December 1, 2019

“Better To Get Half Than Nothing!”

Happy Thanksgiving everyone, we hope you truly spend time with those that you love and reflect on all the great things in this life that you are thankful for. Sorry we haven’t been able to provide more content but we have a bunch of other things going on so bear with us. We do post a lot of current content on LinkedIn and you can follow me on there to get more real time posts. So, what I plan on doing here on out is provide you with some of those posts and insights, as sort of a recap. Anyway, as far as the important news driving the markets, well we can only say that the only game that matters is how much liquidity central banks are adding during times of monetary stress.

Now therein lies the caveat “during times” well it seems every month and especially every quarter we are seeing more and more liquidity needs. What this tells an astute investor that is privy to market mechanics is that without the liquidity and access to overnight balance sheet funding, all the games being played via short term financing, all the interest rate arbitrage, asset based financed arbitrage, would expose the true fallacy of our system. The fallacy is simple, that the markets can function without central banks providing daily funding, or in more simple terms, “rigging” the system.

Well not that a fractional reserve system isn’t rigged already, because by inherent design, it can only be rigged else the system fails miserably. Which brings me to sharing a little classic movie that I’ve grown up watching, “it’s a Wonderful Life” the Frank Capra, Jimmy Stewart classic.

As a kid it was mandatory yearly viewing with my mom. Now as a kid you just take things for face value, but as I grew up, the meaning of the movie became evidently clear. You live your whole life trying to do the right thing and then in one instance and sometimes not even upon the heels of your own volition, things can take a drastic and often accelerating turn for the worse. Please indulge me a bit as I go through one of the most important scenes of the movie. As far as a brief background to the scene, we have poor virtuous George Bailey played by the iconic Jimmy Stewart, he owned a small-town savings and loan. George’s Building and Loan had its credit called in by its lending bank and was forced to make good on full payment. However, this depleted the banks cash (think reserves) and word hit the street that their doors were going to close (think panic).

Fast forward in the scene where depositors begin cramming into the savings and loan demanding their money. Well, this is where George comes in and calms the fears and explains in the simplest terms, the true nature of fractional reserve lending. As the depositors lined up and as George grabbed his chin, desperately trying to solve this problem, Frank Capra tosses in some fire engines whizzing by outside blaring their horns and all the people rush to the window to have a look, as if they were going to see something. Looking back now I know Capra’s intent here was to merely install in the viewer the feeling of chaos, fear and alarm, that the house is about to burn down, sheer classic move.

Anyway George took to the counter and explained to a disgruntled depositor who asked if George could guarantee the money, George said, “Your thinking of this place all wrong, as if I had the money back in a safe, the money’s not here, well your money’s in Joe’s house, that’s right next to yours and in the Kennedy house and Mrs. Maclin’s house and a hundred others. Your lending them the money to build and their gonna pay it back the best they can, what are you going to do foreclose on them?”

What George Bailey just explained right there is the entire crux of our central banking, fiat fractional reserve lending system and what happens next is the most obvious and unnerving outcome from a system designed like this.

A gentleman named Randall walks in and says, “hey Tom, Tom did you get your money? Tom says No, the man says, well I did, old man Potter is willing to pay 50 cents on the dollar for every share you got, cash.”

When George asks Tom to stick to the original agreement of waiting 60 days (think term repo) Tom says “Ok Randall.”

Then a concerned woman asks if he is going to Potter and Tom responds with the typical (think panic equity seller or retail investor) “Better to get half than nothing!”

Then George, leaps over the counter, slams the door shut and tells Tom and Randall the truth about what is truly happening here, ”Tom, Randall, wait, now listen to me, I beg of you not to do this thing, if Potter gets a hold of the Bailey Building and Loan, there will never be another decent house built in this town. He’s already got charge of the bank, the bus lines, the department stores and now he is after us (Think Google, Media Giants, Amazon, Walmart), why? Because it’s very simple we are (think mom and pops) cutting in on his business, that’s why, because he wants to keep you (commoners) living in his slums, and paying the kind of rent he decides (Elites).”

Now George really breaks down the God’s honest truth by asking another patron, “here Ed, you know, remember last year when things weren’t going so well and you couldn’t make your payments, well you didn’t lose your house did yah, you think Potter would have let you keep it? Can’t you understand what’s happening here, don’t you see what’s happening here? Potter isn’t selling, Potter is BUYING and why because were panicky and he’s not that’s why, he’s picking up some BARGAINS.” (think market downturns and bottoms and who comes in to save the day, think Buffett, Soros)

Ok, I won’t ruin the rest and I truly hope you watch this movie, link to the scene Here for many of life’s great lessons exist within its classic confines. I truly appreciate my parents given me this gift even if as I hit adolescence, I most likely complained about watching it every year. I have continued this tradition with my own children in hope’s that one day it means as much to them as it has to me.

The movie is so much more than just a holiday classic it is an investment in life, despair, courage, faith and it is something I will cherish for all my days. I appreciate it more and more, especially as I have matured and become educated upon the very constructs that define our systems. The control mechanisms that shape our deterministic values by which so many truly believe they have freedom of choice. When you break things down today, do we really have much of a choice or are the narratives so shaped and so perfectly gift wrapped that we only have a mere figment of choice. Propaganda and subliminal, targeted ads, 24hr inundation of media, makes it obvious that the only choice we truly have is whether to turn things on or off as everything is truly binary at this point, just 0s and 1s.

