September 7, 2021

Seasonality in Commodities as the Summer of 2021 Ends

By Andrew Hecht

- Seasonality is a historical pattern, but 2021 is anything but a typical year

- Grains enter the harvest season

- The grilling season for meats ends

- Natural gas and heating oil enter the peak season while gasoline moves towards a seasonal lull

- Expect the unexpected as 2021 as seasonality takes a back seat in markets across all asset classes

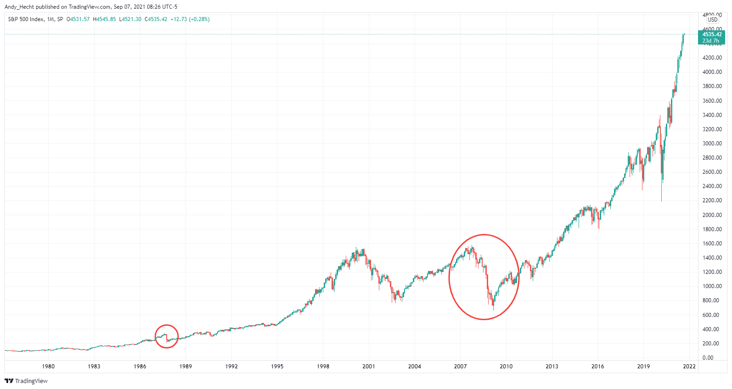

As September began last week, the markets are nervous. Stocks have seen some pretty awful seasonal price action in September and October. Crashes occurred in 1929, 1987, and 2008 in October.

Commodities are highly seasonal markets. Some commodities typically reach seasonal highs and lows during various months of the year. Futures prices ordinarily reflect seasonal factors.

Meanwhile, as we move into the fall season in 2021, the impact of the worldwide pandemic continues to grip markets. Moreover, markets reflect political and economic landscapes. Seasonality could take a backseat to political changes in 2021 that are impacting the global economy.

The natural gas and heating oil futures markets will move into their peak demand seasons over the coming months as winter approaches. The 2021 harvest will impact grain, oilseed, and other agricultural markets over the coming weeks. The Labor Day holiday marked the end of the 2021 grilling season, the peak time of the year for animal protein demand.

Seasonality can be a powerful force for prices, but in 2021, they’re much more going on that may change expectations and the path of least resistance for seasonal markets. At Bubba Trading, we follow trends. The futures markets adjust to seasonal factors in advance as they reflect prices in the future.

Seasonality is a historical pattern, but 2021 is anything but a typical year

Seasonality is logical in raw materials markets, but the fall season has been the time of the year for some of the nasty crashes in the stock market.

The October 1929 stock market implosion occurred on Black Tuesday, October 29. It began in September and ended in late October when the New York Stock Exchange collapsed. The Great Depressions began following the 1929 crash and continued through the 1930s.

While the stock market correcting in 1987 looks like a blip on the chart, the S&P 500 fell from opening in October at 321.83 to a low of 216.46 or 32.7% in only one month.

In 2008, the global financial crisis caused the S&P 500 to suffer its most significant downdrafts from September through October. As we head into the fall season, investors and traders will be highly sensitive to historical weakness in September and October and the stock market’s penchant for imploding at this time of the year.

In the world of commodities, seasonality is closely tied to weather conditions.

Grains enter the harvest season

While grain and oilseed prices have corrected lower since the 2021 highs, the futures are entering the 2021 harvest season at substantially higher prices at the same time in 2020.

As the monthly chart highlights, nearby corn futures opened in September 2020 at $3.4775 compared to the $5.34 opening price on September 1, 2021. Whole corn futures declined from the over eight-year high in May 2021 at $7.75 per bushel; they opened September at 53.6% above the previous year’s price.

The monthly CBOT wheat futures chart shows the grain that is the primary ingredient in bread opened at $5.4250 in September 2020 compared to an opening price of $7.0825 on September 1, 2021. Wheat traded to an eight-year high at nearly $7.75 per bushel in August. After correcting, the price was still 30.6% higher in September 2021 than the previous year.

Source: TradingView

The monthly soybean futures chart shows the oilseed futures opened at $9.48 in early September 2020 compared to $12.9150 at the same time in 2021. This year, soybean futures are 36.2% higher than last year.

The weather conditions, rising inflation pushing production costs higher, supply chain issues, and other factors have created a significant bull market in the grain and oilseed futures markets.

We could see more corrective action with the 2021 crop harvest over the coming weeks, but the cost of feeding the world has risen substantially from September 2020 to September 2021. While the weather in the US and the northern hemisphere had been the primary factor for grain and oilseed prices over the past months, the futures market’s attention will shift to weather in the southern hemisphere over the late fall and winter months in the US.

