June 26, 2018

The Eventual Flattened Yield Curve Will Indeed Flatten The Equity Markets

There was a lot to digest last week, so let’s jump right to it. The AP reported that the Supreme Court has ruled that states can force online shoppers to pay sales tax (all times local). This was an obvious jab at the monopoly Amazon holds in the online e-commerce business. AP also reported that Wayfair, one of the companies named in the case and the e-commerce company that sells home goods expects this decision to have a “notable impact” on its business. Our home state of Illinois is probably salivating, most likely spending the money before its even collected!

We also read a story from the FT, that some novice day trader who thought he was trading a sim account amassed huge losses in a live account, to then realize he was trading a live account. He went on to recoup all the losses and rack up $10 million in profits. Harouna Traroré, was practice trading on Valbury Capital Brokerages platform, but then realized the trades he was doing were in a live account, but not before he racked up some decent sized losses. We hardly doubt this was an “internal” error, anyone in the biz knows how difficult regulations are and how stringent risk is, we feel this story wreaks of fraudulent insider doing, anyway we know damn well, he isn’t going to see any of that money!

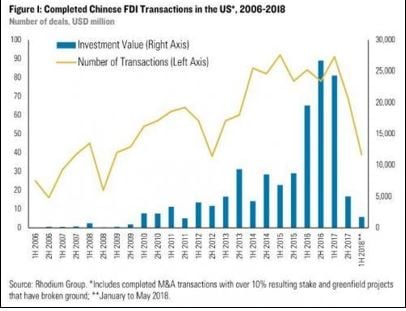

Nomi Prins penned an excellent article last week via tomdispatch.com, entitled What’s the End Game? Her original article can be found under, “Imperial President or Emperor with No Clothes.” Nomi voices her concern about the President’s recent tariff and harsh global rhetoric amongst our trading partners. She called into question his ability to actually sign or negotiate actual bi-lateral trade agreements. She fears these trade wars may end up costing millions of American jobs instead of spurring them. We have discussed at length, what seems to be Trump’s anti-globalist agenda,  and we can’t say that we disagree with his themes. However, we must point out the fact that trade wars spur currency wars and they in turn spur hot wars, or real wars. So, she may be on to something, but then again, is there really any other choice? Can the US continue to afford exporting standard of living around the globe in return for cheap goods and services? We doubt it, so maybe Trump has just forced the issue to the forefront, rather than kick the can any further down the road. We feel that perhaps there is more to this story behind the curtain and that American security is indeed a concern, especially with China. Speaking of China, the tariffs have had an obvious effect as FDI has plummeted.

and we can’t say that we disagree with his themes. However, we must point out the fact that trade wars spur currency wars and they in turn spur hot wars, or real wars. So, she may be on to something, but then again, is there really any other choice? Can the US continue to afford exporting standard of living around the globe in return for cheap goods and services? We doubt it, so maybe Trump has just forced the issue to the forefront, rather than kick the can any further down the road. We feel that perhaps there is more to this story behind the curtain and that American security is indeed a concern, especially with China. Speaking of China, the tariffs have had an obvious effect as FDI has plummeted.

The OPEC meeting was in full anticipation mode on Friday as Crude Oil jumped a massive 4.6% on Friday as speculators and those in the know anticipated higher prices as a result from their recent meeting in Vienna. After agreeing to adding to production by 1 million barrels a day, the price jumped as investors obviously felt that perhaps the increase wouldn’t actually get to that level or geopolitical struggles out of Iran and Venezuela may hinder this production increase.

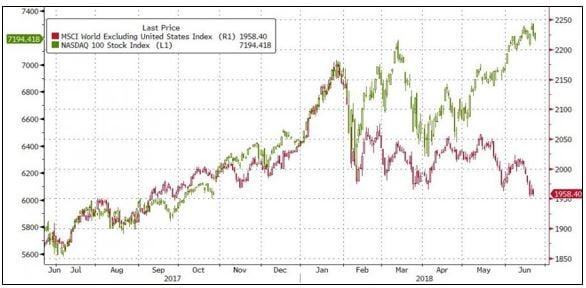

As we pointed out last week, the equity markets have gone nowhere since carving out the Jan-Feb range. This doesn’t bode well, in our opinion and we have a few charts that we are seeing that don’t paint a very formidable picture of market strength. Let us begin with the obvious chart, that is, where is everyone hiding?

