February 22, 2019

It's Not Diversification if Bonds and Stocks Fall in Unison

This week we received the FED minutes and here is what Jan Hatzius, Goldman’s chief economist had to say, “the minutes of the January FOMC meeting continued to emphasize patience in the policy outlook due to uncertainty around financial conditions, slower foreign growth, and softer inflation." In simple terms its #Qe4evR!

We’ve said it time and time again, you can’t have your cake and eat it too, meaning you can’t use debt to raise asset prices and then simultaneously raise the interest costs of said debt. Modern day central banking doesn’t work that way!

This week’s news shouldn’t cause markets to boom, rather we view this as a cue to be very, very cautious. Why? Because the FED is telling us the global economies have and will continue to slow. Many will use the old past is prologue and think that this is the green light BTFD all over again…Bad news is good news because the central banks will cut and QE. Even we thought that at first and actually when the FED hinted at this, the markets did rise, both equities and bonds alike. However now and given this new bearish global economic outlook, we feel that many and we mean many are caught wrong footed here and offsides. How this transpires in actuality will be uncovered as we move forward in time, but for us, well, we will continue to probe inter market relationships for any clues of real stress.

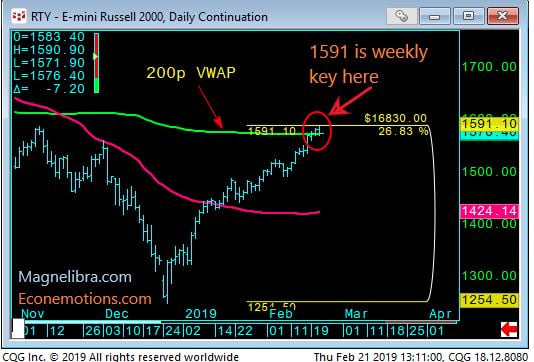

Yes, we know the VIX hammer has been dropped for a few weeks here as vol seller/equity buyers are showing their true colors, but we feel that this is just complacency and fast algo money continuing on a decade long tradition now. One thing we have noticed is that the FAANGs are no longer out-performing the broader markets as both the Nasdaq and SP have rallied around 21% from their late December lows and the Russell 2k has outperformed both of them rising 27% comparatively. Speaking of the Russell, we feel that major resistance is very close by at 1610 and the 200p Vwap was hit this week, a close below on a weekly basis for us would prove as an initial warning short for the broader markets. Here is the R2k Chart:

![]()

This is just one sector we continue to watch and as always, we monitor the US bond markets for clues of panic. We know the US 10yr yield rate is very important and today stands around 2.69%. We feel that the markets will give us some hint at risk off if this yield begins to break down below 2.57%. What’s going to be interesting is if both the bonds and stocks fall in unison. We can’t help to think with all the risk parity out there, that if this were to ensue, that volatility will surely begin to creep up and some heavy players hands would be forced.

See dear readers, we live in a highly sophisticated world by which machine learning and computer driven quant’s dominant monetary flows. The only problem is, if everyone is doing the same thing, then where is the efficiency? Where is the diversification? Where are the pain points? We have always said, in an industry that affects so many, perhaps speed and being the first in the cue isn’t always the best option, but that’s just our opinion.

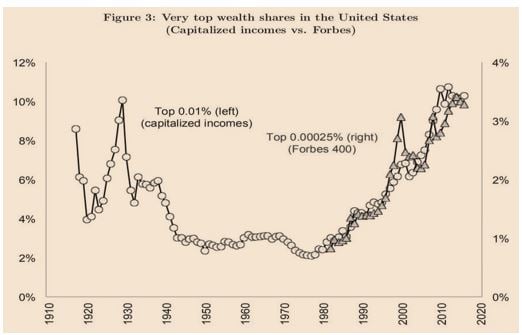

What else have we seen this week? We saw a great graphic of income disparity and which certainly lies at the heart of left leaning liberals and their disdain for capitalism. (dare we mention AOC and the green whatever she calls her initiative) Anyway, check out this chart from economicprism.com:

The only problem we have with socialists using this chart is the fact that their pinning the 100% cause of this disparity on capitalism. Nowhere do they mention central bank rigging or cronyism. They probably don’t mention it because they and most certainly in AOC’s case don’t understand modern monetary mechanism’s or global coordinated central banking. Look, we don’t like the disparity, but if you want change and dispersion to be more widely depicted, than we need to tackle the real problem, and it’s not capitalism.

Free markets, ones that are truly Austrian free, would eliminate excess speculation and over capacitance of both supply and demand inherently. Markets if given the freedom, can clearly pin point risk and reward, the only problem today is, central banks pick the winners and losers, so that is not a free capitalistic market…When we hear AOC and the rest of the socialists start to mention central banks…then they will be on the right track, but no Marxism will never survive and certainly not in America. As alarming as this chart is and should be to all of you…the solution is certainly not socialism and central planning, for nothing in life is ever free.

