December 21, 2017

Interpreting Fed Speak & FOMC Projections, Crypto Craze and Repeal of Net Neutrality

Last week saw the final Fed meeting of 2017 and the final meeting with Janet Yellen as chair. The FED raised rates another 25bp to put the top end of the Fed Funds range up to 1.5%. This move was widely expected and priced into the markets. Here are the headlines:

- FED SEES FASTER 2018 GROWTH

- LABOR MARKET STAYING STRONG

- MONTHLY BAL. SHEET RUNOFF TO RISE TO $20B IN JAN.

- Median dot plot for 2020 rose to just over 3% for Fed Funds level

(What policy makers think is coming in the future)

Yellen doesn’t feel that the equity markets are flashing any warning signs and doesn’t feel that the markets exhibit levels one would deem “frothy.” Even though she didn’t use specific fundamentals or none at least that we can understand, it seems as if the FED simply views the upward move in the markets as “Job well done! Job well done alright, it only takes roughly $2 Trillion a year of increased global debt to keep this linear pig going, but who cares about debt, right?

Now long time readers of ours know that raising rates doesn’t mean what it used to because the FED pays banks IOER and thus any rate hike means a free cash boost to the banks to the tune of roughly $5BN per every 25bps. So at 1.5% Fed Funds and excess reserves of $2.2TN that is nearly $33 Billion in free cash to the banks each year. We figure the FED has to raise rates to continue to fund the banking sector as the velocity of money continues to collapse and organic profits are hard to come by. When the FED raises the short rate, they allow the banks to increase their customers’ rates thus increasing their net interest margins, because everyone knows that your borrowing rate rises but the rate of interest that they pay is certainly not reciprocated. So hiking rates is a win win for the banks, they get free IOER of $33BN a year and they increase their margins by charging higher rates to their customers. So next time someone asks why they are raising rates, simply say the banks need more free money!

As far as Bitcoin and Crypto, she sees Bitcoin as “playing a very small role in payment systems.” Going on further to say that it’s a, “highly speculative asset and that the FED is not seriously considering creating a crypto currency at this time.” Which even if central banks did try to create a private crypto, it makes zero sense to anyone who understands decentralized ledgers, basically its counterintuitive and decentralized vs centralized is really all it boils down to, Trust the masses or Trust a few that control the many, E PLURIBUS UNUM right? Just don’t think it shares the same meaning as the original motto of the 13 colonies, thus the 13 letters and thus we the many equal one unified unit. Now it seems the Central Banks deem themselves the de facto “UNUM” and we are all just subordinates, not sure the founding fathers wanted a private enterprise dictating to the masses, but then again it seems like history is nothing more than a precursor to the future and what comes around goes around again and again and again.

Also out last week and clearly overshadowed by the crypto craze was the fact that the FCC voted to repeal net neutrality protections. This was widely protested by consumer and tech groups as they felt this repeal would give the communications service providers too much power. For those that don’t know what Net Neutrality (NN) is, it can be described as the principle that internet providers treat all web traffic equally.

We can imagine companies like Netflix might be a bit defensive, considering they rely heavily upon internet service providers to provide their streaming services. What happens if the internet service provider decides to slow down Netflix’s speed and instead promote their own streaming content? Yes this is a bit of a stretch, but entirely plausible now that NN is gone.

It’s certainly good to see at least a little resemblance ofsome antitrust at work at the Dept. of Justice, as they are suing to review the merger of AT&T and TimeWarner. The $85BN deal merely hit a speedbump because we know how these things go, but at least they are trying to keep up pretenses of antitrust laws in this country. Somehow this all seems too coincidental in term of timing with the Net Neutrality dissolution. We all know the cable firms are getting smoked from the streamers like Netflix and in all reality the cable companies are the defacto “gatekeepers” and now are free to raise fees as they see fit. Kinda reminds us of the old Travelers/Citibank merger in the 90s and the removal of Glass Steagall. You see how this all works out just right?

CVS Healthcare is also on the DOJs review list as they are looking to tie up loose ends and get approval for the mega $77BN deal to acquire Aetna one of the largest health insurers in the US.

On the heels of that deal we also have Disney buying 21st Century Fox for $52BN. So you can see the pool of shares continue to drop and thus merger mania will also reduce the denominator in the EPS calculation which should raise the quotient. See most people who look at the equity markets rise fail to realize that the amount of companies to actually invest in is shrinking. What amazes us is that we often wonder if risk calculations are being properly accounted for considering this massive concentration of public enterprise. As this next chart shows just how massive the decline in listed companies has been over the last 18 years:

Is it just us or is risk being more highly concentrated and going unnoticed. Is this all the efficient market hypothesis at work? Is this lack of differentiation going to eventually put large asymmetric risk to overall portfolios, who think they are diverse, when in actuality diversification seems to be more concentrated not less? I haven’t heard any bobble head news station talk about this creative destruction of investable public companies. All in all when one looks at it a bit more granular, we can see the power behind the equity up move is fundamentally obvious in one facet, and that is the massive shrinking supply of available public equities.

