August 24, 2017

Sacrificing Civility for Instability

This past week saw the release of the FOMC Minutes. Nothing new to report here, just the typical Fed speak and jargon we have come to expect month in and month out. The usual expectation of inflation picking up in the years ahead, the usual talk of balance sheet reduction and of course what would the minutes be without some doubletalk such as these quotes, “Most Fed officials see inflation rising in the next couple of years and some are concerned by weak inflation.” So, which is it dear Fed, are we really concerned about inflation picking up? Or are we concerned by inflation weakening? It is this double speak that we truly can’t stand and its why we do not take anything the Fed says seriously. We would rather rely on our own empirical research to determine economic and investment possibilities.

We know full well the power of the central banks and they have used that power to the nth degree over the last decade. Their QE policies have robbed savers of trillions in interest, to the benefit of the levered all powerful wall street tycoons. Yes, asset prices have recovered, yes markets have remained stable, yes inflation is benign, but who has truly benefitted?

So, what are the real costs of all this NIRP and QE? We seem to think that one of the major costs is integrity, the other major cost is civility. On the integrity front, we know that the financialization of our economies has laid the foundation for complacency, or what many have come to know as the BTFD mentality (Buy the Fc$king Dip). The good ole folk lore known as, “the Fed has your back, no worries, we are in control mentality.” Hey, it’s worked, we will give them that, but we know the cost. The real cost is yet to be borne and we know full well, that which goes up, must come down and this market will not defy that law, no matter what the Fed and the central banks do. They would have to print indefinitely to overwhelm the market. However, the cost of that comes with a singularity, that point in which there is no turning back. That point where the outcome and inevitability meet a fate that was truly unavoidable given the direction the central banks decided to go some 9 years ago. Maybe we are at that point already, we saw a stat this week showing how $12 in new debt only raised GDP by $4 meaning it takes 4x as much debt to create $1 in GDP growth, considering the United States current fiscal position, we hardly think this mechanism can last much longer. Remember the US has a debt ceiling coming on September 29th, so we know this has been somewhat of a charade every year, but you never know what can happen. So, when we speak of the loss of integrity, we mean, nobody trusts any indicators and they are merely have pushed all their chips in on the hope that the central banks continue their plundering ways.

Mario Draghi was out this week praising the central banks QE programs stating that “they have made the global economies more resilient.” That is an interesting word choice, resilient, which means capable of withstanding shock without PERMANENT DEFORMATION or RUPTURE. What Draghi is really saying is that we are no longer just massaging markets, but rather we are the market. It’s a mantra we have been stating for quite some time and its truly the only rationalization for this linear risk on up move in assets. We like to call the central banks (Non-Zero Sum) players, because essentially, they pay nothing for credit and accumulate real private assets. We also consider them counterfeiters, because for all intents and purposes, it’s the most accurate description of QE and their programs. We believe this chart sums up our evidence well:

Is it any wonder market caps are pushing near the Trillions for individual equities? Is it any wonder just 100 billionaires control 50% of the global wealth? Who needs retail when you have central banks like the SNB (Swiss National Bank) buying $84 billion worth of equities, toss in a few SWFs (sovereign wealth funds) like the one in Norway, mandating an increase to equities and voila, presto magic, the markets rise!

On to other news, we read a great piece this week from Ben Hunt (Epsilon Theory) link can be found Here. His letter this week was a bit metaphorical but we got the gist of what he was trying to say. In our view, he was stating that those in control are acting in an autonomous fashion lacking any unique characteristics to think outside the box. So many at the top are cut from the same cloth and lack any true diversity, thus enacting policy in the same exact manner as those that preceded them. We agree and we know that any true individuality is shunned upon in higher echelon economic circles. The old adage, it’s better to fail conventionally than succeed unconventionally. We find this in our own circles, especially when discussing blockchain technology, but we take comfort in our confidence and our knowledge, so we don’t mind.

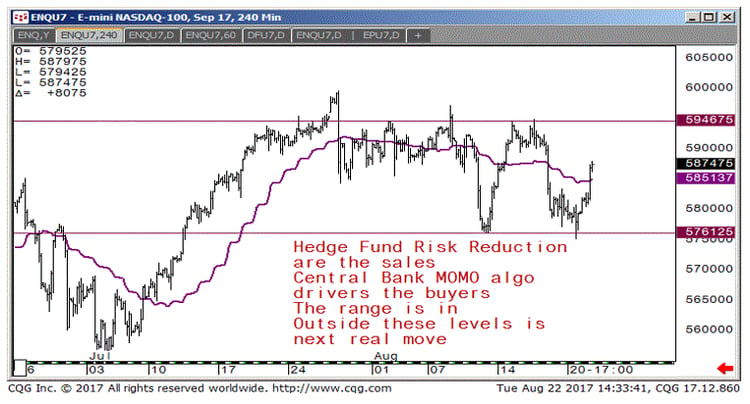

Moving to the technical of the markets, some outfits have been calling for a rotation out of expensive valued US equities and over to emerging markets. This can be seen in the weekly settles as the SP500 lost -13.00 handles, the Dow lost -169 and the Nasdaq lost -37. Meanwhile the Dax gained +163 and the Nikkei gained +45 even the Shanghai was +60! Keeping with the equity theme, here is how the futures charts looked, first up the Nasdaq:

Next up the SP500 where we believe 2450 and 2402 are the keys to the next move:

Amazon which put in a nice high in July hit near the 38.2% retrace this week near $938 should see decent central bank and tech support:

Moving to bond land we see the US 10yr yield chart sitting smack in the middle of its range:

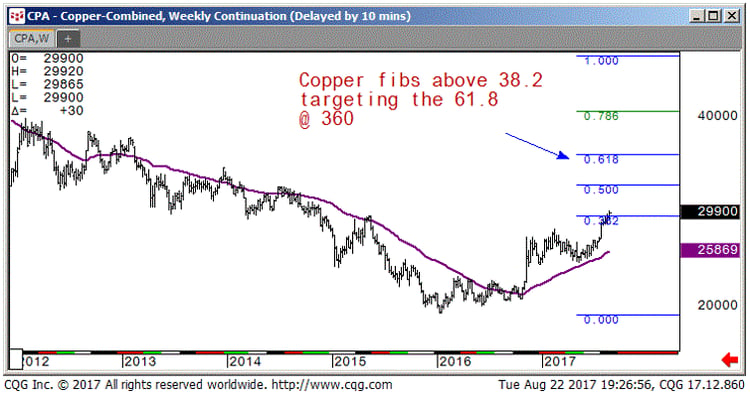

We have heard a lot of talk about copper lately and the futures broke above its 38.2% at 296.00 in search of higher levels:

Ok that’s it, this week we see the annual Jackson Hole Symposium where all our fine bankster’s go to discuss how they will disperse their generosity around the globe. Will there be talk of rate hikes or balance sheet reductions? Will there be any clues out of the Fed whether September is on for a reduction or if the data isn’t quite there yet to warrant such a drastic move! We won’t ponder too much on what they have to say, we know the truth and the truth is simple, without support the markets fall and with support they continue to rise. Either way, the larger the debt pile goes, the wealth concentration continues its divide from those that have and those that do not. We will also keep an eye on the US debt situation where more likely than not, they raise the limit up to $22 Trillion, which should last them about 2 years, maybe! Ok that’s it, we leave you with the settles and once again a new high for Bitcoin, which is up some 326% on the year! Cheers

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.