorry BUBA (Bundesbank) is the ECB, it’s an old trading floor term, but one that still holds a nice ring to it. Anyway, Italy’s TARGET2 imbalance sits around €442.5 or $522 Billion.

Yardeni research posted a very telling chart, what it will show is that since 2011 BUBA has bailed out the peripheral EU to the tune of nearly $1.5 Trillion and now you know why they have negative interest rates:

Let’s move to another fantastic subject and one I generally love to cover, that is Blockchain and Bitcoin. This past week saw 9000 people attend the Consensus 2018 event in New York city. Despite all the negative coverage from protesting bankers, crazy yacht parties and even “Snoop D O Double G” himself, the fact remains the ecosystem continues to grow.

We expect you to be well entrenched with our firm belief that blockchain technology is the future disruptor and it’s still in the very young incubations stages.

As much as Wall Street and its investment grade banks detested it at first, they are now seeing that there is no stopping this force. With that the likes of Goldman Sachs and even JP foot in the mouth Morgan are going to dive right in to the Crypto trading space.

I say let the sharks come and turn crypto into another profit driven asset class, this will open the doors to further advancing the real utility function of a decentralized immutable economy, run solely on trustless binary coded systems.

I am confident that the ecosystem will continue to grow and you should be doing your research!

Ok, that is it folks! I will continue to push your economic and financial jargon intellect in hopes of inspiring your every day routine.

Before we go, we would also want to make sure you are following what is going on around the globe in terms of weather, earthquakes and volcanoes.

Many are focused upon Kilauea but Sakurajima has been blowing for months, you should check it out. Our environment is being impacted and that means we are impacted whether we like it or not, so pay close attention and raise your awareness.

Long time readers know our viewpoint on the connection between nature and our wellbeing as a species. As much as we think we are in control, mother nature always sets us straight. We hope you enjoy the rest of your week. Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.