The grilling season for meats ends

The peak season for demand in the animal protein arena ended last weekend. It begins in late May on the Memorial Day holiday weekend and ends with the Labor Day holiday, marking the end of the summer. Grills tend to work overtime during the summer months and go back into storage sheds as the fall and winter are not ideal times for gatherings.

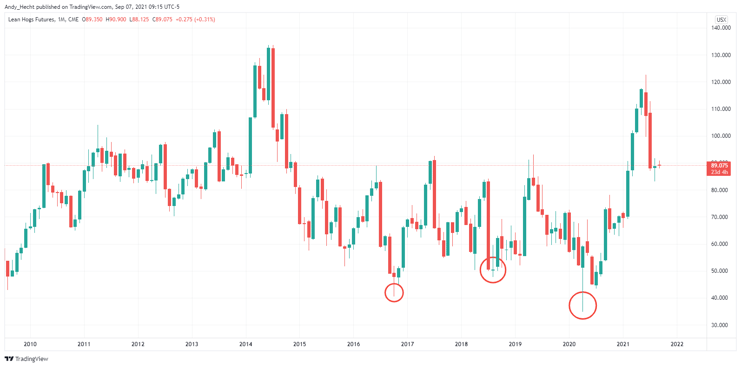

Typically, cattle and hog futures rally into the summer season and reach seasonal lows during the early fall.

The monthly chart shows that live cattle futures reached significant lows in October 2016 and September 2019 as seasonal demand weakness for beef weighed on prices. The April 2020 low was an outlier as the pandemic distorted cattle prices because of shutdowns at processing plants and supply chain bottlenecks. As the offseason for demand gets underway in the cattle arena, the market is experiencing an unseasonal bullish trend.

The monthly feeder cattle chart shows a similar pattern of weakness going into the fall and strength as the peak demand season approaches. Feeders are going into the offseason in a bullish trend with four consecutive months of gains.

Hog futures highlight a similar pattern to the beef market over the past years. The demand for ribs, sausages, and other pork products peaks during the summer months and declines after barbecues goes back into storage after Labor Day. Meanwhile, hog futures have corrected since June, but outbreaks of African Swine Fever in China, the world’s leading pork consumer, is underpinning prices.

Meat prices are higher at the beginning of September 2021 than at the same time in 2020. On the continuous futures contracts:

- Live cattle opened on September 1, 2021, 20.5% higher than at the same time in 2020

- Feeder cattle were 15.9% higher over the same period.

- Lean hog futures were 65.5% higher from September 1, 2020, to September 1, 2021.

Meat and agricultural product prices that are highly susceptible to seasonal factors are heading into the fall season in 2021 at levels that are appreciably higher than last year at the same time.

Natural gas and heating oil enter the peak season while gasoline moves towards a seasonal lull

Energy prices are much higher at the beginning of September 2021 compared to the previous year. The end of summer marks the finish of the peak driving season in the US when drivers consume more gasoline and put peak mileage on their vehicles.

The chart shows that gasoline prices were 74.7% higher on a year-on-year basis on September 1, 2021. While the fuel’s price is likely to drift lower for seasonal reasons, the technical price action is bullish.

Natural gas is heading for the peak winter heating season, but the price has done nothing but make higher lows and higher highs since June 2020, when it reached a quarter of a century low at $1.432 per MMBtu.

The chart shows that natural gas futures have a substantial head start on seasonal strength as they were 67.5% higher on the opening on September 1, 2021, than the prior year.

Source: TradingView

Heating oil futures, a proxy for all distillate fuels, are seasonal but less so than gasoline as diesel and jet fuels are year-round energy commodities. As of the opening on September 1, 2021, NYMEX heating oil futures were 74.3% higher in 2021 than in early September 2020.

The shift in US energy policy that weighs on production at a time when the demand is booming has boosted the prices of energy commodities on a year-on-year basis. Rising inflationary pressures have only exacerbated the price appreciation.

Expect the unexpected as 2021 as seasonality takes a back seat in markets across all asset classes

The US dollar is the pricing benchmark for all commodities as it is the world’s reserve currency. The dollar index measures the US currency against other reserve foreign exchange instruments.

A stronger dollar tends to be bearish for commodity prices, while a falling dollar has the opposite impact.

The dollar index opened at the 92.17 level in September 2020 compared to 92.67 on September 1, 2021. The marginally stronger dollar has not weighed on the seasonal or unseasonal commodity prices, which have been in bullish trends over the past year.

Expect the unexpected over the coming weeks, and months and you will not be disappointed. Rising inflationary pressures, supply chain disruptions, policy shifts in the energy arena, and other factors are putting seasonality in the backseat of the commodities market over the past year. Meanwhile, those raw material markets that tend to rally during the fall and winter months could carry the bullish baton even more aggressively if the current conditions continue.

Seasonality is a critical factor for commodity markets, but 2021 is anything but an ordinary year.

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.