June 14, 2019

Who Is Right Equities Or Bonds?

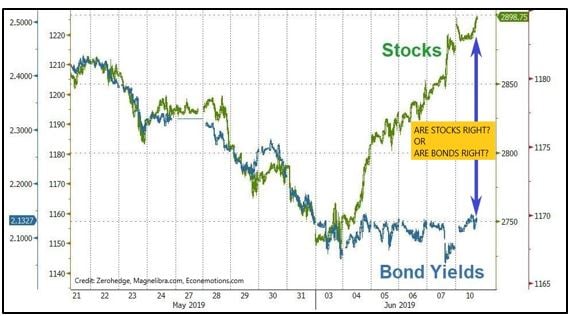

First let’s jump right into this chart here, which Zhedge posted this week and one we mocked up a bit to paint a clear and precise question, that is, who is right, equities or bonds? If the correlation in May wasn’t obvious, it is now, with quite a large negative divergence:

What is driving this divergence? The market sentiment has changed quite dramatically as investors are banking on the FED’s reversal of hiking course and now will embark on a rate cut campaign. Yes, we know it’s crazy, just a few short months ago, the thought was everything was going so well that the FED would need to raise rates. Now, after a complete 360, we have those weak-kneed debt comas induced leverage players begging for rate cuts, which may come as early as next month as the CME Fed Watch tool is now suggesting a greater than 65% chance of a July rate cut!

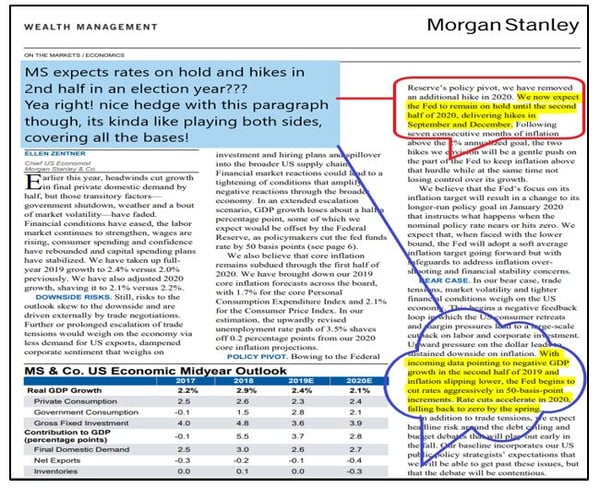

We looked at the latest Morgan Stanley economic outlook and they did a nice job of covering both camps with their base case and more bearish expectations, this infographic sums it up nicely:

So, with the central banks ready to cut, with full disregard with equity markets near their highs, one must truly look at this situation for what it is and not what it is not. Investors have been duped into the BTFD mentality from a decade of central bank volatility squashing buy everything mentality. We are far smarter and we realize what worked in the past, might not work in the same way. So, we are taking this new mentality of having to cut rates with massive doses of skepticism. More plainly, we feel the central banks are very, very nervous and are certainly caught having to desperately explain their rationale. We feel that the underlying economic disparities have led to massive imbalances in both credit and wealth and these systemic imbalances are beginning to weigh on the central banks ability to effectively coordinate global economic output.

The tariffs are adding to their ineffectiveness as central banking requires balance from both monetary and fiscal policies and thus one cannot exist without the other, at least not in a harmonious fashion. Thus, we are about to see just how well volatility can be contained by devaluing global fiat currencies once again.

This next chart should demonstrate with absurdity the massive US equity outperformance vs Europe and solidify our thesis that monetary policy has disconnected with fiscal policy. Pro MAGA?

On the one hand you have a currency that has strengthened (US$) and the other well, this picture should do the Euro its well-deserved injustice and it might just be one of our top 5 memes:

On the one hand you have a currency that has strengthened (US$) and the other well, this picture should do the Euro its well-deserved injustice and it might just be one of our top 5 memes:

Anyway, Super Mario is our poster child for European arrogance and excess. Can we blame him entirely or should the rest of Europe’s leadership be scrutinized more intensely? Mario is just doing what all central bankers do best, #Devalue #QE

However, the peripheral EU member should be thanking Super Mario as this chart clearly demonstrates the absurdity and obscenely manipulated government 10 Year yields, certainly not representative of real dollar value risk, can you say #fantasyisland:

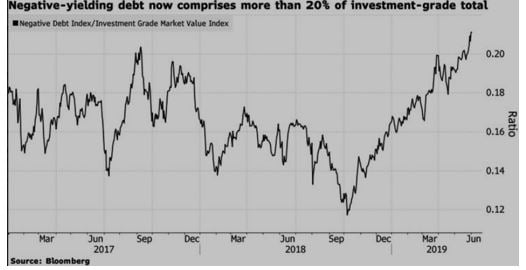

One last chart to outline the manipulation and absurdity, how many investors can even logically contemplate “negative yielding debt” we sure can’t and we are experts, well we thought we were, but when central banks get involved, we too start to believe in unicorns