Now this brings us to the ongoing governmental fumbling of the current tax plan. It’s ready for a vote, it isn’t ready, Dems are in, Dems are out. Anyway, corporations should be happy because their rate is going to fall to 21% from 35% and eliminates the AMT. Not that they paid anywhere near that rate anyway, but now they might even be down to single digits. Where will all this new found capital go you might ask? We can only hypothesize into further reducing the EPS denominator and returning that value in share buyback programs and certainly not into any CAPEX spending. We will not be surprised if this will lead to that last final blow off top everyone is so desperately awaiting. As for individual rates the highest rate moves to 37% from 39.6%. The bill also eliminates the Obamacare penalty for not obtaining health insurance. We applaud Ted Cruz for adding an amendment to the bill which will allow for 529 plans to include K-12 education expenses. We feel this is indeed a great enhancement that can benefit many. Will it all be signed into law? We shall see, maybe they can get a budget resolution this week as well!

Also out the ECB keeping rates at status quo but will reduce QE to $30BN a month starting in January, so we can still count on $360BN in QE from the ECB next year to support things…and people think interest rates can rise, hogwash! Oh yea about that global QE, here is this nice chart from the guys at 720Global-debts the bubble not Bitcoin:

Is it just us or is all this QE really all it’s cracked up to be? For us it seems a lot like stealth devaluation on a global scale, but not easily recognized. We know it’s created the widest disparity in wealth in quite some time, but its true effects are most likely not even known yet and that is a scary thought indeed. Nobody even mentions interest costs and where the money will come from just to pay that.

Another overlooked item this past week was the fact that China is very close to launching a Yuan based Oil futures contract. We view this as a very big deal and anyone that understands the Saudi Arabia-US petrodollar arrangement should see the importance of this development. On a fundamental basis, the fact that China imports more oil than the US lends credence to this development as this chart shows:

We aren’t even going to talk about reserve currency status because China is nowhere close, so don’t worry about that. We do think it’s interesting that Saudi Arabia has certainly made some interesting moves this year and we wonder if this has anything to do with these developments. We hate to say it but the global power realignment is here and turbulence is here and should be widely expected during this adjustment period.

Ok let’s move to some market information and some technical charts shall we. First up and considering this weeks Fed move, let’s look at the US 10s30 Yield curve which in our book seems to be hitting oversold levels. As the chart shows it hasn’t been this low since mid- 2007:

Looking at the US Treasury 5s30 yield curve we see similar extreme weakness which is near the bottom of our trend channel which has seen the spread narrow by 50% over the last quarter:

Looking at the US 10yr yield chart we can see that stiff resistance at the 2.45/2.50 area should put a cap on things for now:

Finally looking at the Nasdaq Index futures we can see its breaking the upper trend channel once again, but needs a convincing close above to further the buying:

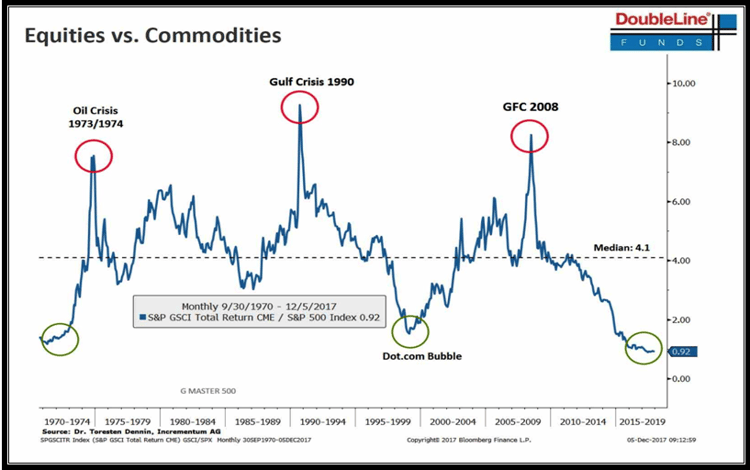

We saw another niece piece from Jeff Gundlach and Doubleline Funds this week from their monthly webinar. For all you technical followers out there, this chart might entice you. We just aren’t sure if it will take a commodity rise or equity decline to drive this chart higher, Mr. Gundlach seems to like its prospects:

