October 25, 2018

It's Not What You Buy, But When You Buy It.

Its kind of amazing how at certain points in time, things happen and they tend to be a wake up call – that is if we just open our ears and listen. We have talked at length about our disdain for the likes of the big investment houses and their pitching of zero fee fund management products.

management products.

We no doubt will look back and point to such lunacy and say, yes people actually thought you could get something for nothing. The only thing you will get is left holding the bag, the bag of empty promises. Its easy to pitch such ideas that you can blindly just buy an index fund and wait and watch. What this should tell you is that the market has reached such idiotic proportions that the big houses now have to give things away for free to continually attract AUM. Why do you think they do things like this? Because in order to maintain status quo, the financial system needs a constant IV drip of funds and yes, we know these big houses manage trillions…we get it. However, if markets take a turn for the worse, asset prices fall and in the gigantic ponzi house of leverage, well, cash is king, always has been always will be. Well, we like gold too, but that’s a topic for later, as we believe the shiny metal is setting up for a much larger move above $1300.

Anyway and as our last few letter have pointed out, the net present value is  about to put a heavy discount on markets. As rates rise, so too does the cost of playing the game and if you don’t have your house of cards in order, well, you are in for a very rude awakening. If you haven’t seen the movie Rounders, we highly suggest you do. So much of what goes on in the movie relates perfectly with managing the psychology of our financial markets. The battle not only against the market forces, but inter-personal forces as well. The movie was highly underrated and well before its time, needless to say, we love it! We believe you will gain a greater appreciation for knowing not only the game and how its played, but how well you understand your own self and what motivates your decision making process.

about to put a heavy discount on markets. As rates rise, so too does the cost of playing the game and if you don’t have your house of cards in order, well, you are in for a very rude awakening. If you haven’t seen the movie Rounders, we highly suggest you do. So much of what goes on in the movie relates perfectly with managing the psychology of our financial markets. The battle not only against the market forces, but inter-personal forces as well. The movie was highly underrated and well before its time, needless to say, we love it! We believe you will gain a greater appreciation for knowing not only the game and how its played, but how well you understand your own self and what motivates your decision making process.

So many have been lulled to sleep by the somber music of sir maestro central banks, who have played everyone for the greater fool in thinking rates can rise without nobody noticing. We certainly have noticed and we have warned all of you, but lucky for you this market topping process will take years to play out. The FED has warned us time and time again, it will not stop until neutral is reached. We told you where neutral lies and its somewhere at parity with the US 10yr rate or near 3%. How we get there is simple, consecutive 25bp hikes, when do we get there, sometime around next June, what happens in the mean time? Reversion and discounting future values. That’s really it in a nut shell. So without further adieu let’s take a look at the damage shall we.

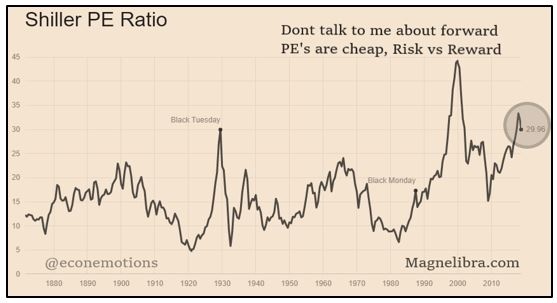

Let’s first just end the argument right now that equities are cheap, they aren’t no matter how you slice it, now we don’t care about forward SP500 earnings expectations. What we do care about is this chart right here:

The only reason this chart looks like this is because of the 5X growth in Central Banks balance sheets, now if you think this is going to be replicated anytime soon, then go ahead gamble, we would rather just wait for a better opportunity. Remember it’s not about what you buy necessarily, but rather, WHEN YOU BUY IT that makes all the difference.

As far as the why, look no further than the US Govt 5s30 yield spread which has exploded higher and has now reached the peak from last may:

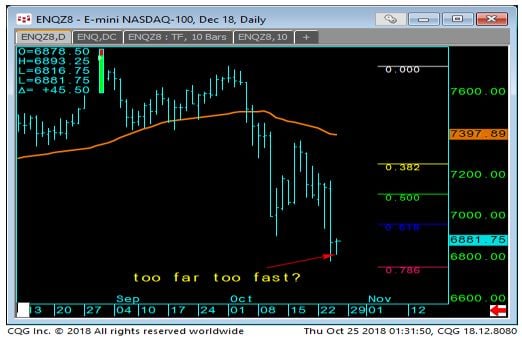

As far as every investor’s favorite index the FAANG loaded NASDAQ down over 12% from its highs a few weeks ago:

The SP500 Index put in a decent low at 2652 and not sure we are going to test it again tomorrow as it is backed up by the .786 fib at 2634 as well, Bulls need above 2701:

The Russell has reached Feb low support zone:

As for the DAX well, it opened the dam when it broke the 7-month long trend channel:

As for the DAX well, it opened the dam when it broke the 7-month long trend channel:

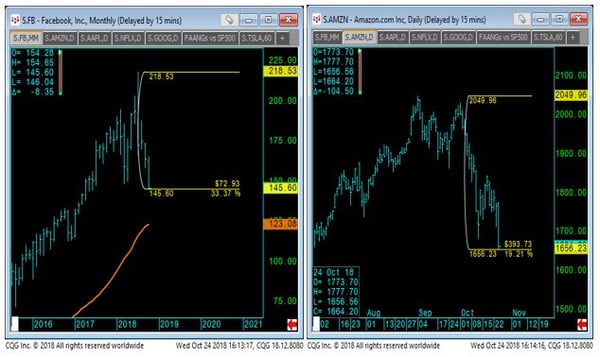

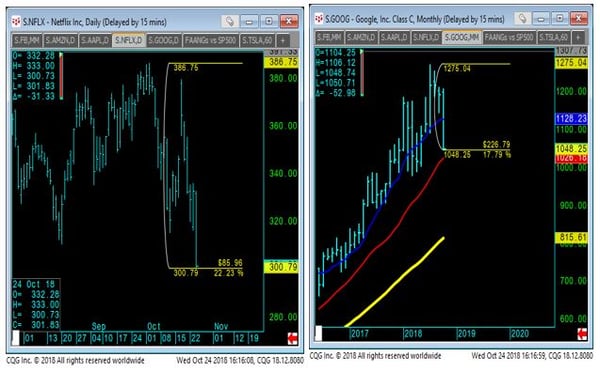

As far as the FANGs go, they are all down double digits from their highs:

Looking at the Euro Currency we can see the dollar’s strength has pressured it back down toward its August lows:

Crude oil has broken down as we warned a few notes back and now sits at pivotal trend channel support:

As far as gold, well we continue to see it as constructive and it seems to be continuing the path of least resistance vs its counterpart silver:

Ok, that’s all we have for now, stay tuned for me, expect more whipsaw action as those players late to the game continue to buy in hopes for a bounce. Trust us the market will bounce, but there will be plenty of sellers looking for a decent exit. We know that the market conditions are ripe for heavy volatility and with that opportunity so stay nimble and quick and do not get married to positions. If you like something dip your toes and see how it goes…damn we should coin that…Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.