March 21, 2018

Neither Investor nor Manager are immune from innate human behavior

What never ceases to amaze me about investors is their utter disdain for logical explanations of economic occurrences. It seems to be that logic is often forgone for euphoria, this feeling that “the good times can never end.” Maybe that logic is NOT as widespread or dispersed as I once thought. The older I get the more market experience I have, leads me to believe that investors are perpetually ignorant, and certainly forgetful. I can’t really attribute one specific human trait that perpetuates this theory about investors, but I am sure it’s a whole host of things. However I can safely now, include investment managers into this loop as well. Maybe managers are a bit more arrogant, a bit more complacent to their own inadequacies and that’s what leads them down paths of destruction.

Maybe it’s the idea that the majority of managers can’t take a loss, that they are so willingly to risk everything rather than admitting the possibility that their decision on any one investment may be in fact flat out wrong. I have seen it time and time again, considering my many years in the prop trading world and have seen it from all demographic types. Neither Investor nor manager are immune from innate human behavior, nor do I believe is Artificial Intelligence, as it is merely an extension of one programmer’s code. The past week or so has seen the dynamics of financial markets change and change in a way that is certainly inconsistent with the last few years. Basically investors and managers have been lulled to sleep by central bank milk. Has the milk now spoiled? Did nobody check the expiration date? If not let me break it down for you in the simplest way I can, WITHOUT CENTRAL BANKS SUPPORT THE MARKETS WILL FALL! It is really that simple.

For those that don’t believe it, fine, keep selling Vol, keep buying equities and think that debt levels don’t matter. But don’t think for one minute anyone is going to feel sorry for you, they won’t. My goal is to get you to realize that no matter what, markets rise and fall. These market fluctuations at various points in time are the direct result of many exogenous influences. The main influence over the last 9 years has been two fold, yet really one fold that is purely predicated on central banks, via quantitative easing and artificial low interest rates. THAT IS OVER! Now the logical trader, investor in me says well if that’s over than something has changed and to think the markets will exhibit the same linear path before is COMPLETELY ILLOGICAL! That is how I think, but I guarantee the 99% of you do not. Many of you are believers in the system and have been rightfully conditioned, but that’s ok, I am here to force you to question that belief.

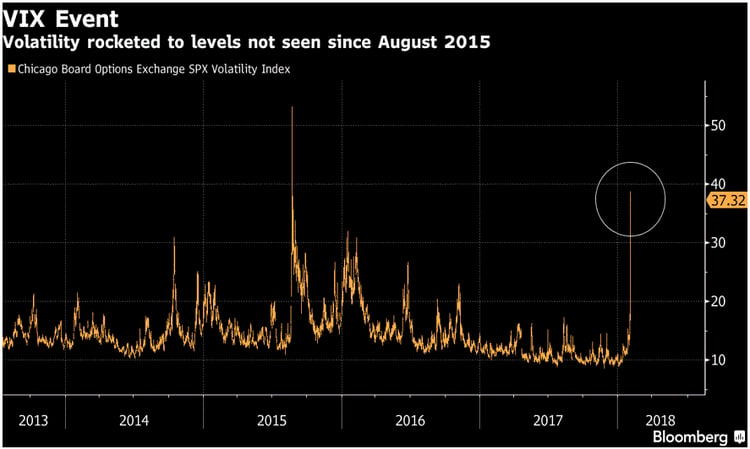

With both the equity and bond markets falling, to the utmost dismay of risk parity funds no doubt, I hope you the reader now know why. Many pundits on CNBC and the other financial networks will give you a plethora of reasons, VIX sellers, trend following CTA’s, etc…the real reason is as you know are central banks and higher interest rates. So when one looks at things like the VIX which is nothing more than a THEORETICAL expectation of market volatility in the short run, they really have to do their homework. Hey at face value the VIX is great when used as a gauge of investor fear or used to price an option, but when you create products around it and use the VIX as a BENCHMARK, I have a serious problem with that. It’s a theoretical metric one which cannot can be independently valued based upon something intrinsic. What do I mean? Well you can benchmark an equity index, a bond index, because the underlying components have intrinsic value. Unless someone can flat out tell me that I am wrong, the VIX is nothing more than a statistical measurement, a guess if you will. Anyway for a veteran trader I know better, I know that those willing to use VIX as a trading apparatus to short volatility are doing nothing more than picking nickels up in front of a steam roller.

