November 15, 2018

Corporate Treasuries Have Chosen a Life That Does Not Have a Future

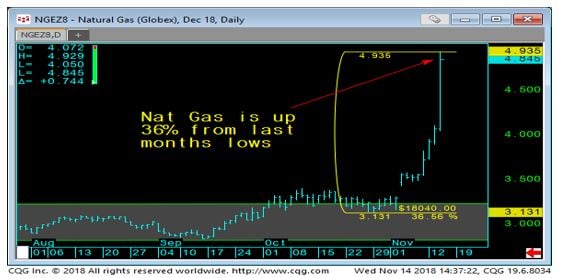

This week’s note will begin by reiterating our bullish theme on the Natural Gas market. We have been clamoring for weeks about both the technical and fundamental backdrop that continues to underpin this Bull Run.

We have highlighted supply constraints as well as the fact that nobody seems to be recognizing that the northern hemisphere went right from Summer and into Winter. We however knew better as we follow the right sources who do an excellent job of deciphering our climate and our solar cycles and their effect upon our atmospheric conditions. Anyway, without getting to technical as to the veracity of solar cycles, we would rather just show you a chart of the December Natural Gas futures:

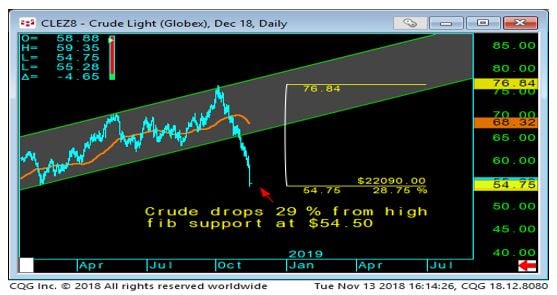

Now if we compare this to Crude Oil, we can see the Crude market has fallen quite a bit from its highs. This is why despite both falling underneath the industry classification of “energy” the dynamics that drive both markets can sometimes be completely different. Here is the chart of Dec. Crude Oil and considering what is going on with the global economies and the future prospect of a recession starting, we can’t help but think this is bigger than just supplies or technical conditions:

The WSJ reported this week that in the last decade alone, US debt held by the public has risen by a whopping factor of 3.1x or in nominal terms it rose from $5.1T to $15.9T! The US treasury has been working overtime this year as it is going to issue nearly twice as much debt than last year. Why do we mention these numbers, because one always need to be cognizant of interest costs. When central banks peg short term rates at zero, it isn’t much of a concern, but when they raise them nearly 200 basis point, well things begin to add up!

If the US gov’t starts to run Trillion dollar deficits, the most likely result will be inflation. This type of inflation or stagflation will most likely punish the emerging markets more so then our own domestic market, but nobody is truly safe.

The other flipside of this type of monetary phenomenon is present values have to be discounted with higher rates and thus the reciprocation is of course is LOWER ASSET PRICES as future cash flows i.e. payment streams will be worth much less.

We aren’t saying this is all easy to digest, and even more obvious, investing in this type of environment will be very tricky. One has to say reticent, diligent and well disciplined and we would expect many players to be caught offsides.

To make matters worse, we can’t imagine the lack of foresight from some of our more new and junior hot shot AI Algo driven asset managers out there. Their linear systems may work well when central banks are pumping $2 Trillion a year of liquidity, but if these last few months should have made things quite obvious as to where this is all leading.

Speaking of AI funds, the WSJ highlighted the disappointing returns from some of the AI ETFs out there, including Robo Global Robotics & Automation (ROBO) with $1.57B in AUM is down 12.1% thus far. Just to be fair they were up by 44% in 2017 doubling the return posted by the Nasdaq.

Ok, so let’s review what we know or see out there:

- The Federal Reserve will continue to raise short term interest rates, however the US yield curve is steepening on the heels of fast money coming out of equities and parking it in short term funds. The easy trade would be to sell the US yield curve in anticipation of higher rates, but money flows make that a bit tougher to time

- The Equity markets are vulnerable, in part due to lack of liquidity provisions from hiking central banks and QE pare backs, but more importantly from fear of deglobalization and national polarization leading to currency and fiscal fighting amongst the US, China and Europe

- Crude Oil was the standout for the year, that is up until a few weeks ago when on its high’s was up some 31%, now its down 6%! How is that for passive investing, does seem to work when things heat up. All the talk was $100 oil, we suppose now $50 is a major concern and we don’t think OPEC will step in anytime soon

- On the political front we can’t believe the shenanigans that have transpired and we can only hope that a drivers license or ID will be mandatory going forward, the fact that nobody questions this crap anymore is disheartening. The system we have is clear, one person, one vote, lets use our IDs and be done with it. Not to mention fraud would be easy to detect with all the AI tools now

So, by knowing where we stand, we can try to formulate using technical analysis some locations and trends for some of the markets we tend to follow. This is a process and its never easy as money flows fast and it never sleeps, so let’s look at the charts.

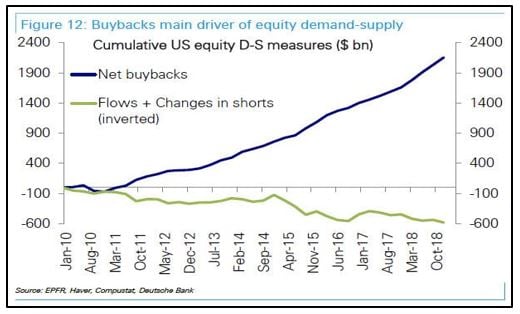

Let’s stick to equities and let’s look at a chart as to why exactly the market tends to rebound and bounce, despite all the bouts of selling we see:

Do you see the massive $2.4T in net buybacks? Let’s add zero interest rates and $15T in global central bank liquidity and voila. Simple right? Well there’s two components to the Earnings per Share calculation. On one hand you can buy back shares and decrease the denominator which will reciprocally raise your Earnings multiple. On the other you can organically grow your Earnings through increased CAPEX and Revenues. Which one is easier??? Corporate treasurers have taken the easy way out and have decided that money invested in buying shares back offers more utility than money spent on CAPEX.

