August 16, 2021

The CPI Fantasy and Commodity Prices

By Andrew Hecht

- Another significant increase in the inflation barometer

- Core CPI is fantasy land

- Look at the evidence- It costs more to power our lives and fuel our bodies

- Transitory in Fed Speak and the literal definition is not the same

- The trend is always your friend- Economists are behind the curve

Rodney Dangerfield was one of my all-time favorite comedians. He was a master at the one-liner, and while his catchphrase was “I don’t get no respect,” he got plenty.

Rodney passed in 2004, but his legacy lives on in films. His role as Thornton Melon in the 1986 comedy classic Back to School continues to have a cult following. As he sat in an economics class, the professor created a theoretical company that sold widgets, the favorite product of academics. The lesson included funding the company and developing a marketing strategy for the widgets. Rodney’s character, already a wealthy businessman, attempted to point out the realities of starting a business, but the professor objected. Rodney then glibly asked the economist if his factory was in “fantasy land.”

While the film was a fictional comedy, there is a fine line between fiction and nonfiction. The US Federal Reserve continues to call rising inflationary pressures “transitory.” Long ago, the economists massaged the consumer price data to extract a core that excludes food and energy prices called “core CPI.” Thornton Melon would call the core data “fantasy land” as food and energy are the critical factors that take a bite out of consumers’ budgets.

Another significant increase in the inflation barometer

In June and July, the previous month’s consumer price index data was off the charts, indicating rising inflation. This month, the July CPI reading rose 5.4%, another sky-high level. While the number was in line with the market’s expectations, core CPI, excluding food and energy, was up 0.3% compared to the forecast level at 0.4%. The market interpreted the core number as less inflationary as it was below the expected reading.

Core CPI is fantasy land

Economists are social scientists, making their projections and interpretations highly subjective. They argue that core CPI better reflects inflationary pressures because food and energy prices can be highly volatile. Excluding them from the inflation barometer smooths the data.

In statistics, the science of data, hedonic regression is the application of regression analysis to estimate the impact of various factors on the price of demand for a good. Hedonics is commonly used in real estate pricing as a quality adjustment for price indices. When it comes to inflation, excluding food and energy from the CPI is similar.

The problem with core CPI is that food and energy make up a significant part of budgets. Rising prices for the products that fuel our lives and provide nutrition for our bodies is taking an ever-increasing bite out of paychecks is a reality, while eliminating them distorts the actual cost of living for the majority of people. Economists massage data. The US Federal Reserve relies on statistics in its monetary policy decision-making process. Thornton Melon would say that core CPI only exists in “fantasy land.”

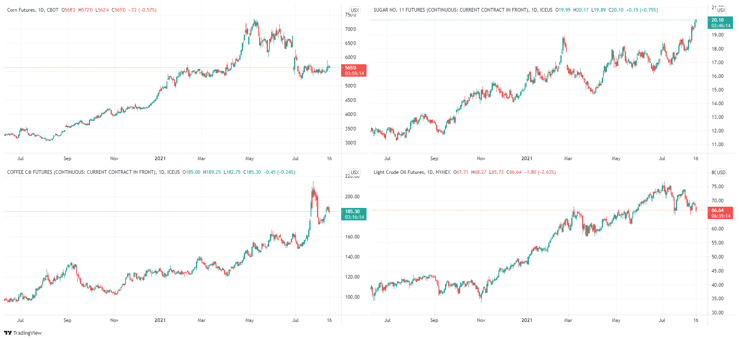

Look at the evidence- It costs more to power our lives and fuel our bodies

Anyone that fills their car with gasoline, heats or cools their homes, or eats, will tell you that prices are a lot higher in August 2021 than they were in August 2020. Futures prices are real-time objective data as they reflect where buyers and sellers meet in a transparent environment. The evidence pointing to the reality of rising inflation from the August 2020 high to the August 13, 2021 closing level on the nearby futures contracts is clear:

- Nearby NYMEX crude oil prices increased from $43.78 to $68.44 per barrel, an increase of 56.3%.

