February 14, 2019

Quantitative Easing......Forever!

What is becoming obvious now is the fact that the global central banks can no longer hide the fact that without their QE and balance sheet expansion, asset prices would fall and economies would reverse. The last month or so has seen a huge reversal in the markets expectations for future rate hikes and one by which certainly shouldn’t have surprised any of our readers. We have used and will continue to use the #QE4EVR theme as basically we are and will all continue to be bound to the low interest rate to negative rate environment. We aren’t stupid…

Anyway, let’s look at the latest headlines and make some comments (headlines and charts are from D.Wienke of Cabrera Capital)

- U.S. DEC. RETAIL SALES FALL 1.2% M/M, BIGGEST DROP SINCE 2009

PPI Growth Slowest Since July 2017 (How long will Sears and JCP and the rest of the retail sector last)

- CHINESE OFFICIALS FOCUSING ON WAYS TO BOOST U.S. EXPORTS TO CHINA- WSJ

- CHINA’ PROPOSING TO INCREASE U.S. SEMICONDUCTOR SALES TO CHINA TO $200 BILLION OVER 6 YEARS- WSJ, CITING U.S. COS BRIEFED ON THE PLAN

- Trade talks remain deadlocked as Beijing refuses to eliminate coerced technology transfers - WSJ

- KUDLOW SAYS RETAIL SALES AFFECTED BY GOVERNMENT SHUTDOWN

- KUDLOW SAYS THERE ARE `GLITCHES' IN RETAIL SALES NUMBER

- Kudlow says US negotiators in China will meet with Chinese President Xi tomorrow

- BRAINARD: DOWNSIDE RISKS HAVE DEFINITELY INCREASED; SAYS FINANCIAL CONDITIONS HAVE ALSO TIGHTENED

- FED'S BRAINARD SAYS BEING ON HOLD ON POLICY RIGHT NOW IS THE RIGHT PLACE TO BE

- Fed's Brainard: Program to shrink balance sheet should come to end by year-end

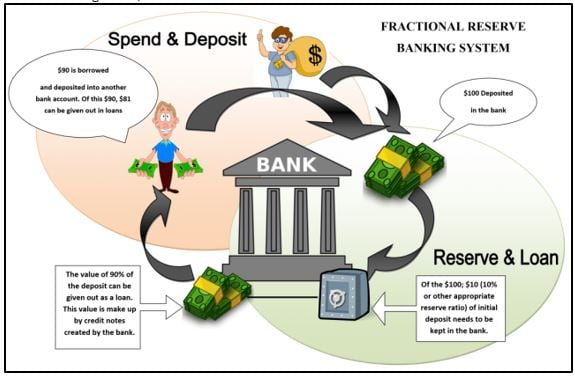

With all these lackluster headlines and with all the fanfare drummed up over the last year how the FED and the global central banks were going to be able to raise rates (insert laugh here) and cut balance sheets…what a farce, what shills, its pathetic. Even worse and if its not obvious by now, that without the central bank’s debt-ridden bonanza fest of free money to the bankster’s and corporate elites all things would collapse. Essentially, we have one gigantic fractional reserve Ponzi Scheme, albeit a legal one and purely all authorized by decree only.

What’s also obvious is that we are beginning to see once again the same fundamental financial die-hard’s across the broad media spectrum calling for equities to fall based upon all the bad news…Even though we agree with their basic fundamental analysis, this is no longer an Econ101 regime, we left that station long ago…The environment we seem to be in is one by which any news will be spun as good news even if it is fundamentally bad. I.E. retail sales down…buy stocks…payrolls down…buy stocks…layoffs increasing and CAPEX down…buy stocks…why you ask? Because the only thing that truly matters are the Central Banks balance sheets and whether they are increasing or decreasing…well we aren’t stupid, once you fall off the cliff, there’s now turning back!

As for the reaction of the markets off of this morning’s terrible number, well here are a few of Mr.Wienke’s charts:

SPX fall to the .382 retrace of the week, before bouncing back near the 200dma.

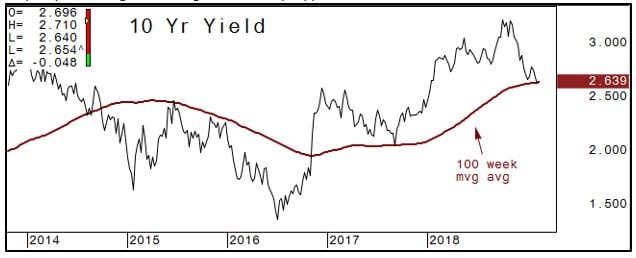

10-year yield testing and holding the 2.64% key support:

The only questions that remains now is will the equities out pace the bonds at this point. If the reflation trade is back on and risk is back on because the FED and all the other central banks are continuing to employ the only tool they have left, QE-Ad-Infinitum then will stock and bonds both appreciate in price? Seems to be the case, but what if, what if this time is different, what if the stimulus doesn’t have the same effect? We are curious as to that question and will continue to watch if indeed equities don’t run up and the bond yields continue to fall, then maybe we are in a new paradigm. Many don’t understand how our system works, but we hope by reading our letter you are gaining a better grasp of how things actually function.