This type of strategy works and works until it blows up spectacularly. So here is a picture of the VIX with a bit of past context in order to show you how its past tendencies to do exactly what it did this week should always be taken into consideration:

Short Vol. ends the same way every time and if it doesn’t end badly its only because you got lucky or someone bailed you out! So for all you in the ETNs, ETFs and any other even worse leveraged VIX induced products, you are put on notice and you best not be surprised to see a chart end up looking like this one:

The XIV brought to you buy Credit Suisse states in that it reserves the right to terminate the investment based upon a large outsized % based move in the VIX. Basically it says, hey it’s risky and you can lose everything…Well let the lawsuits begin and they have with this notice just today, Notice to Velocityshares

We are quite confident that this is not just a one off event. We are fairly confident that many investors are going to get wiped out as these leveraged products unwind. These products are the direct result of the monetary and interest rate policy of the Fed and central banks. They have falsified the value of assets and have created a false indicator of liquidity and are absolutely 100% to blame for this induced market complacency.

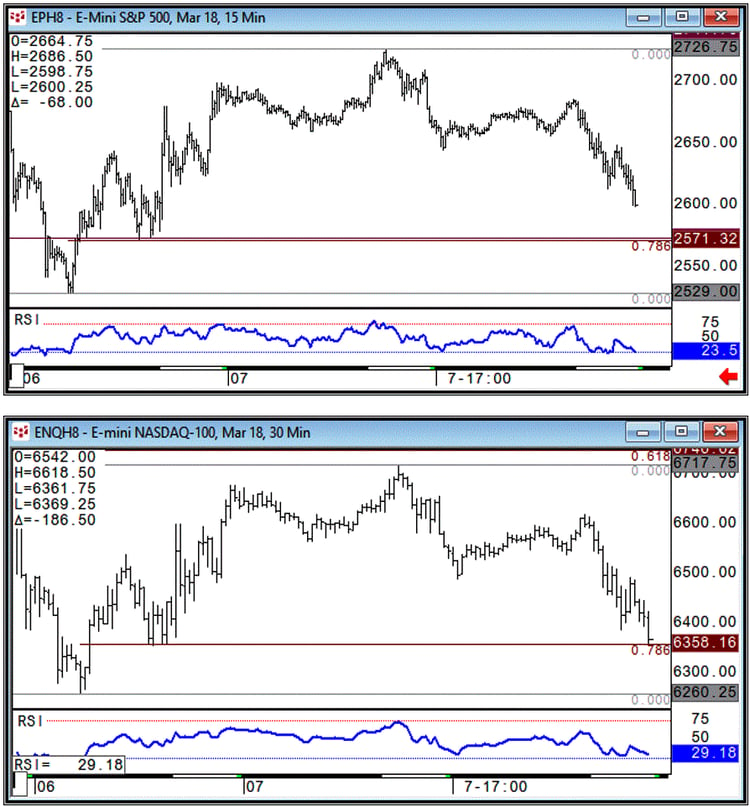

How do we know it’s not over, because we have seen this same play before? This short Vol trade is just the beginning. On Monday the Dow dropped 1100 points and saw continued selling into Europe overnight. Then the buyers stepped in during Tuesdays New York trading session. The NY rebound was an expected move after a disastrous Monday night. Why? Because the belief over the last 7 to 8 years has been that the central banks and SWFs will be there to save the day and maybe they were, considering Tuesday’s rebound which can be displayed in this chart here from Tuesdays NY session action:

But in reality, the house of cards has been built so high, the complacency of investors is so high, the expectations of a never ending business cycle is so high, that reality has been sacrificed. Well we are realists and realists take things for what they are and not for what they appear to be.

The reality is something has changed and your strategy better change. So let’s see today’s Equity action shall we. As of this writing The SP500 lost another 2.5% to trade at 2600 in the March Futures. As far as the NASDAQ that is down another 2.8% as well. We haven’t seen such action, such consecutive large selling days in quite some time, here are the charts:

Ok so in other news now that we got the big stuff out of the way.

