December 11, 2018

Money Flow is Fickle

Last week we touched upon the importance of the Federal Reserve and their waffling in regards to staying consistent with their rate hiking plans. The FED is supposed to be independent of political influence but it seems that POTUS and his constant remarks have taken their toll as Powell seems to be tight roping his options right now.

We all know that the markets have extended this current economic cycle well past historical precedents, then again considering the amount of global QE, why would we expect anything else? We wouldn’t, we haven’t, but the game has certainly changed. The FED has hiked rates and the Fed Funds now sits at 2.25% and the expectation for another 25bp hike at the upcoming meeting next week stands at 75%. We do not feel the FED has the guts not to go through with it, despite the abysmal performance of equities as of late, but we will know soon enough.

The US bond market, particularly the yield curve is beginning to front run the FED a bit, calling their bluff and saying, your rate hiking cycle is near complete. We have spoken at length about our call for the Fed Funds to reach parity with the US 10yr yields and we still feel this will be the case sometime just after Q1 2019. Two more hikes should do it, December and March consecutively. The equity markets will remain on the ropes as this cycle plays out and calls for new highs there seem overly optimistic. Yea, we hear record corporate earnings, margins are good, yadda, yadda, yadda. We would rather just play the odds here saying the FED will continue the path irrespective of the level of the Nasdaq or SP500, well we think they should at least.

What could derail their plan is the on-going tariff war between the US and China, as this week it hit a new low as Canada, at the request of the US arrested Huawei CFO, Meng Wangzhou, who happens to also be the founder’s daughter. The US alleges she committed fraud in regards to working around US sanctions with Iran. China has issued heavy warnings, if her release is not granted and has even recalled their US ambassador. We have said all along currency wars can lead to hot wars and this is certainly a dangerous step in that direction. We have to admit the equity markets may brush this news off, but it will certainly have direct ramifications of things like this continue to heat up.

We also saw Brexit back in the mix this week and Trump even stated it may hurt the UK in terms of trade with the US, the US enjoys a net $4.6bln trade surplus with the UK so we don’t really think that is a big issue. The bigger issue is what will it mean for other countries, will they start to think about an exit? Can the other countries like Italy, Spain, etc exit? Who knows, the interesting thing about all of this is the TARGET2 balance of the peripheral EU, who ultimately holds the claims to those imbalances? The ECB? How will they actually collect or be made whole on these Trillion-dollar claims? We think all these questions will become relevant in the next decade and investors should be fully aware of the currency ramifications. We also believe the dollar has remained strong, not only because of the FED’s rate hikes, but because of the uncertainty that exists in both the EU as well as Asia.

Speaking of the EU, we can’t help but notice Macron totally being blindsided by the powerful populist uprising of the yellow vests or gilet jaune protesters. What started out as a viral video has turned into over 100k strong protesting, destroying and burning up the streets of Paris. As one French retired Air Force worker was quoted saying, “Macron taxes the poor and gives it to the rich,” (WSJ) Sounds like a central banker to us…the globalists have taught him well! What’s crazy about this movement is that we see the populist movement that has propelled Trump to the presidency here has taken hold across the Atlantic as well. That so-called conspiracy movement known as “Q” has also received world wide attention. We spoke of this movement last year, as some of our sources have been quick to point out the on going struggles of main stream to squash this thing. Well this picture from France tells us, this movement is growing and its not just here, the #WWG1WGA movement is well entrenched, whether the globalists like it or not, just look at some of these yellow vests from Paris, “Q” was everywhere:

Main stream pundits can denounce it, call it conspiracy all they want…but everyone that doesn’t have their head buried in the mud, understands that sometimes the commoner does rise up and it has the tendency to grow into a movement that can change the course of history. We are glad we enlightened you to this last year, as we pride ourselves in knowing just enough about a lot of things that matter. Believe us when we say, this movement matters.

Alright we have tariffs out of the way, Brexit, TARGET2, Macron, what else are we seeing. Well curiously enough, as the equity markets hit their lows last week, we noticed something, that the Nasdaq was actually outperforming the broader markets. We know the tech sector has come off quite a bit and we can mainly attribute this outperformance to a few heavy hitters taking a stand that this move has come to far too fast. As last weeks note and the one prior spoke of the all important 6495 level in December Nasdaq futures as being our line in the sand. It held the first time down and it hasn’t really been tested that closely again. We took this as a cue that risk players are back in dipping toes, even if the CTA macro trend players are jumping on the equity short bandwagon. We are to smart to realize money flow is fickle, it only has loyalty to returns and it moves faster than AI can anticipate despite all their data and technological wizardry. So, let’s take a look at the FAANGs vs the SP chart to demonstrate the level we are watching, very, very closely:

The December Nasdaq continues to be buoyed by our 6495 level, shown here, but down trend is obvious. However, don’t be fooled, a break out of this channel to the upside is likely given the recent bottom pickers for risk as well as they never make it easy to just sell and walk away, 6750 trade above would pressure the shorts:

As far as the December SP500 2648 is our key for now and as long as it is below there, the risk is toward a test of 2550 whether the Nasdaq holds this up will remain to be seen:

When we look at the Dec. Dow the trend support is very obvious, so too is trendline support:

We know the DAX has been a major drag on the global equity scene this year and we can highlight that since its highs in October, its down some 14%. The truth there is the ECB continues to play zombie bank and as long as it does, risk will remain effectively priced. Considering Deutsche Bank is trading near $7, can’t help their sentiment either:

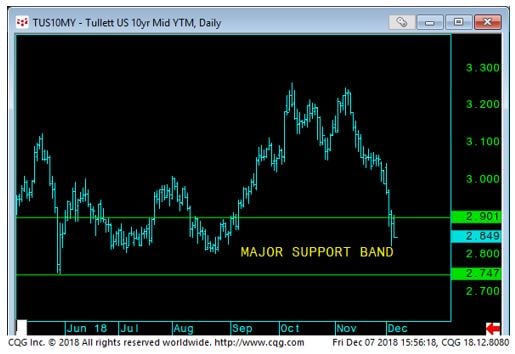

The all-important US Govt 10 year has traded toward our target yield of 2.91% and sits just below it. We would suspect an ongoing equity sell off would help continue to put downward pressure on yields. However, if equities do rebound, we would suspect the 3% level to act as a magnet for now. The 2.75% area will be our forward target to merge with Q1 Fed Funds:

Sticking with the bonds, we see that the March 2019 Bond contract has some hefty resistance near 144-26, we know what to do first time there, but will be mindful that many are underestimating the power of the US bond market:

Another one of our favorite charts is Feb Gold, it’s had a decent run up since August and sits right near heavy fib resistance. Although we view the chart as very constructive, we expect some LME banks and players to find this level an appealing short:

We like tracking Gold vs Silver and as a spread, you can see the clear outperformance of Gold, but resistance in the spread, just as the futures charts suggesting is close by:

Well, that’s it, we expect the FED to do its thing next week and hike the Fed Funds up another 25bp. Remember that adds another few billion to the banks for free, via IOER. We suspect the equity markets may test the recent shorts wherewithal but overall, we anticipate a range trade. Barring any major catastrophe’s, we tend to think people have placed their chips on the table and are in a wait and see what cards are flopped mode.

Finally, we want to show you this chart from one of our favorite analysts at Pension Partners, where he points out that the 20-year total return for the SPY and Vanguard Long Bond fund are exactly the same…Show that to your favorite equity pitching advisor! Cheers, everyone:

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.