December 13, 2017

Artificial Intelligence is Supplanting Humans

What a week for Blockchain, that’s all we can say. For all the hoopla circulating around the introduction of Bitcoin futures and all the endless blather of uncertainty, we feel that the CBOE futures came and went without a whimper. The CBOE site was down for a bit, but overall the trading of Bitcoin futures, had zero effect on the overall Bitcoin price. As we have stated for quite some time, Bitcoin should never be confused with any derivative, nor should any of our readers be confused about what we refer to as Bitcoin.

We will never refer to Bitcoin in any other realm except in the realm of buying and selling of the actual, storable Bitcoin. No futures, no options, and certainly no derivatives. In fact the creation of and the mere thought of even creating derivatives of Bitcoin flies square in the face of decentralization and blockchain in general. So prepare yourselves for the onslaught of snake oil salesman, gurus alike and all the self-proclaimed expert crypto traders because when CNBC makes it main stream, no doubt the charlatans will be coming out of the woodwork in droves.

Rest assure we won’t be spinning or spoon feeding any propaganda, but rather we trust our reader trusts us and that’s the only way we want it. We strive to give you the utmost important and factual information we can in an unbiased approach. Well somewhat unbiased as we view our understanding to be superior than most researchers out there and thus try to reinforce our way of thinking, call us pragmatic, but we rather not confuse our reader and thus we must be forthright and honest. As most of the liberals squirm in the presence of arrogance and self-confidence, we tend to think sometimes having a tough thick skin is a good thing!

So what’s on our mind this week? We can’t help but think that the continuation, absorption and adoption of blockchain technology are growing faster than most realize. We knew years ago this would be the case and we feel that there is so much more work to be done, so much more education to be had and certainly more evolution in the entire ecosystem in general. This transition period if you will, is always topsy- turvy turbulent and it should be expected. Nothing ever transitions smoothly, especially one that involves pulling back the wizards curtain and exposing the system for what it truly is. For, isn’t Blockchain doing just that? Exposing the global fiat/debt/inflation system for what it truly is nothing more than a mega pyramid scheme that the Federal Reserve and the rest of the counterfeiting central banks conspire and feed upon. (maybe that’s a bit harsh, nah) They even have the audacity to toss the pyramid on the face of their fiats they create, just to spite everyone.

So how is Blockchain disrupting this well entrenched, well established, well engrained system?

Well, imagine a world by which trust was inherently built into the system, if you can even imagine such a place?

It seems as if the masters of our universe try desperately to achieve the exact opposite, they want the general public to be untrusting of one another, they want chaos and confusion, its seems that their utility requires it. Yes we know it all sounds silly but the reality is, there is no profit in peace and thus chaos leads to all sorts of skimming, racketeering and profiteer ways.

Maybe even one day Blockchain will improve our trust in our elected officials, boy wouldn’t that be something. Blockchain can do all this because it can create an impervious track record, immutable data and a system that is 100% trusted.

That is the vision of Blockchain and if we haven’t figured out by now that artificial intelligence is supplanting humans by the day, then surely you are lost, because it most certainly is. We feel this is a mere appendage in the organic life of adaptation. Which as all our readers know is the true key to a species survival, adaptation. Whether humans like it or not, adaptation and cohabitation with AI is required and it’s all fitting nicely with this new term you will begin to hear a lot more about in the coming years that is I-O-T. IOT stands for the Internet of Things and its all part of the 5G movement which will allow humans to interact, respond and go about daily activities without even noticing this interaction is even going on. Sensors will be in everything, all around you, recording, compiling and deciphering the data in Utopian AI bliss.

So what does this have to do with an investment and trading newsletter? A lot! It’s all a part of this symbiotic relationship that is merging mankind with the advancement of robotics and artificial intelligence and whether you like it or not, it affects your wallet, you’re future and certainly your way of life. As we have written in the past, the bulk of the investing and trading is being done by algorithms. Now let’s not be dissuaded by such a term, it’s fancy, but it’s really nothing more than a set of rules to follow. So when someone wants to sound cool, like your advisor or your friend who’s trying to impress everyone at the holiday party, they will use words like Algorithms, Big Data and AI. When in reality all they mean is a set of rules collecting information and being deployed by a computer.