- Gasoline moved from $1.4395 to $2.2626 per gallon or 57.2%.

- Heating oil and distillate prices rose from $1.3054 to $2.0779 per gallon, a 59.2% rise.

- Natural gas appreciated from $2.743 to $3.861 per MMBtu or 40.8%.

- Corn rose from $3.53 to $5.6825 per bushel or 61.0%.

- Soybeans rallied from $9.67 to $13.73 per bushel or 42.0%.

- CBOT wheat increased from $5.5175 to $7.6225 per bushel or 38.2%.

- Coffee rose from $1.3080 to $1.8275 per pound or 39.7%.

- Sugar moved from 13.28 cents to 19.95 cents per pound or 50.2%.

- Live cattle appreciated from $1.08225 to $1.28125 per pound or 18.4%.

- Lean hogs are up from 56.70 cents to 86.525 per pound or 52.6% over the period.

Source: TradingView

Source: TradingView

The substantial increases in food and energy commodities paint a very inflationary picture. Moreover, the price rises reflect wholesale levels. Retail prices have risen far more over the past year. Yesterday, I paid over $4.20 per gallon for gasoline in Las Vegas, double the price last year. Food and energy prices are the tip of an inflationary iceberg. Education, health care, and housing costs are soaring. All raw material prices have moved appreciably higher.

Transitory in Fed Speak and the literal definition is not the same

In reality, prices are soaring in the Fed’s “fantasy land,” the core CPI data does not look all that bad as they only rose 0.3% in August. However, our food and energy bills went up a hell of a lot more last month.

Over the past months, the Fed blamed rising inflationary pressures on lumber, new and used car prices, and other “transitory” factors created by bottlenecks in supply chains and other pandemic-related factors. The academic ivory tower where the economists sit is far above ground zero, where consumers shop each day.

The definition of “transitory” is not permanent. Adjectives are temporary, transient, brief, short, short-lived, fleeting, and passing. “Transitory,” in a literal sense, requires an end date. So far, the Fed has not provided that data to the market. When asked about the period the central bank measures its 2% average inflation target, Chairman Powell replied it is “discretionary” or available for use at the user’s discretion. Transitory and discretionary is Fed-speak for leave it to us. They are non-answers to critical questions about the Fed’s interpretation and policy stance. Transitory reflects the central bank’s hopes and wishes, while discretionary tells us they will figure it all out someday.

The trend is always your friend- Economists are behind the curve

The bottom line is that the most objective measures of inflation are the wholesale futures prices and the retail costs of living. Food and energy prices are only a microcosm of rising prices across all asset classes. Money’s purchasing power is eroding because of the tidal wave of central bank liquidity and tsunami of government stimulus. Even if the Fed bites the bullet and addresses rising inflation, the government continues to spend without abandon. A $3.5 trillion budget initiative before the US Congress with an infrastructure rebuilding package only increases the debt level.

The Fed is living in “fantasy land” as inflation continues to rise. In August 2020, gold made a new record high. In May 2021, lumber, copper, and palladium prices rose to all-time peaks. Grains and oilseeds rose to eight-year highs in 2021. In July, coffee futures rose to their highest price since 2014. Bull markets in the volatile commodities sector rarely move in a straight line. The ascent of prices has been nothing short of a bull market relay race, with one commodity handing the baton to the next. The most recent recipient was the sugar market, which rose to over 20 cents per pound last week, the highest price since 2017. Even if we use statistical methods to smooth the bullish price action, the underlying trends reveal that the Federal Reserve’s approach to monetary policy is far behind the inflationary curve.

Inflation can be a challenging beast to tame. As it rises, the central bank’s refusal to acknowledge and address the economic condition will reward it with the lack of respect it deserves. We live in a stark reality created by policies that continue to erode money’s value.

Rodney Dangerfield was a comedian. There is a fine line between comedy and tragedy. If the approach to monetary policy that hides behind massaged data were not so tragic, it would be funny.

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.