While writing this, it dawned on us that we have now totally disregarded the “zerobound” constraint, this means that there is zero limit to negativity. In fact, in the laws of physics we have dynamically lowered the effective level of equilibrium and thus, the balance or overall rate structure in this case, it too must be lowered. For more on the physics side, we are speaking of two facts, one, the energy of a system tends to gravitate toward less and two the center of gravity must be below the point of support for equilibrium to exist. What central banks are doing is that they have destroyed equilibrium in the overall system and all interest rates in the system will have to fall and thus are NO LONGER A MEASURE OF SYSTEMIC RISK! They are an artificially created construct that investors need to disregard in terms of quantifying risk, in fact for us lower rates = higher risk, because the unknown consequence of the future cannot be properly quantified. We tend to think that investors have been completely fooled here and lulled into permanent sleep.

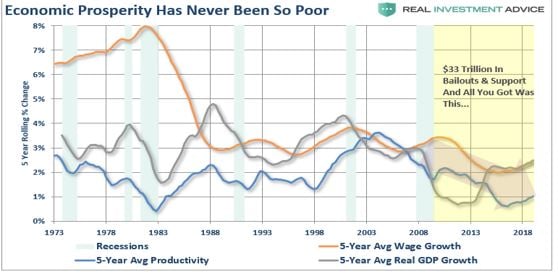

Speaking of central banking, Real Investment Advice put this excellent chart out this week, highlighting the fact that monetary easiness hasn’t led to an excess of overall prosperity, in fact its almost counterproductive, what Austrian economist would have thought that???

So, the central banks will continue to expand their balance sheets and most likely investors will continue to park all their faith in that signal notion. This graphic tells by factors how much these private enterprises have had to facilitate, so not to fail:

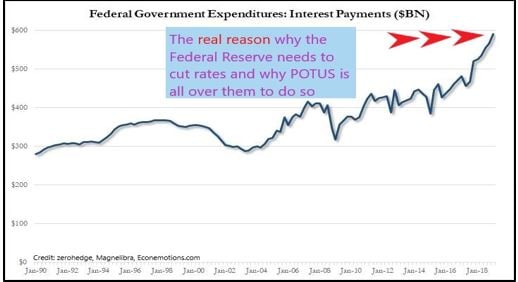

We would also like our readers to realize that there is a cost to all this printing, even to the US government, which often believes it operates with unlimited resources, but this chart demonstrates just how much this has cost the government and why interest rates are explicitly negatively correlated to the amount of debt the government takes on. As overall debt rises, interest rates must and will be artificially held low. Sending all sorts of false business risk signals:

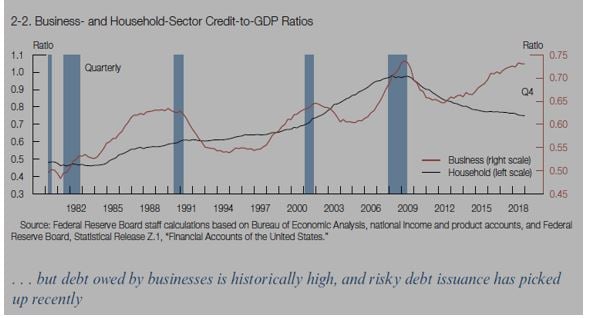

The following chart will also paint a very clear picture of why Main Street continues to deleverage and Corporations continue to go full tilt Modigliani and Miller debt for equity bonanza! Yea this will end well, just like 2008 alright:

For further evidence to this corporate excess, but in a more granular yield spread relationship picture, we can see that historically as corporate debt takes on an overabundance of debt relative to GDP, high yield spreads have tended to mean revert and do so in dramatic fashion or in trader parlance “blowout”

There are a couple of tech charts we want to bring to light and they are brought to you buy David Wienke of Cabrera Capital, if you don’t follow him or get his stuff, well you should. First up is his SP500 chart, which hit major resistance and has now begun to back off:

Here is his US Dollar chart running up against the 200dma and will set the tone for the next move:

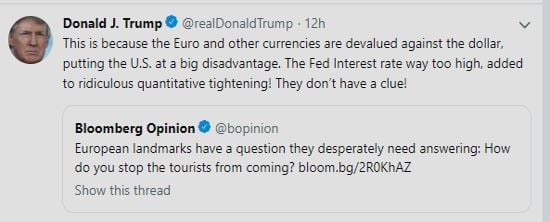

Speaking of the US Dollar, President Trump has been vocal lately and he seems to be trying to jawbone it down just a bit:

So, we have Trump calling for a weaker dollar, we have the 200dma…keep a close eye.

The next chart is an update on Beyond Meat which has taken off some 3x since its IPO and an equity we felt deserved attention, well are we going to get a pause or is this thing way over valued? Anyway, the chart shows a run up above $180!

Before we go, we thought we would mention the fact that Bitcoin is holding the $8k level and continues to exhibit strength. We feel the area continues to garner attention and one in which you as investors should keep an eye on.

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.