Everyone is wondering why volatility is so low, why the equity markets never go down, why the markets aren’t really moving around…as we theorized in a past letter, maybe just maybe the AI is learning and reinforcing itself based upon its own actions and if its actions say the market always rises, then by goodness the market always rises. To the rational person they might think your crazy, but the AI doesn’t think, IT JUST DOES!

So that is why we speak of these crazy subjects like blockchain and IOT, because it is the future, it is the now and it’s affecting the financial markets. So if the digital world is truly in the integration stage, well, should it shock most of you that something like Bitcoin is exploding?

Should it be a shock that crypto currencies that are born from the internet, from integration are just a part of the digital assimilation process? Fundamentally if you really think about it, the fiat currency system is about as archaic as using the horse and buggy when there are cars. Yes we can truly break it down to that. As much as the media would like the masses to believe they are these uninformed uneducated pawns, the reality is a more interconnected world means we have the ability to reach anyone, anywhere at any time and that is the real benefit of all this integration. Its why we write letters like this, in hopes that we inspire you to think, to act, to reach your potential, we feel it’s our duty to spread this keen knowledge and knowhow. Do we agree with all this surveillance, hell no, but that’s a topic for another day!

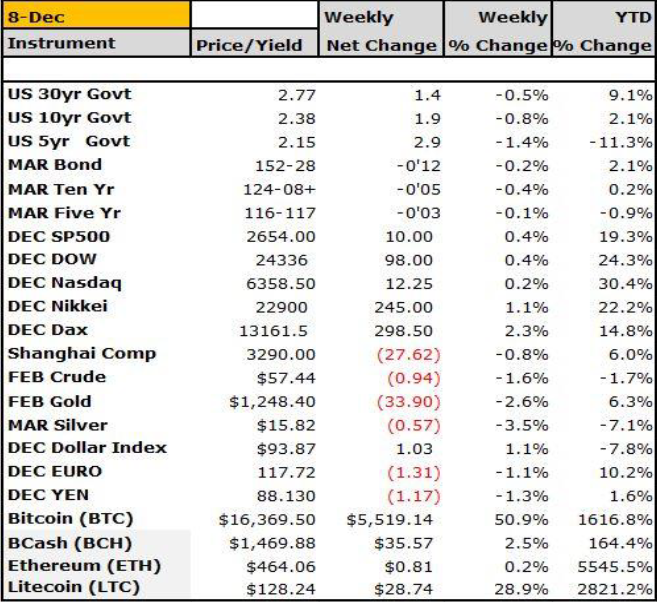

With that information in mind let’s review the moves this week in cryptocurrency land. Obviously the media has been plastered with Bitcoin this, Bitcoin that. Now when people speak of crypto they are usually referring to Bitcoin mostly, but as our readers know and from our weekly settlements, we follow other coins, such as Ethereum and Litecoin. Both Ethereum and Litecoin saw massive moves this week. Let’s look at a chart of Ethereum first:

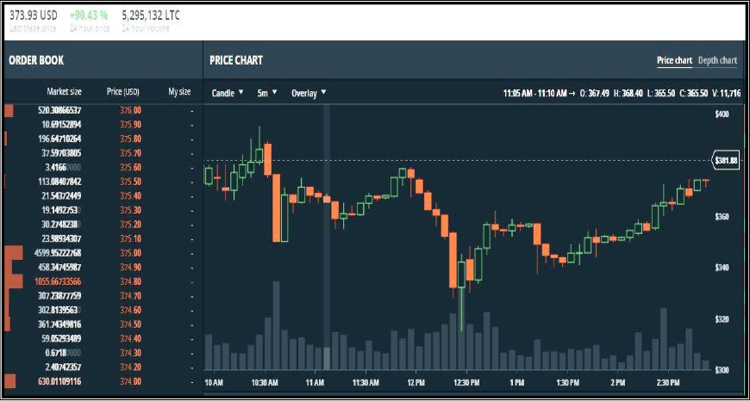

Ethereum has exploded higher and now sports a market cap of $63BN and that’s with a coin supply of 97 million. Next up we have Litecoin:

