August 30, 2021

Cryptomania Is Back - Afghanistan Is Bullish

By Andrew Hecht

- Bitcoin and Ethereum rise above the midpoint of a very volatile move since April and May

- The market cap is back above $2 trillion

- Afghanistan is bullish for cryptos- Portable wealth that transcends borders and scrutiny

- The Taliban’s return shatters faith in foreign policy

- Weak governments weaken currencies- Expect the evolution of the crypto revolution to continue

This week is the beginning of September 2021, the twentieth anniversary of the horrendous terrorist 9/11 attacks on the United States. Soon after, the US began military operations in Afghanistan, a hotbed of harboring terrorists under the Taliban.

It took twenty years, four US Presidents, trillions in military expenses, and many lives to achieve the goal of replacing the Taliban with the Taliban. On August 31, the US will officially leave Afghanistan, and it will not be the first superpower to learn a lesson in the mountainous, tribal country. The Russians paid a price in the 1980s when they left the nation after failing to achieve military objectives.

Tens of thousands of Afghans that assisted the US and NATO are now in a dangerous situation at the hands of the new leadership. While promising to be a “kinder and gentler” Taliban, the punishment for treason is likely to cost many lives. Moreover, the strict interpretation of Sharia Law will bring a return of brutal punishments and human rights violations.

Scenes of the crowds of Afghans descending on Kabul’s airport in the final days of the US and NATO presence and the terrorist attack at the hands of ISIS-K were heartbreaking. While tens of thousands left their homeland to start over, others are stuck as the borders have sealed. Over history, we have seen many events where refugees fled their homes carrying little more than the shirts on their backs. The events over the past weeks strengthen the case for means of exchange that transcend borders and are easily portable. The case for cryptomania may have never been more compelling than right now.

Bitcoin and Ethereum rise above the midpoint of a very volatile move since April and May

Bitcoin reached its most recent all-time high on April 14, the day of the Coinbase (COIN) listing. Ethereum followed, making its high in May. Over the past years, cryptocurrencies reached new peaks on the back of supportive events. In late 2017, the leading cryptocurrencies rose above the $20,000 level for the first time when futures contracts began trading. Meanwhile, the parabolic moves that took the two leading cryptos to highs in April and May ran out of upside steam, and both more than halved in value, reaching lows in late June.

China’s ban of crypto mining and trading and news that Elon Musk’s Tesla (TSLA) decided not to accept Bitcoin for its EVs because of the carbon footprint helped push crypto prices appreciably lower from the highs.

As the weekly chart shows, Bitcoin dropped from $65,520 to a lot of $28,800. The midpoint of the move stands at $47,160. At the end of last week at $48,030, the leading crypto was above the mean and had probed above the $50,000 level on August 23.

Source: TradingView

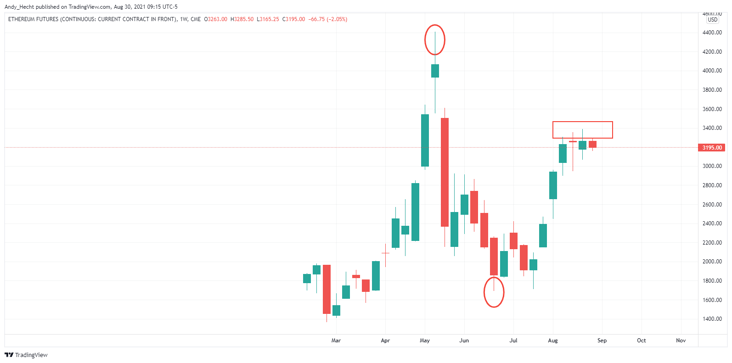

Ethereum futures fell from $4,406.50 to a low of $1697.75, with the midpoint of the move at the $3,052.125 level. At over $3,220 per token on Friday, August 27, Ethereum made a substantial comeback from the low and had traded near the $3400 level at the beginning of last week.

The market cap is back above $2 trillion

The overall market cap of the cryptocurrency asset class peaked above the $2.4 trillion level when Bitcoin and Ethereum were on the highs in April and May. The correction sent it well below $1.4 billion. As of the end of last week, the asset class’s value was back on the upswing, over the $2 trillion level.

Source: CoinMarketCap

Source: CoinMarketCap

The chart shows on Sunday, August 29, a total of 11,468 cryptocurrencies had a market cap of over $2.088 billion, with Bitcoin and Ethereum accounting for 61.8% of the value. Meanwhile, the other 38.2% was spread over 11,466 tokens. Only 94 tokens or 0.82% of the asset class have market caps above the $1 billion level, so there is plenty of room for growth.

