September 11, 2019

Is Yield Curve Inversion Signalling Recession?

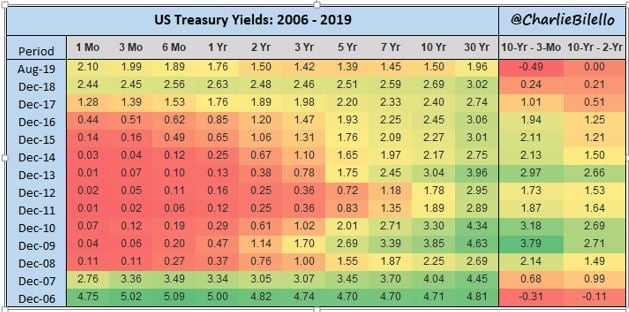

There has been a tremendous amount of speculation circulating around whether the U.S. is

moving into a recession. As many of our readers know, one of the things we like to look at

as a forward indicator is yield curve inversion. Here Pension Partners Charlie Bilello puts out

an excellent graphic, which highlights the fact that its been 13 years since the U.S. yield

curve last inverted in regards to the US 10yr vs the 3-month bill (-0.49):

Yes, we know the text book academic definition is 2 consecutive quarters of negative GDP,

yet in todays increasingly predictive modeled world, nobody cares about after the fact! As

you can see December of 2006 was a full 2.5 years ahead of the 2 negative quarters of

2009.

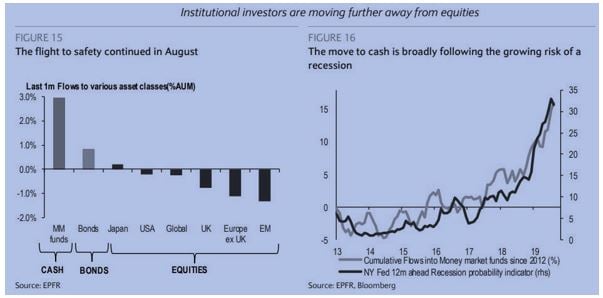

With the ramp up in money market flows which transpired into record low U.S. yields, we

can’t help but think this panic buying of safety seems to have run its course. All the while

the equity markets continued to show their resiliency, most likely on the hopes of this

weeks ECB meeting where we expect them to lay the foundation for future central bank

largesse. Anyway, you could see the start of this week has seen some heavy momentum

investing liquidation where value is being sought over growth. This comes on the heels of a

disastrous under performance all year long of the Russell 2k vs the SP500 and Nasdaq

markets. We have also seen liquidation in U.S. bond markets and metals have certainly lost

their mojo. Anyway, we thought this chart depicts the last 1-month asset flows and they

tossed in a recession forward indicator to boot:

So, before we get into some of the pair’s trades, we watch let’s look at the U.S. 10yr and

then Gold as profit taking has ruled the last few days!

As you can see the 10yr has pulled back from the 132-16 highs and has fallen continuously,

we peg 129-14 nearly 3 full points off the highs as near support. Now looking at gold we see

a similar profit taking move:

Gold is down over $70 and is at risk for falling all the way back to key longer term supports

at $1460.

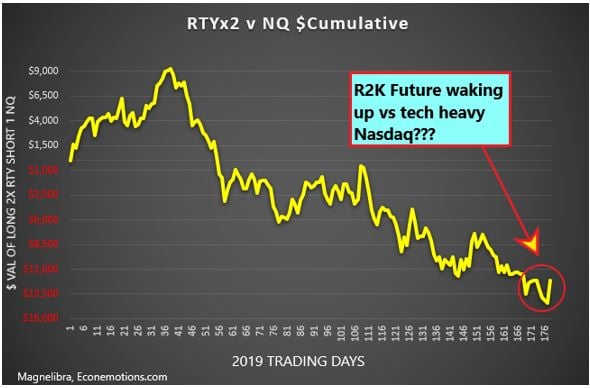

Now let’s get into some further analysis of the move into value over growth here which by

the way has seen the Russell 2k get smoked vs the SP500 and Nasdaq for the greater part

of this entire year. Is this a reversal of this trend? Maybe, but we feel that since money is so

concentrated now, reversals take a long time to work themselves out and that this is just

the beginning of more to come. For us it feels like risk is being taken off the table here in

terms of the Nasdaq as the tech heavy index is certainly under the scope lately, especially

in terms of anti-trust and censorship rhetoric making its way around DC these days.

Anyhow these next two charts are a couple of Magnelibra prop charts that we use to gauge

real contract dollar risk of one asset vs another. First up let’s look at the RTY vs SP500 1:1

pair trade. You can see dollar for dollar actual gain/loss here:

As you can see the SP500 futures outgained the RTY by nearly $16k this year. This chart set

up may just be the beginning of a move the other way.

As far as the RTY vs Nasdaq, we look at it with a 2:1 ratio, long 2 RTY vs short 1 NQ:

As you can see from Feb. on the RTY has lost some $23k from that $9k high. Is the

momentum over for tech outperformance? Speaking the Russell 2k let’s look at a nice tech

chart here:

This box is about as clean as we can get and if the overall market is going to attack new

highs, it will have to come with a breakout of the RTY out of this channel. Just to be fair, the

downside will be ushered in with the unfortunate roll out below 1425 area!

So what charts are looking good, well energy has piqued our interest. A few weeks ago, we

noted the base of Nat Gas forming and possible break out above 2.25 may see some follow

through, well here is the latest chart. We took a longer view chart just to show you how far

Nat Gas has fallen:

We also like Crude Oil as it has broken out above $56 but continues to be plagued by $59

which we feel is the first order of business for a renewed bounce to attack 2019 highs of

$66:

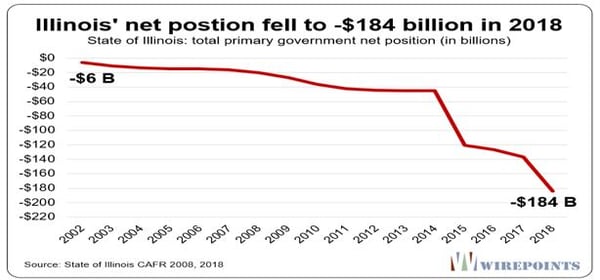

Ok so that pretty much does it, we have a few other items to note this week, Illinois just

came out with a terrible picture of its fiscal net position, let’s just say the chart speaks for

itself:

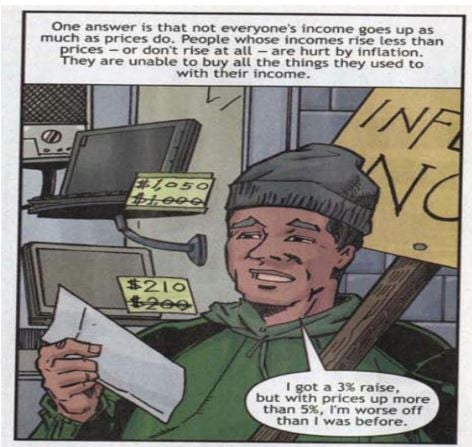

Finally, we saw this cartoon on twitter and we had to post it, we have no idea where

it came from but we think it points out a very simple and sensible way for anyone to

understand our current central bank policy administration of control, enjoy and till next

time:

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well‐rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of

market stress, alternatives can offset some of these risks. It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more

questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long‐term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs). We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well‐rounded set of investment vehicles; a first‐hand understanding of the instruments and the organization behind those instruments is needed as well. Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors. Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted. This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to

be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any

references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.