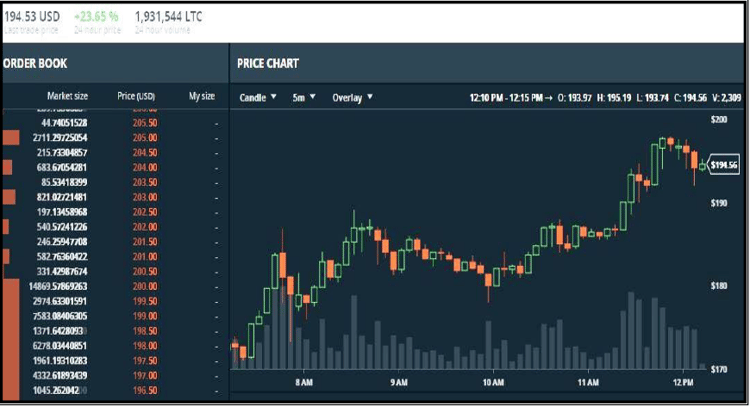

Litecoin has just exploded this week up 226% and trading at $327. At this price Litecoin has a market cap over $17BN. The largest Litecoin address holds 1.17MN so that puts the address worth at $382MN. As we were watching the Litecoin trading we noticed a very large order keeping the market capped. As you can see, on GDAX someone on Monday was offering 14869 Litecoin @ 200.00 that is nearly $3M US Dollars. You can also see all the shorts lining up in front of that heavy offer:

Then once it was taken out, it traded to $208 immediately and by the next day; this is where it stood nearly 90% higher, trading $373:

Moving on to Bitcoin, it too has had a decent run up, 33% at $17,220 with a market over $280BN:

Maybe we can all just agree now that this thing is here to stay and that we are all in this together or at least we should be. What amazes me about people when you try to explain this concept to them, this Bitcoin, blockchain, cryptocurrency thing; they really have a hard time grasping it. We feel a lot of that has to do with the negative connotation that the technology has been labeled with. We also feel it is due to nothing more than the human condition. A condition that doesn’t like change, that likes the status quo, that is content until forced. Whatever the case maybe, many more are coming into the light and are seeing that this world is just not working the way it was supposed to.

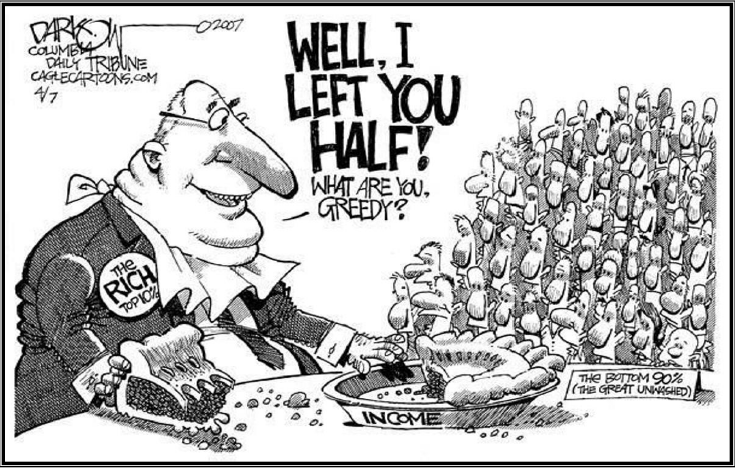

We were told that if we work hard, that if we get an education that we can earn an honest day’s work and live a decent respectable life. Many have lost faith in that concept and are drowning in uncertainty, drowning in debt and they can’t figure out why this system is failing them. Even the Central Banks are dumbfounded that their QE policies aren’t having that “trickle down” and inflationary effect they were supposed to.(damn Phillips Curve) So we feel the time is right and that the digitization and encoding of our financial and economic system should lead to a more trusting, diverse and provident system. We found this cartoon and couldn’t help ourselves:

We will strive each week to point on the key facts in the space, because whether you like change or not, doesn’t matter; all of this technology is changing the investment landscape, economics and finance like nothing we have seen before. We feel the fiat currencies days are certainly numbered and that should scare the hell out of any current establishment whose very existence is predicated on archaic ways of doing things.

Continuing in the Bitcoin space we had the Winklevoss twins of Gemini Trust Co. in an interview on Bloomberg this week, some of their quoted highlights are:

- Bitcoin is gold 2.0

- Bitcoin matches and beats gold in all facets

- Building out a Bitcoin ecosystem which we think is the largest component for Bitcoin to exist going forward is what they are trying to accomplish

As far as their ETF product they are currently in the appeal stage with the SEC. They own and operate the Gemini crypto exchange.

Another tidbit we discovered was that USAA, NYSE and BBVA were a part of Series C financing round in Coinbase back in 2015, we are interested to see if this will affect their respective returns, good for them for getting involved.