- Last week saw Yellen’s last meeting at the FED and it was basically a nonevent as expected. The market is still expecting 2 to 3 hikes this year, expecting inflation to pick up a bit, but still below their mandate. We are still waiting to see the FED actually reduce the balance sheet and January numbers should give us a good indication by how much

- NFP up at 200k with an uptick in wages mainly due to reduced avg hrly hours worked

- We had a lot of high profile names calling out the equity markets frothiness, the likes of Jim Bianco, Alan Greenspan and Albert Edwards, although the Soc Gen strategist is normally bearish anyway. He did site that yields rising is bad for equities, too which we agree and he also said that we haven’t seen a secular low in yields yet, which we also agree, but will save that for #QE4 when things get bad enough

- Atlanta Fed GDPNow forcasting a 5% GDP this year, hah can we laugh that, we know their predicting skills and we know that will easily be sawed in half by midyear

- Amazon earnings smash estimates with a EPS of $3.75 exp.$1.83

- Apple earnings barely beat expectations coming in at $3.89 exp. $3.84. Q1 Iphone sales missed however coming in at 77.3m with exp. 80.2 we noted in our December letter that the Iphone price hike was out of necessity and that certainly seemed to be the case. Apples cash position net of debt stood flat at $163Bln mostly held overseas

- BOJ offers to buy unlimited 10Y notes at 11bps, will it matter with US yields rising?

- Amazon (AMZN) is partnering with Buffett’s Berkshire Hathaway (BRK.A) and JPMorgan Chase (JPM), the nation’s largest bank, to try to address one of the nation’s thorniest and priciest problems- soaring health care costs.

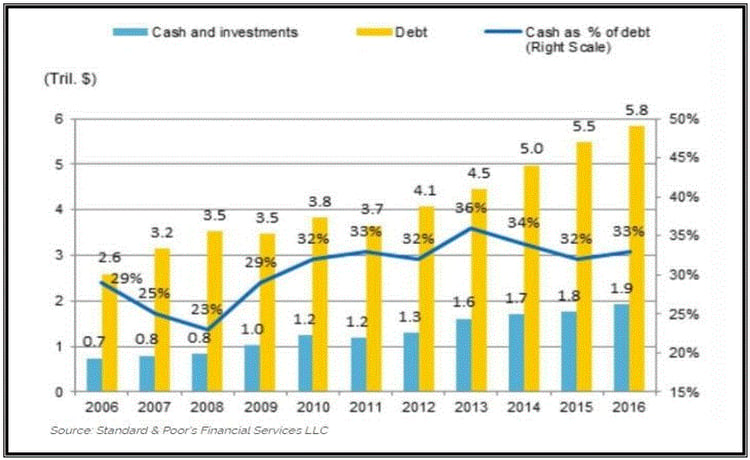

We have just a few more charts before we finalize all of this. When markets fall we always here that BS story of cash on the sidelines and how corporations are full of it. Well what pundits never tell you is that the debt easily overwhelms this cash and in a rising rate environment, we hate to say it, debt matters and considering since 2009 debt has grown some 61%, it’s safe to say that the cash is merely a buffer at this point and a small one at that:

So investors you have to be on the lookout, we are expecting further surprises and another place to look is risk/parity funds. As we can only assume this next chart probably isn’t sitting so well:

In conclusion, we have to remember that in the market for every buyer there is a seller and vice versa. We are confident that someone is cleaning up taking the other side of all these volatility trades and things like this don’t happen just out of the blue. A lot of times larger hedge funds can predatorily seek out weaker hands and force the issue. We aren’t saying this was the case this week, but we are certainly skeptical of some of the timing of a few VIX trades particularly in the futures on the close. Anyway, Bloomberg posted the following information:

- On Jan. 26, Bloomberg’s Luke Kawa reported that the volatility-seeker was at it again: “Patterns associated with the trader dubbed ‘50 Cent’ resurfaced [today] as 50,000 March VIX calls with a strike price of 24 were purchased at 49 cents a pop."

Fast forward a week and those March 24 VIX calls traded as high as $5 a contract!

- Bloomberg also noted a block transaction:

On 2/2 some 260k March $15 calls were bought for $1.83 some 4 days later the same 260k March $15 calls were sold for $8.20

Now we don’t know what other trades were involved but it’s a good demonstration of the markets dynamic of one traders loss is another traders gain. Thus that is the true nature of our financial market and all things considered, great traders, great managers should win more than they lose and they are generally experts at recognizing when to take risk and when to shed it, for all the Vol players out there, regression does eventually come, the only question is, will your solvency be able to wait that long…Cheers

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Danielle Bourbeau, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.