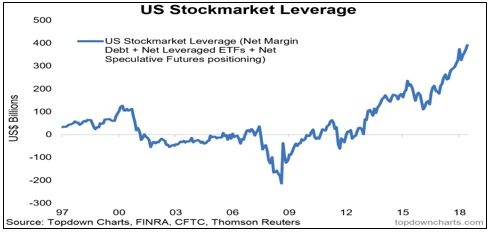

Next let’s display exactly how this market has been so well supported and we have a great chart from Topdown Charts, entitled “US Stockmarket Leverage”:

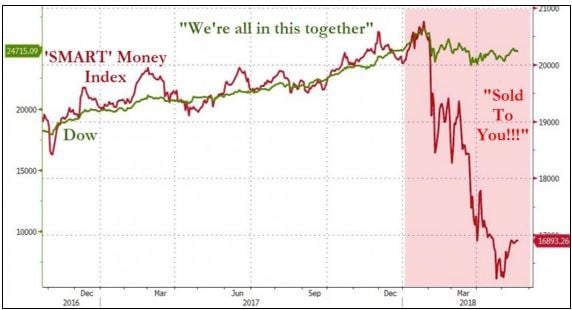

Now let’s see what the “SMART” money has been doing:

![]()

Now we know something will have to give here, this simply cannot stay this far out of sync for long. With short rates continuing to be hawkishly driven higher and with long rates holding steady, the eventual flattened yield curve will indeed flatten the equity markets. Long end rates have held up swimmingly despite all this Russian and alleged Chinese Treasury selling. Speaking of this false threat of China dumping treasuries, we feel that would exacerbate their problems not fix them, you can’t peg your currency and sell the currency that you are pegged to without repercussions. So that threat is patently false in our opinion. Anyway you can see the US Treasury Bond chart below and we figure any break of 2.96 will see further piling on driving rates lower and yield curves that much flatter:

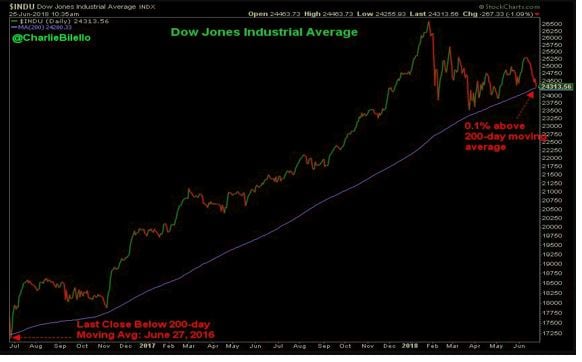

Now the icing on the cake, from one of the best analysts on the streets in our opinion, Pension Partners Charlie Bilello, if you don’t follow him on twitter, or listen to his webinar’s, you are a fool. He is a straight up quant that gets it more so than normal, so we advise you to follow him.

Anyway, he posted this chart on twitter of the DJIA, when this breaks, we are certain, the flood gates will be sprung wide open:

Ok, not to add insult to injury but we have been doing a bit of home price monitoring around the old hood and we can’t help but think, the two-tiered economy is evident even at this microlevel. What is strange is that we still have multimillion dollar teardowns, but we also have homes that are barely above 2005 prices or are indeed still underwater. For those that think homes are an investment, after reading the following we believe you will rethink that proposition. So, we wrote a piece awhile back about this very subject, but we think revising this with a current exercise is well worth the time. So here we go.

There is a home for sale in the neighborhood for $1.45 million. It was purchased in 1999 for $1.1 million. Many will say, wow, what a good investment right? Even if they sell it for $1.4 million they are going to make $300k on the home! This is how people think, but in reality, this thing is a huge loser and we will tell you why using real data:

DATA INPUTS USED:

- Purchase price of $1,100,000

- 20% down payment of $220,000

- Avg 30yr Mortgage Fixed Interest Rate in Nov 1999 is 7.5% (Generous for Jumbo)

- Taxes per year $13,000 ($500 increase per year)

- Sales price in 2018 $1,400,000

- Actual holding period 18 years or 216 months

So, let’s break this down via Total Actual Outlay over 18 years by the owner:

- Total Principal and Interest payments = ($349,283 + $765,107) = $1,114,390

- Balance remaining $530,71

- Total Taxes paid $310,500

- 5% Brokers fee for sale $71,325

Here is the Breakdown:

Gross Sales Price = $1,400,000

Minus:

20% Down Payment = $220,000

Balance Owed = $530,717

Brokers Fee = $71,325

Total Taxes paid = $310,500

Total Principal & Interest Paid = $1,114,390

NET RETURN = -$846,932 (Yes Negative $846k)

Now a few takeaways, this doesn’t include any updates to the home, any yearly maintenance fees, which in total will most likely push this number well north of $900k in money spent, cash spent. However, the big question is why do it? Is it all worth it? Or the bigger question we get, what alternatives are there? You need the big home, the big expenses, the big car, we call BS, we say it’s a scam. In fact, econometrics may likely deem it as a likely leading cause of divorce. Look we aren’t advocating everyone should run out and rent, but when you buy a home and you don’t pay cash for it, I am sorry, you are renting, in fact it’s worse than renting, your overpaying in every single way and for what? The obvious arguments are extremely valid, great schools, a good neighborhood, safety, protection, accomplishment, we get it, but how much is this really worth?

