September 18, 2019

Crude and Repo Turmoil Drives Markets

Well this week started off with sheer panic in the energy complex as a large production facility in Saudi Arabia was attacked and bombed cutting off potentially 5% of the global supply of oil. The highly sensitive to Saudi production output, Brent Crude jumped nearly 20% on the open hitting a high just shy of $72 after closing a tad over $60 on Friday. Obviously, there was quick finger pointing and geopolitical posturing but we don’t deal with unknowns, what is known is that stability in the region is weakening and now SA will have to figure out how best and how quickly to get the supply up and running again. Here is a quick technical chart of the Light Crude Oil Futures which jumped Sunday to a high of $65.23 up some 20% from Friday’s close of $54.80, however as trading progressed, Crude Oil continued to lose ground. The hourly chart resistance is backed up by the longer-term time frames below $63.32 which is the .786 Fib retrace level, so expect further pressure down as we stay below this level:

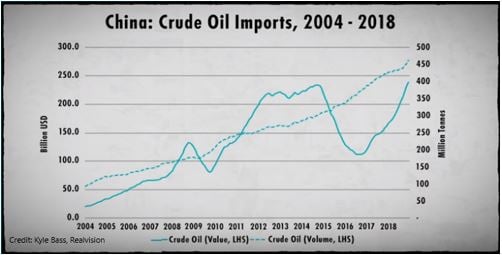

As a side note, and if China didn’t have enough net capital account issues, this chart from Kyle Bass reflects their sensitivity to the increased cost of crude oil:

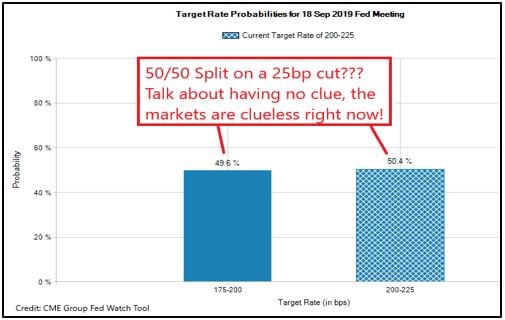

Obviously, the big story this week other than Crude Oil is the FOMC meeting on Wednesday. The markets have discounted most of their rate cutting bonanza by barely signifying a 25bp cut at this meeting. Talk over the last few weeks were of a dovish Fed needing to cut significantly over the next few months, but it seems a few players have taken this time to smash this expectation as now it’s a 50/50 toss up between no move and a mere 25bp cut. This is indicative by the CME Fed Watch Tool here:

(Bloomberg has the odds tilted toward 86% for a 25bp cut, which is attributed most likely to the methodology used, CME uses an effective weighted rate for the month and last night repo action had its effect that’s for sure)

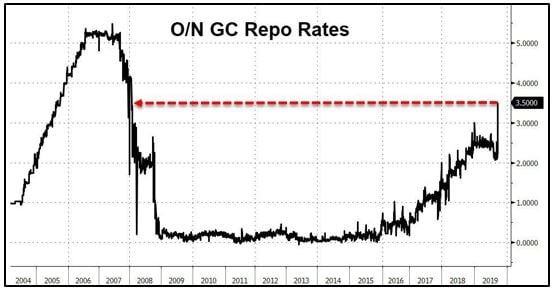

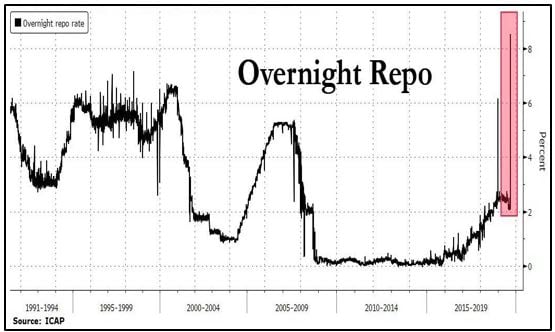

What is most certainly on the Fed’s mind this week is the fact that they had to intervene in the Repo market this week for the first time in over a decade. This indicates funding stress and as a dollar shortage continues, this is putting the Fed in a very precarious position. We can’t help but notice the similarities leading up to 2008 but as usual, the equity markets have buried their head in the sand (Zhedge charts):

