December 19, 2018

Signs of Things to Come

As we noted in last weeks letter, the equity markets looked locked and loaded to test their crucial supports and they did just that. The SP500 tested the 2550 level and the Nasdaq the all-important 6495 level, both markets saw minor follow through. All eyes are dependent upon what the FED does on Wednesday as the markets still see around a 68% chance of another 25bp hike. We read in the WSJ on Monday an Op-ed from Stan Drunkenmiller and Kevin Warsh and it can be summed up via this quote, “the central bank should pause its double-barreled blitz of higher interest rates and tighter liquidity.” As much as we respect the both of them, we disagree whole heartedly.

The mistakes of the past will not be rectified via further mistakes in policy and in order to purge the leverage and the incessant risk chasing that has become pervasive throughout our financial markets, interest rates should and must rise. We have said it for years now that the Fed Funds must rise to meet US Gov’t 10-year yields in order to stem excessive speculation. One thing we did agree upon was the fact that the FED missed its hawkish chance in the early 2000s which lead to the housing crisis, but now, we would rather see the Fed Funds rise toward that 10-year rate and we think it will get there in Q1.

The equity markets continued to hold up on the shoulders of both record dividend payouts as well as equity buybacks. Whether or not this makes good corporate treasury sense or not, will soon be judged, but for now, its effect has most likely stymied an even sharper sell off. US companies within the SP500 have spent $421bln as of Q3 2018 on dividends, surpassing last years total of $420bln. (WSJ) Toss in the record number of quarterly buybacks in Q3 of $203.8bln, putting the yearly total of buybacks at $583.4bln, with Q4 still in the wings, then you begin to see exactly where the monetary inflation is hiding. (WSJ) So you see dear reader, these are just some of the data points we would use in order to back up our claim as to why we think the FED should continue to raise rates. A central banks job is to not target asset prices so that they appreciate indefinitely, rather a central banks job is to provide a stable economic environment with valid signals so that consumers and businesses can forecast future assumptions with some accuracy. It seems as if central banking now is more akin to raising asset prices at all costs and avoiding any sort of pull back in said assets. The central banks create this illusion of independency when in reality, all they do is pass the baton. All the while creating a very large divide between classes, no wonder the populist movement is gaining a foothold world-wide, can you blame them?

So, with all this in mind, we feel the FED will raise 25bp tomorrow. If they do not, we suspect that bonds will be well bid, the US curve will steepen smartly and even the equities may take it as an initial sign to run up. We say initial sign for the equities because the real signal that the FED would be sending, after the AI and headline reading bots hit the buy all button is that the FEDs rate hikes are over and the economies have turned south. This should cause a greater need to discount future cash flows and equities should continue to falter. In fact, just after the close today, the equity markets sold off on the heels of FedEx slashing its adjusted earnings targets, sighting that, “Global trade has slowed in recent months and leading indicators point to ongoing deceleration in global trade near-term.” (Zhedge) Signs of things to come? Definitely, but is it enough for Powell to cave? We doubt it!

Ok, so let’s hit up some charts! Since the FED is on tap tomorrow let’s look at the bond markets first, here we see the US long bond and the level we continue to watch is 144-21. We suspect some trend followers are waiting in the wings to jump on this train:

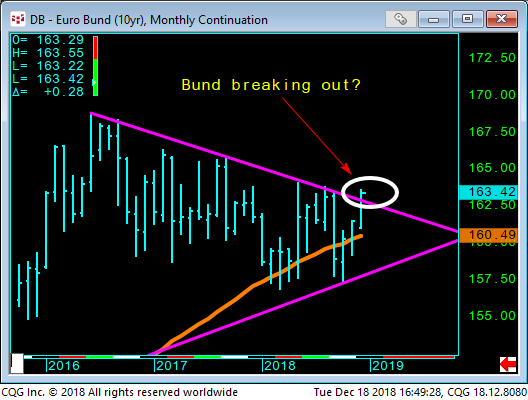

If the German Bund is any indication, a little bit of foreign front running has already been seen:

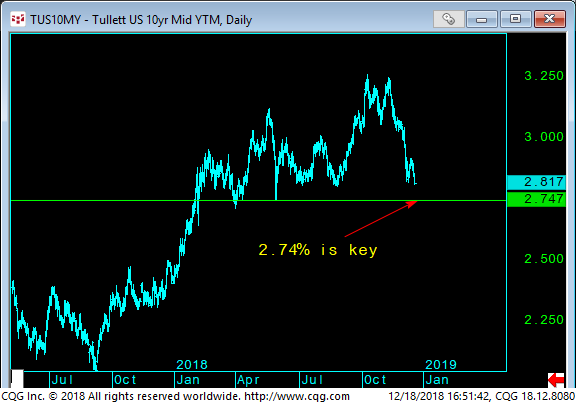

Looking at the US 10-year yields 2.74% seems so obvious:

We have one more year before the end of the decade, the last 3 decades have all started out with lower 10-year yields than where they started, we suspect this decade will be no different. In December of 2009 US 10yr yields were 3.85%, considering we are nearing the end of the FED hikes and we are already 100 bp below…you get the picture #QE4EVR

As for the equity markets, first up the Dow, after breaking the trendline, we still think another 1000 points below here seems logical:

The SP500 tested and broke the 2550 level that held earlier in the year, will it bounce again? Maybe but the damage has definitely been done:

The NASDAQ continues to journey our trend channel and below 6495 is bearish for a continuation of this journey:

What we have noticed over the last few weeks is that some bottom pickers in the tech heavy index have come in to support it vs the broader SP500 market. Will their resolve be tested here?

We can’t blame the bottom pickers, can we? After looking at this Netflix chart, many think it’s a bargain being down some 37% from its highs. We know better:

How bout that German DAX market, which has taken it on the chin all year, we suspect another 6% slide may be in the offing:

As far as the other markets we watch, the Euro currency seems to be holding up here, curiously, but a break of 11475 to the upside would peak our interest:

The Gold market has looked pretty decent and once it broke back above the $1232 Vwap level, it gave the bulls another green light, $1296 seems logical:

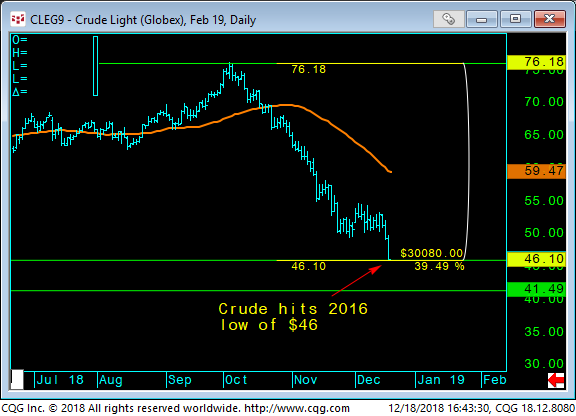

On the flipside of this gold bullishness, we have Crude which has pulled an absolute and dramatic reversal of earlier fortune. After hitting its highs for the year in October, it has lost a whopping 40%:

Our final chart is Natural Gas, you can see the large moves over the last month and a half after the massive volatility in global weather caught many off-guard. The Grand Solar Minimum, which we brought to your attention a few months ago is something that you definitely need to be aware of:

Ok, that’s all we have for you this week, we hope you received some information that you may not have been privy too already. We thank you for reading and remember the FED’s decision is tomorrow so be on the look out for any change in their direction or their sentiment, we may be witnessing the last few hikes for another decade…cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

_____________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.