What truly means the most to you? Money, wealth, family, happiness? It seems as if the strive for humbleness is overshadowed by the quest for power and wealth. Its not easy keeping a level head because conservatism isn’t short on certain stigmas to overcome, especially in the financial arenas. We get it, if you don’t drive that fancy hot car, if you don’t live in that mega mansion, if you don’t belong to the country club, people use these as benchmarks to success, why? Because it’s been driven into the psyche that success is somehow measured strictly within monetary constructs. Your anathema, especially in the financial spheres if you exude conservatism, but we are hoping to change that thought process. This is really how some people think, not all people, but some, not that they will ever admit it though, but shallowness is perhaps in abundance.

Anyway, we tend to think America is finally realizing that this system of debt is not all its cracked up to be. All this debt, taxes, etc. are hidden wealth thievery propositions which are being met with mass American anti globalist mantras. People finally deciding, they have had enough. The prior example we just showed you is a symptom of decades of conditioning, which is now slowly being broken down. If you ask anyone out there if a home is a good investment they will shout a resounding yes. We say, define investment. How many people buy what they can afford, truly afford? It always seems to be a push to the absolute limit and even if the limit is set, the brokers and bankers are always there to sell you just a little bit more.

Please don’t be offended by this quant analysis of housing, it should enlighten you and make you think about VALUE and exactly what investments are able to extract it and which ones ultimately end up consuming it.

If people would live with a little bit less, expect a little bit less and sacrifice just a little bit more, spotting value might just become a little bit easier. Obviously, this doesn’t pertain to the 1%, but for everyone else, you really want the key to happiness, do the 3 things we just mentioned. Hell, if you are damn lucky enough, that you can afford the $1.4 million-dollar house, buy the $900k house instead and then toss the extra dollars into a rental property! This is the real secret of wealth accumulation, letting your money go to work as opposed to you working for your money!

Anyway, we leave you with our weekly settles first up the crypto currencies which have seen new lows once again last week. They tend to look vulnerable here, but we know full well these aren’t going to just disappear and remember, Bitcoin last year on this date was $2606 and settled Friday at $6014 so when the negative bias bobble heads start rattling, you have the data to say, it’s up 130% year over year. Data and perspective have a great knack for clearing any argument

Anyway, we leave you with our weekly settles first up the crypto currencies which have seen new lows once again last week. They tend to look vulnerable here, but we know full well these aren’t going to just disappear and remember, Bitcoin last year on this date was $2606 and settled Friday at $6014 so when the negative bias bobble heads start rattling, you have the data to say, it’s up 130% year over year. Data and perspective have a great knack for clearing any argument

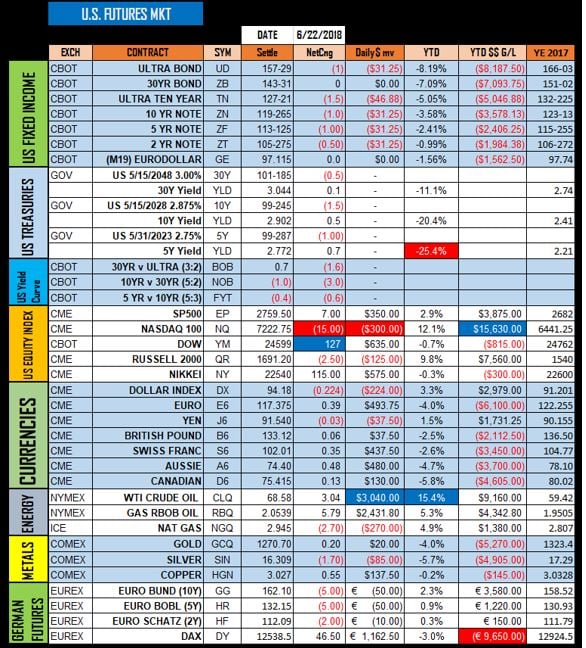

Finally, we leave you with our weekly futures settles of the markets we tend to follow closely, RBOB has peaked our attention, Crude continues to be black gold and the equities haven’t done much, in fact the Nikkei and the DAX are of utmost concern which may perhaps lead to a broader global sell off. With the half way point of the year gone, we can’t help but think a reversal of fortunes from the first half of the year may be in order and that volatility is begging to pick up, Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.