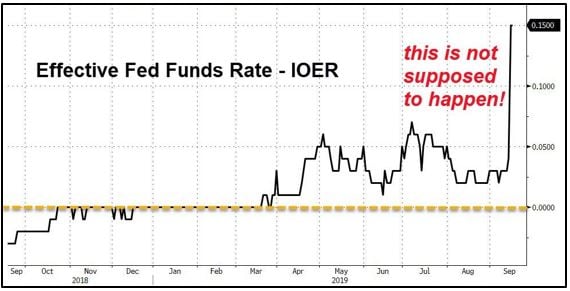

Furthermore, the Fed continues to lose control of the short rate as Effective Fed Funds once again trades significantly above IOER:

We are quite sure Powell doesn’t like the looks of this next chart as Overnight Repo’s hit a staggering 10% (one day funding costing perhaps half a year’s profits?) We also know the fine stigma attached toward any institution having their name posted as a user of the discount window, this is shaping up to be quite an event, can’t wait to see who comes forward first, or shall we say who lay victim first:

The U.S. 30YR Bond Futures have fallen back quite a bit, nearly 11 full handles from their highs and have hit the 2019 support zone which has been supportive of higher prices when hitting this upsloping channel since March:

The metals have followed bonds down as Silver Futures back away from the $18.50 area and are at risk of further consolidation or rotation down to the .382 fib at $16.75:

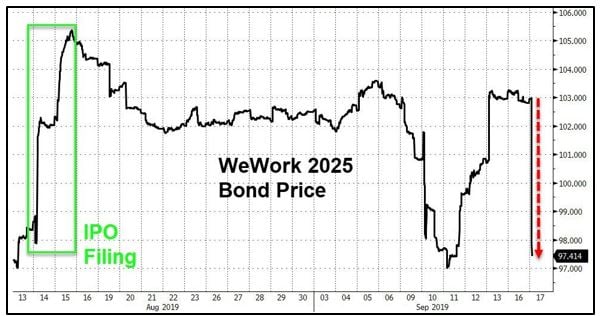

In other news we have been following the WeWork debacle and many of our readers know our disdain for such terrible business models. We are sick and tired of investors falling into this absurd unreality whereby profitable business models seem to be things of the past and we are seeing more euphoric hyped up financialized gimmickry take precedent. We are glad to see that some have at least taken the opportunity to scrutinize WeWork just a bit and this chart clearly demonstrates that funding is the only source of revenue, look at the WeWork bond price here with the IPO announcement and then reality hits:

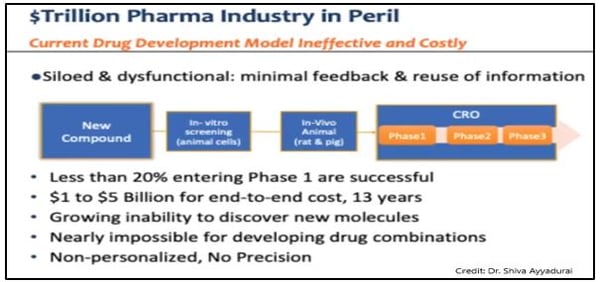

Also, we heard a great periscope today from Dr. Shiva Ayyadurai the patent holder for “Email” who wrote the system code when he was just 14. Anyway, he was speaking of the medical industries lack of risk management and testing when it comes to the veracity of immunizations. He would rather see much more empirical testing done as to whether the risks are warranted or if this is more of a case of putting profits ahead of logical, fundamental assessments, we follow this debate closely and so should you. Why? Because any time someone is trying desperately to mandate something, especially one that means subjecting one to the injection of foreign bodies or unknown bodies, well, you would be stupid not to question the narrative:

We also saw this graphic from Statista, that Chicago is among the top 10 in the world as one of the safest cities in the world! Well done my home town!

Finally, we wish you all the best this week, be on your toes as anything and everything is possible, which brings us to our final graphic. We would give due credit yet it was online with no listed originator but we thought it highlights the life of a trader, or anyone else who choose to never gives up, so enjoy:

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.