Just to be clear on the steps of how money is created we will show a graphic depicting how fractional reserve banking works, then we will show how QE works:

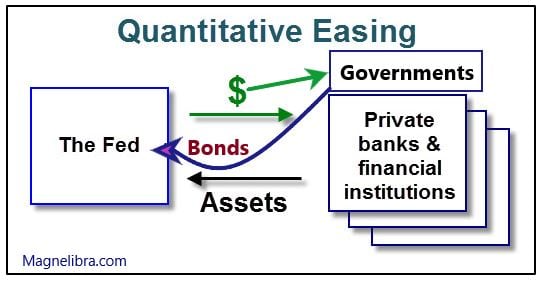

Here is how QE works plain and simple and you can see who actually gets the benefit:

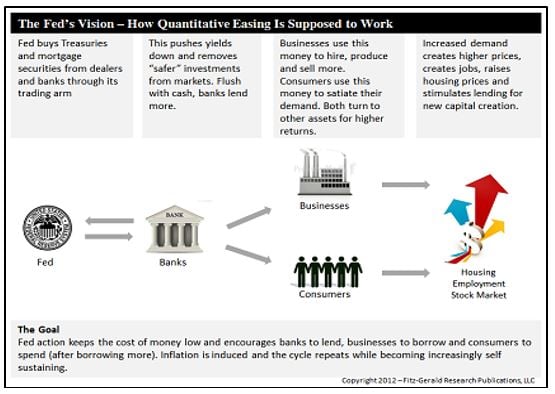

Now here is how the FED envisions and sells it to the commoner:

Notice the “Goal” at the bottom of the graphic, “Fed action keeps the cost of money low and encourages banks to lend, (yea right, to only well qualified buyers and at a large spread to O/N funding), businesses to borrow and consumers to spend (after borrowing more money they don’t have). Inflation is induced (Wrong, lower real rates creates deflation, not inflation, think Japan for 3 decades now), and the cycle repeats while becoming increasingly self-sustaining…Well at least they got the last part right, “self-sustaining” what they truly mean is that the FED itself becomes self-sustaining. Not only that, but the global central banks use QE to buy real stakes in real assets, such as public corporations, they buy influence in almost every government they support.

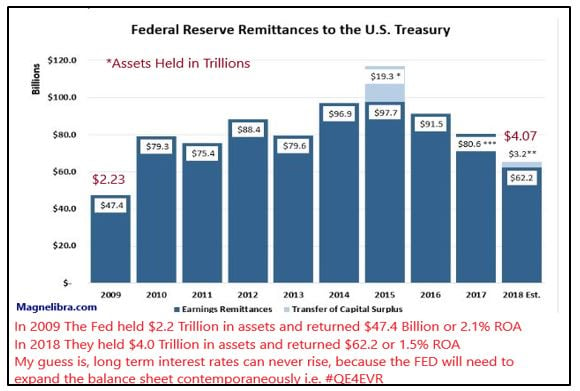

Another part of this circular financial scheme is the remittance back to the US treasury from the FEDs massive interest in US govt. debt. Here is the latest graphic. What it will show is the fact that despite record holdings, the Return on Assets is actually declining and declining rapidly. Many will say that the FED and central banks can sustain losses, well they really can’t. Why? Because their cost of funds is zero and they are guaranteed a profit by decree and their 6% dividend. We know who loses, citizens and governments of these heavily indebted nations as the income disparity grows wider and wider as QE benefits those at the top of the pyramid who hold all the assets and deflation destroys any sense of ability to save or generate returns for those that don’t:

However, as an investor, we can’t worry about the why and the what, but rather we must take the how and cultivate investments and trading accordingly. What does it all mean, it means for now, the future depends upon whether or not the global central banks can work together and whether or not on a geopolitical front, they all get along? I think the former is a no brainer, the latter, well not so much. History has shown that tensions run high when the commoner starts standing up and asking questions. As much as western media hides the fact that the populist revolt continues on in France and other places around the globe, the fact is, people are getting angry and it only takes a small fuse to light a very big powder keg…till next time, cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.