This reminds me of one of our favorite movies, The Matrix (1991) When the Agent asks Neo to decide on choosing a life as an ordinary citizen, or his alter ego one steeped in hacking government files, the Agent says,

”One of these lives has a future, the other does not, we are willing to wipe the slate clean, FOR YOUR COOPERATION!”

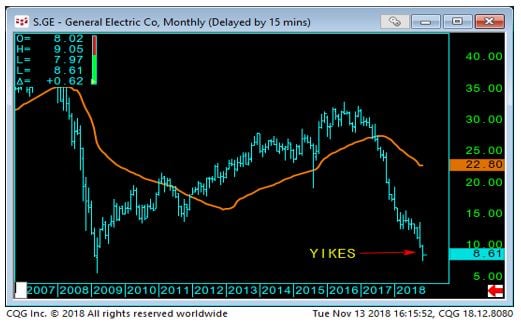

The corporate treasurers have chosen the life that does not have a future, one that sells the corporation to the highest bond auctioneer after the equity holders are left holding the bag. Case and point, GE! They bring good things to life alright, malfeasance is one of them. GE treasurers spent $24 Billion on buying back stock in 2016 &2017! All that government support money well spent and they still can’t get by…if we all had it so easy anyway, its 2009 all over again for their stock price:

Another eye opener for us has been Netflix. We can’t help but think Blockbuster Inc circa 2002. Yea we know, subscriber base is growing, but so is their competition and how long will investors wait, not only if the global economy turns sour, but if free cash flow continues to plummet, which will hit NEGATIVE $4 billion this year!

Another eye opener for us has been Netflix. We can’t help but think Blockbuster Inc circa 2002. Yea we know, subscriber base is growing, but so is their competition and how long will investors wait, not only if the global economy turns sour, but if free cash flow continues to plummet, which will hit NEGATIVE $4 billion this year!

For those not paying attention to the clear devastation going on in California, let us paint a little picture here. Some are speculating that there is more to this story then just some camp fires, some are saying that the energy company PG&E may have something to do with it. Whether or not that speculation is true or not, we can only opine that it’s stock price is sending us a very clear message and that is, something is definitely up:

For those not paying attention to the clear devastation going on in California, let us paint a little picture here. Some are speculating that there is more to this story then just some camp fires, some are saying that the energy company PG&E may have something to do with it. Whether or not that speculation is true or not, we can only opine that it’s stock price is sending us a very clear message and that is, something is definitely up:

These fires are burning extremely hot and seem to be very selective, this is why many are claiming something else is going on. We hate to agree with speculation but it does seem a bit odd, you will have houses on one side of the road, just fine and the other side completely burnt to the ground, not to mention some of the trees around the homes seem to be fine. Lot’s of questions, and certainly lack of credible answers.

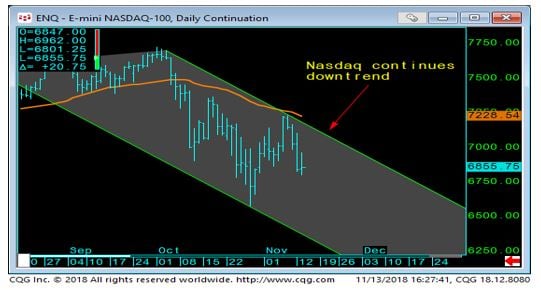

Looking at both the NASDAQ and the SP500 we can clearly see that sellers continue to be in control as downtrend is two months and counting:

One thing did stand out to us after today’s action and that is the Nasdaq is holding up well as the overall equity markets are falling, we aren’t sure if this is fast money looking for a quick pop or if this is part of a longer term buy thinking its cheap. Anyway we just want to make sure that you the investor are aware that even if the market looks weak and is falling, it will experience some snap back bounces here and there that is to be expected.

Moving over to bond land we can see from the US treasury 5s30 yield curve that it is still steep and that this seems mainly due to institutional money hiding out in the front end of the US curve as protection as nervous equity players keep the volatility up. With the FED maintaining course, if equities base, this may revert back to its trend.

US 10yr yields continue hover around the Vwap magnet of 3.15%, we don’t expect too much movement either way for this complex as short rates rise, this will most likely stay well within a tight boundary:

Our final chart is Dec. Gold, which has seen some heavy selling over the last week dropping it from $1240 down to $1200. This may be driven by a collateral call but we aren’t really sure, however we do think as interest rates rise, Gold will rise with them. All this talk of a stronger dollar hurting hard assets like gold, hogwash, it hurts the other fiats, which in turn is bullish for gold in our opinion:

Finally its not all bad news for the bricks and mortars, as we read in the WSJ that the discount retailer Five Below is up nearly 80% year to date! It operates some 750 locations and their profits are up 6 fold in 5 years.

Their stock was trading near $120. (WSJ) What’s their secret? Low prices and items made from scratch from hundreds of suppliers. We hope they have continued success as we don’t like the fact that everyone else seems to have been Amazon-ed to death.

We hope you enjoyed this weeks post and we hope you learned something from it. Our goal is simple, to bring you a fresh perspective on the markets we follow in hopes that it engages you to dig a little deeper into your own processes. We aren’t overly excited for the fact that Summer has basically gave way to Winter without a Fall season, but none the less, we live in Chicago, so we are well used it! Stay warm, stay alert and till next time, Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.