Ok with after that random walk, let’s move on to a few charts of note that I found this week. This first chart from Zhedge presents solid evidence that the trade war is truly hitting china very hard as YoY industrial profits continue to plunge:

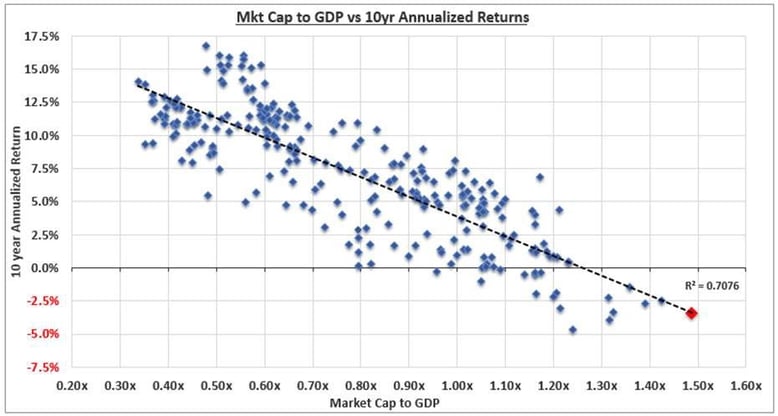

As industrial profits fall there, on the US front we saw an excellent chart from @GS_CapSF on Twitter which is a regression of the 10yr annualized returns vs the market cap to GDP ratio. Well we think the chart speaks for itself and is most likely another reason why the central banks are all in:

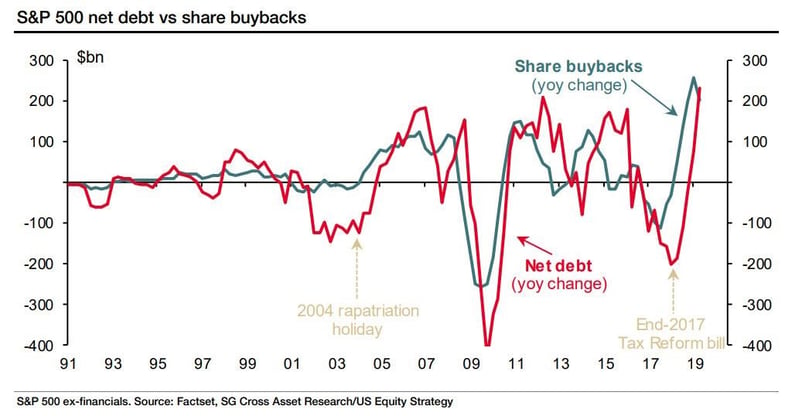

This may also be the reason corporations continue to take on massive amounts of debt to buy back their equities:

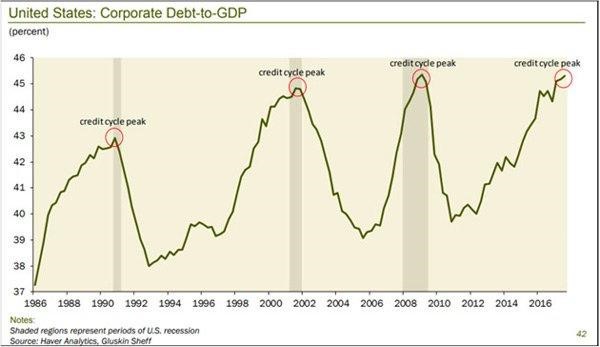

Haver Analytics posted this graphic as well which paints a very formidable picture of the past limitations of the amount of corporate debt to GDP:

We aren’t going to post any technical market charts, as we feel the new highs are obviously being massaged higher buy continued liquidity from our central banks, thus we will not expect any targeted change in this trajectory unless said liquidity is taken away. However, the central banks have made it very clear and our words of advice are as follows, if you want to be the smartest guy in the room this holiday season...when all the dopes talk about overvalued, recession, dollar is going to drop...just take it all in and when the time is right, just say...the only thing that matters is Overnight Repo...one, they won't know what the hell you are talking about and two, it’s the dead truth, so you will be king either way...the FED and the central banks are all in!

How do we know, well look at this headline, “The Federal Reserve Bank of New York added $108.95 billion in temporary liquidity to the financial system on Wednesday.” As much as the FED keeps using the word temporary, I guess the only other option would be for them to add the word indefinitely before temporary, this way at least they wouldn’t have to keep up these pretenses.

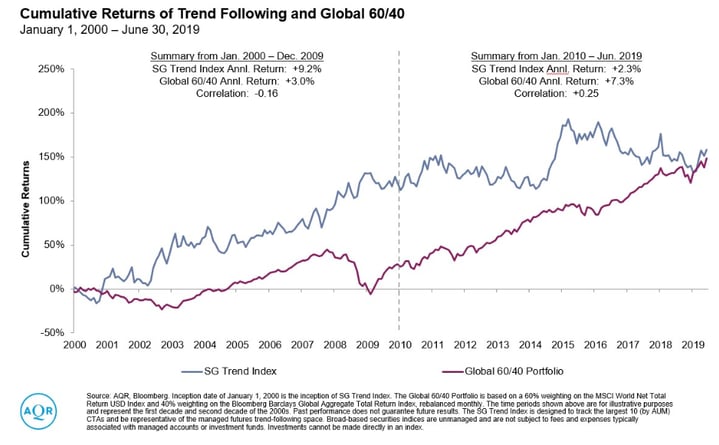

Ok now for our last chart and we are glad to see this data pointing this way as we can’t figure out why CTA’s are generally considered negatively correlated products. This chart provides evidence that this is indeed changing and is more a matter of necessity as the industry struggles to compete against these non-zero sum playing central banks whose only obvious mandates are 1. Higher Asset Prices and 2. Low Volatility.

Don’t kid yourselves and don’t buy into the Kool-Aid this is our regime and it’s been this way for quite some time. Nothing has really changed since It’s a Wonderful Life first came out, in fact the only thing that has changed are the names, the actors are all still the same! Have a great holiday season. Cheers.

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.