While two trillion is a huge number, considering Apple’s (AAPL) market cap was $2.,456 trillion on August 27, cryptocurrencies remain an emerging asset class that poses little systemic threat to the financial system. However, the potential for disruptions will rise with the value over the coming months and years.

Afghanistan is bullish for cryptos- Portable wealth that transcends borders and scrutiny

Capital flight occurs when assets or money flow out of a country because of an event of economic consequence or as the result of economic globalization. There are many historical examples of people fleeing their homeland because of a change in the political landscape.

In 1930s Nazi Germany, many people fled to other countries with only the shirts on their backs. Some carried gold and diamonds as flight capital to assist in starting a new life in another home.

The latest example comes from Afghanistan, where the sudden takeover by the repressive Taliban caused panic to get western citizens and Afghans that assisted in the two-decade failed war effort out of the country. As the Taliban took control of Kabul, banks shuttered, and it became impossible to withdraw cash. Those with the foresight to open cryptocurrency accounts could carry a flash drive or secure password out of the country, protecting their wealth and savings.

Cryptocurrencies that sit in computer wallets in the cloud are portable wealth instruments that transcend borders and scrutiny and are likely to gain utility and acceptance in the aftermath of the situation in Afghanistan.

The Taliban’s return shatters faith in foreign policy

Meanwhile, the US and NATO defeat at the hands of the Taliban after a costly twenty-year war and the surrender of control, leaving many at risk, has divided allies. Criticism over the retreat logistics could change the US’s role as a world leader over the coming years. Afghanistan’s legacy could make countries think twice about the US commitment to world security.

We could see the event trigger other political changes as some interpret US foreign policy as weakened. China has made no secret of its desire to “unify” Taiwan, which it considers a part of Chinese sovereign territory. Russia has designs on influence in Ukraine and other bordering former Soviet bloc countries. After a twenty-year war where the Taliban and terrorist organizations believe the US-occupied their lands, the potential for attacks in the US and NATO countries will increase. Afghanistan is back in the hands of a government with a history of harboring terrorists that seek to strike outside its borders.

Fiat currencies reflect the full faith and credit of the governments that issue legal tends. The dollar may still be the world’s reserve currency, but the standing along with all fiat currencies has taken a giant step backward. Monetary and fiscal stimulus have diluted the currency values, and the foreign policy missteps have taken the US down more than one notch in the world’s eyes. The bottom line is the faith has declined, and the credit is suspect, weighing on the dollar and all other fiat means of exchange.

Cryptocurrencies are the embodiment of libertarian ideology, returning power to individuals. The decline in faith and credit only bolsters the case for the burgeoning asset class.

Weak governments weaken currencies- Expect the evolution of the crypto revolution to continue

An almost perfect bearish storm has descended on fiat currency markets. It is challenging to watch them depreciate because the foreign exchange arena is a mirage.

We watch the value of one currency versus another; the dollar versus the euro, the euro versus the pound, the dollar versus the yen, and the many other cross-currency relationships. It is easy to identify when one currency weakens against another. However, what is not readily apparent is the decline of the entire fiat currency asset class.

Inflationary pressures erode currency values. In 2019 and 2020, gold rose to a new record high in almost every currency on the planet. Over the past months, commodity prices have increased to multi-year, or in some cases, all-time highs. The US Fed calls the inflationary trend “transitory,” blaming it on supply chain bottlenecks and other pandemic-related reasons. Meanwhile, the Fed, other central banks, and governments planted the inflationary seeds with a tidal wave of liquidity, artificially low interest rates, and a tsunami of fiscal stimulus to stabilize the US and global economy because of COVID-19. The currency markets were already under pressure from a credit perspective. Afghanistan is another blow to the faith component of their value.

Cryptocurrencies are in the right place at the right time, and timing is critical in markets. Expect the evolution of the cryptocurrency revolution to continue. The technical trends remain higher. Moreover, the underlying fundamentals on the political and economic landscapes favor the continued decline of fiat values, lifting the potential for gains in instruments that embrace fintech.

Cryptomania is back, and the events in Afghanistan add another reason for the asset class to thrive. As the prices rise, expect the speculative fever to reach even higher levels over the coming months and years as market participants search for the next Bitcoin or Ethereum.

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.