{CryptoCorner}

- We came across an awesome article on the comparison of Ethereum and NEO and for those that are truly interested in the blockchain space and investing in cryptocurrencies, this is a must read, reread and dig further. We understand the complexity of all this and we continue to find you relevant articles that we think best articulate the essence of the blockchain movement, its advances, its disadvantages and its overall potential. Knowledge is not given it is acquired and it’s the reason why so many people lack it, were sorry to say is, but humans tend to be lazy and privileged, we know better and we will continue to push your intellectual envelope because we know in the end, the more educated cunsumers are the more quest for knowledge they will have. (Sorry that sounded a bit Yodaesque) We value knowledge, research and the utmost understanding of any subject matter that we deem important. We basically act as your information gatekeeper, filtering out the garbage while allowing the important facets to come through. Anyhow there is a lot in this article and the majority of you will have never heard of NEO but we feel that it does a great job in explaining the protocol and its comparison to Ethereum. The article can be found here

- Another good article out of Fortune can be found here which delves into the world of cryptocurrency called Ripple. Ripple has been adopted by financial companies and institutions and allows users to send, receive and hold any currency in a decentralized way utilizing the Ripple network. (Fortune 2017)

- Charlie Lee the brainchild behind Litecoin and goes by the Twitter @satoshiLite divulged that he has sold and donated all his holdings. He sighted conflicts of interest and influence his personal statements may have. He stated that he is not abandoning his creation but will continue to work on Litecoin’s success. We noted a large seller on the GDAX exchange last week offering nearly 15k Litecoin at $200. So we hit up @satoshilite on Twitter and told him if he really wants to sell that many then he should pull the order because all the HFT frontrunners were sitting in front of that offer. He didn’t reply back, but within a few minutes the entire order was taken out and within a few hours Litecoin was 50% higher trading $300. We don’t know if that was SatoshiLite’s order but we can only suspect he was the one willing to sell that many at 1 single price, seems logical now. Anyway we wish him luck.

- APMEX the world’s largest online retailer of precious metals is now accepting Bitcoin

- Bitcoin data

- 11839 new addresses added this week that hold at least 1 Bitcoin

- Total addresses up 3.15 million on the week

- Largest wallet added 12619 Bitcoin putting total BTC owned at 135439 with a value of over $2.3BN

- 2nd largest wallet holding steady at 119203 Bitcoin unchanged for 3 weeks

- Bitcoin block height now over 500k

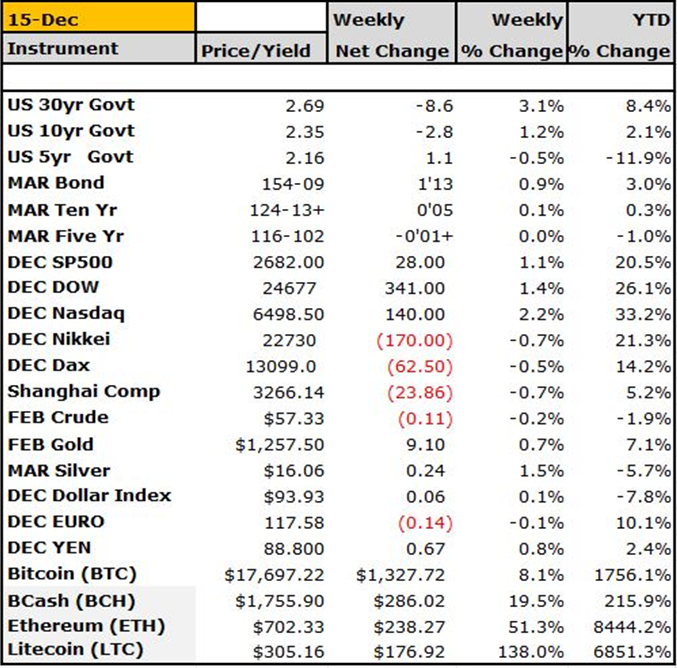

Ok that’s it, we look forward to the upcoming holiday break, we hope you are able to enjoy this joyous time of year as we mark time with the closing of another year gone by. We hope you find time to get away from all this investing, trading and economic madness and sit back relax enjoy some good, food, drink and thought provoking conversations. We will most likely be putting out a 2018 outlook next week and we look forward to the coming New Year and all the surprises it will have instore for us. We hope that you pass along our letter because we want you to enlighten your associates and give them some good analysis to ponder over. We feel it is our job to inform, educate and disseminate information so that you the reader are well versed well informed of the things we feel matter. We thank you once again for staying with us on this journey and we hope that you continue the course with us. We leave you with the weekly settles, which show the Nas and Dow the traditional investments the clear standouts on the year, the US 5yr the big loser with the US dollar not too far behind and obviously the Cryptos who are in a class all their own, with Litecoin up some 138% on the week alone! Ok that does it, Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.