July 10, 2017

DEPRECIATING SAVINGS

With the equity and bond markets struggling a bit this week, it didn’t surprise us that the large institutional banks decided to announce a juicy share buyback and dividend increase, just to boost pessimistic spirits. This all on the heels of last week’s announcement by the FED that all the banks passed their stress tests. Gee go figure, we mean how could they fail considering 10 years of ZIRP and QE and $2.4 Trillion in excess reserves! Any way you, our dear readership knows full well our disdain for central bank manipulation, so to add to this and to allow you to improve your central bank understanding we are going to provide you with a link to the not even covered by media, hearing on monetary policy and trade.

We can't stress enough the importance for any investor, to listen to the following video link which can be found Here The link is from the subcommittee on Monetary Policy and Trade (Committee on Financial Services) Hearing entitled: “The Federal Reserve’s Impact on Main Street, Retirees, and Savings"

We will outline just a few of the important facets of the meeting and we especially enjoyed the panel members and their outright real and honest answers. We especially enjoyed the comments from the Heritage Foundation's Dr. Norbert J. Michel and Mr. Alex J Pollock Distinguished Senior Fellow of R Street Institution.

Please listen intently to Mr. Pollock as he sums up a lot of what we tirelessly complain about, which is the lack of true transparency to the FEDs ZIRP. His speech begins at 50:40

In his written testimony, he stated:

“Savings are essential to aggregate long term economic progress and to personal and family financial wellbeing and responsibility. However, the American government’s policies, including those of the Federal Reserve, have subsidized and over emphasized the expansion of debt and have forgotten savings.” (our emphasis)

“Expropriation of American savers thru the imposition of negative interest rates on savings thru a remarkably long period, 9 years!"

“Expropriating savers through the Federal Reserve is a way of achieving unlegislated taxation,”

“An inflation target rate of 2% is an equivalent plan to DEPRECIATE Savings at a rate of 2% a year.”

He went on to say that, Thrift, Prudence and Self Reliance should be promoted and that the government should advocate for a formal savers impact analysis, perhaps quarterly to study the impact of FED policy on savers. Yes, wouldn’t that be nice if we tried to distinguish the impact of organic economic growth from savings as opposed from the expansion of debt. We can’t help but think that the Federal Reserve and the central banks want anything of the sort, but we know the difference as do they, but they just can’t commit to admitting it.

When it came to question and answer time these exchanges stood out to us:

Question by Chair Barr about IOER (interest on excess reserves) is it a deterrent to lend?

Dr. Kupiec says its problematic because it’s a higher rate than normal market rates.

We agree and the FRB (Federal Reserve Board) must pay IOER to stop the banks from lending and causing that runaway inflation that they so desperately are trying to avoid. With every 25bp hike in the short rate the FRB must pay basically $10 billion more to the banks. As we discussed in our past letters, this currently means a nice subsidy to both domestic and foreign banks of around $40 billion a year. No wonder they are buying back stock (and increasing executive option pay) and increasing dividends. Seems like a no risk win win right? Too good to be true, right? Well that is the reality and its undeniable.

Another Question came up “on the size of the FR (federal reserve) balance sheet and if its problematic:

Dr. Kupiec, “Yes, it is a problem.”

It seemed like the gentleman on the panel were in agreement while the one gentlewoman, Dr.Dynan was somewhat protective of Fed policy. When she was asked about auditing the FED she said, “it would undermine their abilities.”

Let’s be honest, what she meant to say is that it will expose their ponzi scheme.

A question on IOER came up, Dr. Michel said “IOER is bizarre! Its essentially an overt bailout of the banks. Represents an opportunity lost. It’s a diversion from the main stream sector of the economy.”

Someone asked how can the FRB raise rates?

Dr. Kupiec answered and said, “there are two ways to raise the short rate, they could raise rates by selling treasuries-which would spook long term rates, or increase IOER which is used to keep bank money out of the system so they need to keep getting paid, banks are going to get paid more and more money. This will directly affect the deficit as less and less remittance to the treasury. If they cancel IOER the depositors would be charged higher rates and thus inflation would ensue.”

We were delighted to see Congressman Emmer go off asking, “can you tell me something the FED has done right in a decade, or wait since 1913?

Dr. Michel, hesitated and said, “umm, hmm maybe Volcker during the great moderation.”

As for the 2% inflation target- “let’s just call it theft.”

Where is the incentive to save? Dr.Kupiec stated that “the FED made up itself that inflation should be 2% and that 2% meant price stability. William Machesney Martin the longest standing FED Chair called Inflation "A thief in the night"

So, all in all and just like the rest of us who don’t have an unlimited arsenal of free money, PHD analysts and those that have to live in the real world, the Federal Reserve is nothing more than sanctioned counterfeiters whose only real job is to enrich its shareholders and dupe the public into thinking they are a government entity existing under the guise to promote employment and price stability. Unfortunately, we the people have no such powers and thus continue to be undermined and beholden to production via labor and savings.

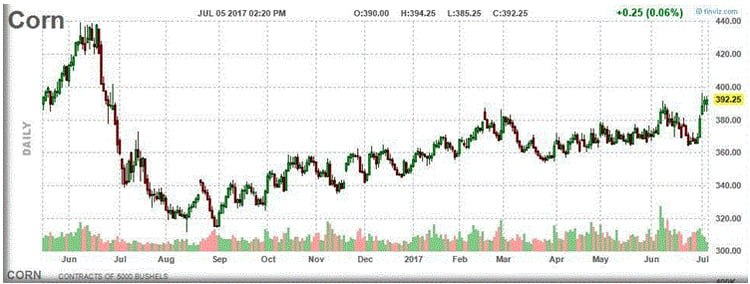

We know the markets never sleep and thus we are always keeping a mindful eye. We saw a continuation move of the weaker US treasury yield curve which is consistent with a more hawkish FED. Now we know they must raise rates because it’s the only way to keep the banks from lending. If this holds true, then certainly equities will finally turn lower and both leverage and volatility will increase. SP500 continues to pin that 2425/2430 area and the US 10yr yield is at the upper end of the short range at 2.3%. The US dollar continues to suffer and we hate to say this trend may begin to gain some footing. The Euro is looking strong and a close above the 114 handle is constructive for higher prices. Crude even bounced a bit this week as we noted that $41-dollar area as very important. We have heard some chatter out of the grains as well as Corn, Soybeans and Wheat are all on a decent run, with the latter seeing some heavy resistance @560. We have some charts courtesy of finviz.com:

Finally, we would like to thank our fellow countrymen especially all those brave souls that have given their life and who currently fight to secure our liberties and our freedoms. We must never forget those men and women that bravely and so unselfishly provide the

blanket of security so that we may live our lives in relative peace. This year marks the 241st anniversary of our battle for independence. Despite all the trials and tribulations that we have faced in that time, we believe our country has withstood all the threats and repeatedly demonstrated that this is truly the greatest country on earth. We must not let a few bad actors destroy the very foundations of our natural rights to life, liberty and the

pursuit of happiness. It is in that spirit that we close this week's letter and yet mark another turning point in our countries ongoing fight against tyranny and oppression.

We leave you this week with this quote "if we can but prevent the government from wasting the labors of the people, under the pretense of taking care of them, they must become happy." - Thomas Jefferson to Thomas Cooper, November 29, 1802

What was true then is still true today, that we should hold our own destiny, not have it predetermined for us. Thank you for reading our weekly letter and we hope you have a safe, happy and relaxing Independence Day! Cheers

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more

questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained

herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks

associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have

investments in markets or programs mentioned herein.