The CME Group is still planning on launching their Bitcoin future this coming Sunday night, so we will see how that big contract trades, considering its 5x as big as the CBOE one. In fact here is a nice breakdown of both their respective Bitcoin Futures:

CONTRACT UNIT

- The CBOE Bitcoin Futures Contract will use the ticker XBT and will equal one bitcoin.

- The CME Bitcoin Futures Contract will use the ticker BTC and will equal five bitcoins.

PRICING AND SETTLEMENT

- Both CBOE and CME bitcoin futures contracts will be settled in U.S. dollars, allowing exposure to the bitcoin without actually having to hold any of the cryptocurrency.

- CBOE contract will be priced off of a single auction at 4 p.m. Eastern time (2100 GMT) on the final settlement date on the Gemini cryptocurrency exchange.

- CME’s contract will be priced off of the CME Bitcoin Reference Rate, an index that references pricing data from cryptocurrency exchanges, currently made up of Bitstamp, GDAX, itBit and Kraken.

TRADING HOURS

- CBOE XBT contract will trade on CFE, with regular trading hours of 9:30 a.m. to 4:15 p.m. Eastern Time on Mondays and 9:30 a.m. to 4:15 p.m Tuesday through Friday. Extended hours will be 6 p.m. Sunday to 9:30 a.m. Monday, and 4:30 p.m. Monday through to 9:30 a.m. Friday.

- CME BTC will trade on CME Globex and CME ClearPort Sunday to Friday from 6 p.m. - 5 p.m. Eastern Time with a one-hour break each day beginning at 5 p.m.

MARGIN RATE AND CLEARING

- CBOE contract will clear through the Options Clearing Corporation and a 44 percent margin rate will apply.

- CME contract will clear through CME ClearPort and will have a 35 percent initial margin rate.

CONTRACT EXPIRATIONS

- CBOE said it may list up to four weekly contracts, three near-term serial months, and three months on the March quarterly cycle.

- CME said it will list monthly contracts for the nearest two months in the March quarterly cycle (March, June, Sept., Dec.) plus the nearest two serial months not in the March quarterly cycle.

PRICE LIMITS AND TRADING HALTS

- CBOE will halt trading in its contract for 2 minutes if the best bid in the XBT futures contract closest to expiration is 10 percent or more above or below the daily settlement price of that contract on the prior business day.

- Once trading resumes, if the best bid in the XBT futures contract closest to expiration is 20 percent or more above or below the daily settlement price of that contract on the prior business day, the futures will be halted for 5 minutes.

- CME will apply price limits, also known as circuit breakers, to its bitcoin futures of 7 percent, 13 percent, and 20 percent to the futures fixing price. Trading will not be allowed outside of the 20 percent price limit.

Sources: Reuters, CBOE, and CME

It seems as if we don’t report too much on the equity or bond markets anymore, well it’s because there isn’t much to report really. Equities continue to advance, the bonds aren’t moving as the yield curve continues its flattening ways and the fundamentals don’t really matter anymore. The 10yr US Treasury Repo has been at full negative penalty rate for a week now and nobody seems to care. Just so you know, it is a big deal and when a repo fails, that means the system is broken and it’s not functioning properly. I didn’t see one headline on it, but those short the thing, are paying a steep price. Anyway, it will be interesting to see if a tax deal gets done and if the FED changes its predictions as we get the final FOMC of the year and for Janet Yellen. Status quo is all we can say and as her predecessors before her, she was damn good at keeping the rhetoric going, can’t say we will miss her, just another foregone conclusion. Anyway the banks will be glad tomorrow as they will be getting another $5.5BN added to their now nearly $33BN in annual free capital to “trickle down” via the IOER mechanism. That doesn’t look like a hike to us now does it? Let me get this straight, the banks are paid interest and earn $33BN a year for not lending it out…ahh yea, duh!

In conclusion it seems as if the blockchain race is on and we are glad we have had the foresight to see it coming. We are glad that you continue to enjoy the journey with us and we hope you learn something week in and week out. Please tell your friends to join us in this revolution of truth and pass our letter along or have them sign up. We appreciate any feedback you may have and as usual we leave you with the weekly settles. We are noticing gold and silver falling and we don’t want to speculate, but maybe there is some reallocation out of there and into crypto, wouldn’t that be something…Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.