September 27, 2018

Fed Raises Rates in Highly Anticipated Move

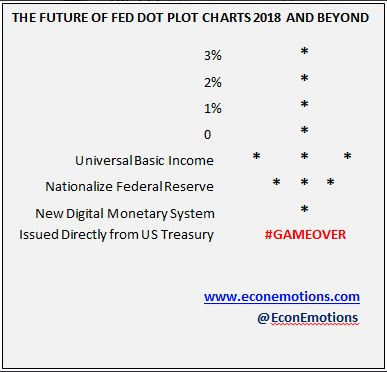

The FOMC decided to raise rates another 25bp to a high mark range of 2.25%. We applaud the continued move; however, we feel that we could be doing more and doing it faster. Holding interest rates or real rates still negative, some 10 years after the 2008 crisis is deeply concerning. All too often people focus on the Fed Funds rate, but the real rate, the FF less inflation, is still negative. Rates are still very accommodative...although the FED left that word out of the statement today. Watching Powell is like watching your Accounting professor discuss reconciling the balance sheet on a late spring afternoon. He and the FED continue to use words like transitory, gradual and appropriate, a decade into a recovery and we are still using these words. The dot plots are all calling for continued hikes peaking around 3.25/3.65%. We view this as highly opportunistic and we do not think the global economy nor the domestic economy will be able to absorb such a short rate given the sheer size of global debt growth. For those that haven’t seen, we often use our own “dot plot” picture:

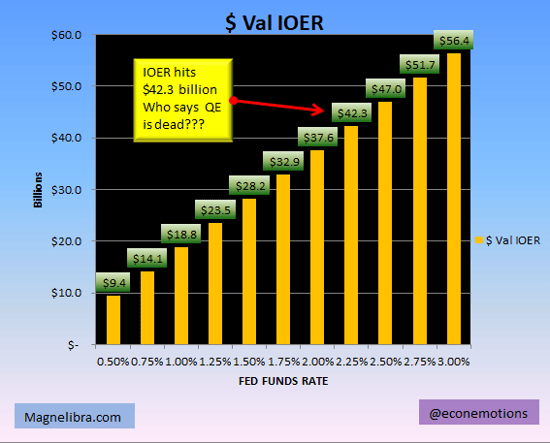

Considering the FED’s efforts are essentially being offset by continued negative global interest rates, and continued asset purchases via the PBOC, BOJ and ECB, we wonder just exactly what the ultimate outcome will eventually be. Another and most often overlooked facet of each rate hike, is the fact that the Interest on Excess Reserves rises as well. As this next graph shows, the subsidy to the banking sector per annum now stands at $42.3 Billion in free money:

Steve Liesman of CNBC asked why the Fed Funds rate needs to move above a neutral level, Powell responded, monetary policy will be assessed at each meeting and there they will discuss the appropriate level to meet our policy goals. Basically, he didn’t answer anything, which is appropriate, because they really don’t know why or exactly how a certain rate will reverberate through an economy. The FED trusts their 700 PHDs to guide them, but the reality is they are just guessing, plain and simple.

Anyway, the FED raised rates, it was widely expected and as our readers know, the goal is to get the Fed Funds to rise above the 10yr rate and they will succeed in doing so, most likely in June of 2019 as the rate rises toward the 2.75% to 3% level. You see dear reader how these central banks buy decades of time…it just seems to fly by.

That is enough on that topic, in other news we continue to see the political gamesmanship rear its ugly head with the confirmation hearing of Brett Kavanaugh. It seems as if the Dems are hell bent on stopping the confirmation hearing and are dragging out accusation after accusation. Somehow, we feel that Trump has already vetted this and this is just a large show, confirmation will undoubtedly come Friday, no matter what the media may be saying. This will usher in a new conservative era, one by which is much maligned by our global so-called allies as was indicative when laughter was heard as Trump spoke at the UN of the renewed Pro-America non-globalization rhetoric was reaffirmed. We know he is serious and the rest of the world knows it too, they are definitely worried and rightfully so, America can no longer just kick the can. As interest rates rise and debt rises, so to does the obligation to pay said debt. Who doesn’t love the definitive nature of mathematics? Some things you just can’t fudge and eventually interest will consume more of our domestic budget than mighty defense itself.

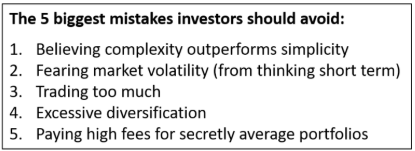

We read another great piece from Rusty Guinn at Epsilon Theory. In it he outlined the 5 biggest mistakes investors should avoid:

The link to this letter can be found Here We feel there is a lot of truth to this list and it condones some deeper contemplation. We all seek value, we all seek limited risk, but within those realms, we must find what is appropriate at any one given point in time. As time changes we change and those changes require us to adjust our strategies, that is as real and honest as we can get.

Ok, onto the technical side of the markets that we follow:

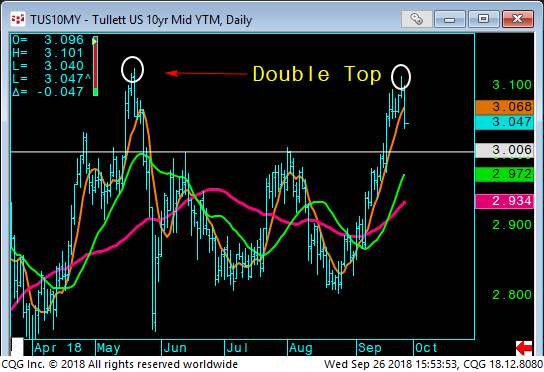

The US Treasury market rallied after the decision and the 10yr yields fell 5 basis points off its highs and is putting in what is currently a double top formation:

The German Bund market hit some key technical levels and are currently supporting the overall positive tone in US markets as well:

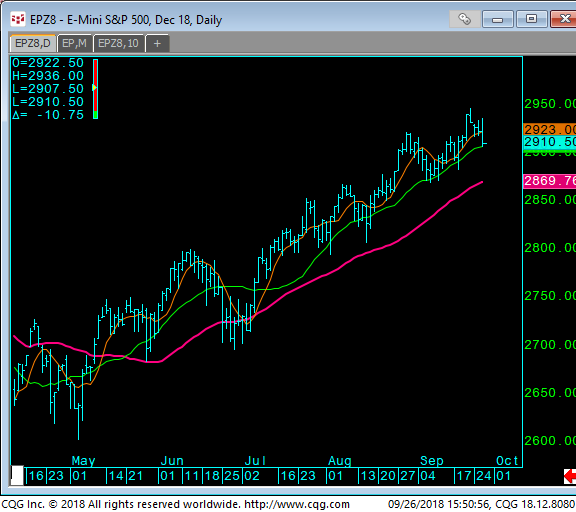

Moving toward the equity markets, the EminiSP500 fell hard off its highs and ended up lower on the day and the bull/bear fight continues 2870 below is the short-term support:

The Nasdaq fell nearly 1.2% after the number and has outpaced the other equity markets but continues to look vulnerable:

The Dow hit the top of our trend channel and continues to be defined within these parameters:

The German Dax market is also defined within our channel and is plagued by the VWAP as well, the following chart points this out:

Finally, we can see that the Gold market which we have shown defined within the forming triangle looks like it is on the precipice of falling out, but we must wait for confirmation. This set up in our opinion may be consistent with ushering in a new down turn in equity markets as we feel a weaker metal market is indicative of stress in funding markets, so this is one to keep an eye on:

Thank you for reading and following our thoughts as we navigate these financial markets. Cheers!

---

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.