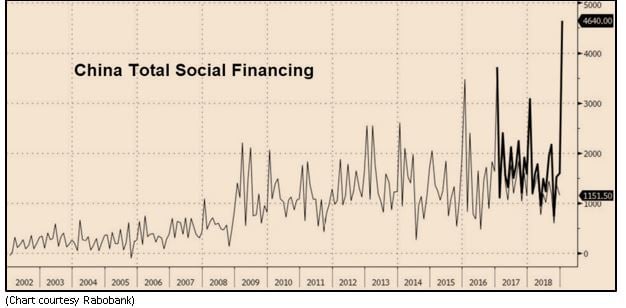

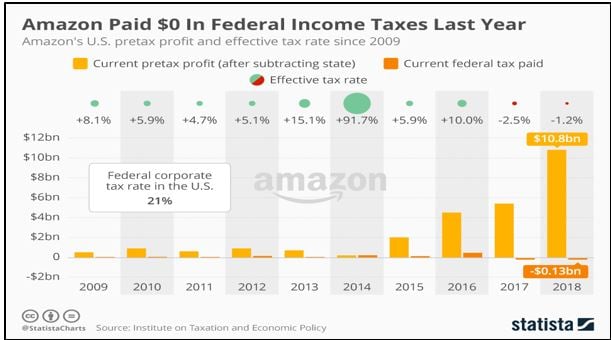

Some of you might disagree with our assessment of the current monetary mechanism run by the global central banks, that’s fine, but we have spent decades following this charade and can attest and present many examples of their “interference.” The belief that the global central banks aren’t politically motivated, that they don’t create a crony incentivized system, can be shown here in these two charts, the first the PBOC and their massive financing injections and the second a chart of exactly how much federal income tax Amazon Inc. pays…hint, its ZERO:

Yea so we get the income disparity frustration, the crony elite monetary mechanism, but what we won’t ever do is say that pure free market capitalism is the problem, it’s not. In fact, rather let’s just say that the problem might be intelligence and an underwhelming effort to learn about the system we actually live in. Let’s stop blaming others and be a bit more personally proactive in our understanding of our economic system. This is exactly why we write our letters, to help you understand such things. We know it’s a complicated world and it’s up to all of us to coordinate for each other’s benefit, information gathering and expansion of both knowledge and understanding.

OK, so you know where we stand on the markets, our keys in the equity market have been laid out, our key to the bond market lies with the US 10yr yield rate and as always, geopolitically, a certain wild card. We expect the proxy wars to continue as they have fallen somewhat in the Middle East, now Venezuela is in the mix, this military and political posturing will continue as it always does. We find ourselves trying to remove as much bad news, fake news and worthless information each week, it proves to be a daunting task, wish there was just some simple AI filter that could do that…maybe we should create it, one that differentiates substance from emotional rhetoric, one that is predicated solely on facts, rather than opinion, wouldn’t that be something!

Finally let’s touch on Crypto Currencies, a subject that has taken a back burner for quite some time. We find it highly ironic that non-other than JPMorgan has created its own digital coin for use in corporate payments. “JPM Coin” is based upon blockchain technology relying upon a decentralized public ledger. (Bloomberg) What’s interesting and highly suspect is that further on in the same article this was said,

“JP Morgan is the first of the major U.S. banks to publicly introduce its own coin. The coin has some differences from a traditional cryptocurrency, according to the presentation. Cryptocurrencies use public, open-access blockchain technology and their value is intrinsic to the coin. A JPM Coin always has a value equivalent to one U.S. dollar and uses JPMorgan’s private blockchain.”

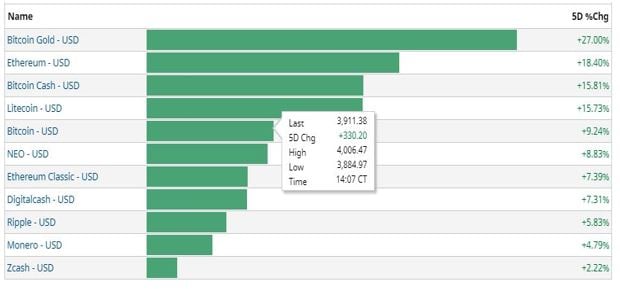

So, you can see that JPM coin is not a cryptocurrency rather nothing more than a private enterprise network payment system. This is not a cryptocurrency, it’s an internal digital transfer system, for us the bigger question is, how exactly will the Federal Reserve regulate such an internal private system, or are they creating it for the Federal Reserve to hide transactions??? Well us mortals will never know, but what is even more interesting is maybe JPM and Jaime Dimon have for now, put a low in the Crypto Currency markets as the sector has rallied ever since this announcement:

Bitcoin is once again threatening the $4000 marker, we continue to be believers in this blockchain technology and longer term think Bitcoin provides some great diversification for some portfolios. The technology is still in its infancy and nobody can honestly say with certain, what the final outcome may be. One thing we can state for certain is that the digital future is here and this is just another extension of that future. How it evolves, how it takes shape, how long adoption takes place are all questions that time can only answer. We believe that blockchain and Crypto Currencies are here to stay and the fact that Bitcoin continues to be the leader after nearly a decade, should be testament enough to its resiliency. Till next time, Cheers.

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.