January 31, 2019

The Real Elephant in the Room.....DEBT.

We decided to wait till the FOMC meeting to release this week’s letter so that we could capture the most important event of the week. It’s not that we didn’t expect a few of the tech giant earnings would be painted with bullishness, but we felt maybe the earnings didn’t really matter. Maybe all that mattered was the “Powell Put” which was made quite obvious by the monotonous speech he gave after the FOMC decision. It’s amazing how quickly the FED has caved to the pressure laid out by both the bond market and #POTUS himself.Here are the bullet points as laid out from Zhedge:

- Fed removes reference to further gradual rate increases

- Fed says it plans to continue with current floor approach

- Fed says it’s prepared to adjust balance-sheet normalization

- Fed reiterates federal funds target is primary policy tool

- Fed says economic activity rising at solid rate, jobs strong

- Fed says labor market strengthened, unemployment remained low

- Fed says spending grew strongly, investment moderated

- Fed says core and headline inflation remain near 2%

What is interesting about this recent about face by the Federal Reserve is that it is quite apparent the reality, the truth, that without central bank printing or QE, asset prices will indeed collapse and an economic calamity will assuredly ensue. This is something we have been banging the drum about for some years now and well today, we have confirmation. What it all means, how it will all transpire, we aren’t quite sure. One thing is certain, if this indeed is the end of this hiking cycle, the following things would make perfect sense:

- The dollar will go lower

- The US bond yield curve will steepen dramatically

- Gold will appreciate

- Equities will rally

- BTFD becomes the norm once again

All in all, the transparency of all that has been laid out is obvious, yet we also know there are many exogenous effects that cannot be quantified, such as geopolitical posturing, tariffs and of course war. The central banks cutting back will offer more of the continued global debt expansion and will do little to alleviate the real elephant in the room, that is debt itself.

So, once again the only thing that matters is how much liquidity the FED withdraws and when. This is something Nomura pointed out this week, and that is the roll off schedule from the FED itself. This schedule outlines the days where the FED will enact their QT, well QT-lite of course because they are barely making a dent into their balance sheet. None the less, these days whereby the FED enacts QT will, as Nomura puts it, strain the market of liquidity and thus perhaps put pressure on the equity markets. So once again, we have the idea that the FED not only affects the markets, well by default they are the de facto market.

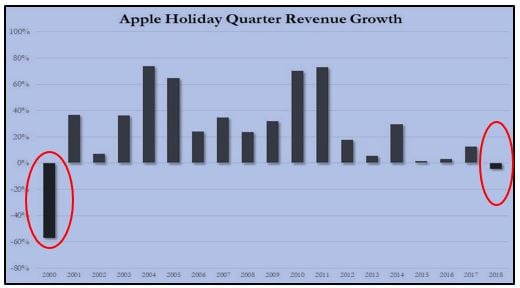

So, with the FED out of the way and their dovishness well absorbed by the Momo Algo’s who assuredly hit the buy all button, let’s focus a bit on some of the FAANGs who were reporting this week. In fact, we cherry picked a few of the Apple Inc. charts for some clean data, the first chart shows the first decline in Q4 revenue growth in 18 years:

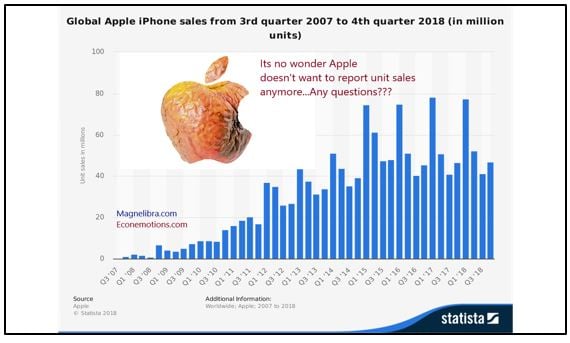

The second chart shows exactly why Tim Cook will no longer reports unit Iphone sales:

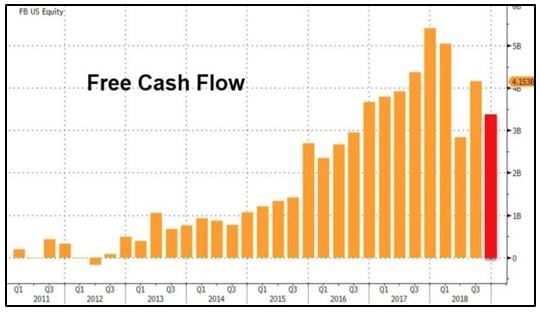

Next up Facebook which beat expectations by posting a $2.38 EPS on $16.91B in revenue beating expectations of $2.18 and $16.39B respectively, but and a big but at that, is this chart of their free cash flow which fell to $3.318B:

Who even uses Facebook anymore? How many are bots? Facebook’s appeal amongst the millennials and Gen Z and Y has certainly been waning, none the less you decide what to make of it all.

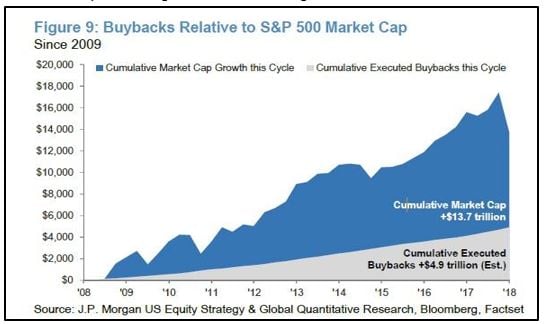

One thing we certainly need to be cognizant of and considering the Powell Put is well in play, is the fact that corporations are set to buyback as much as $800Bn in stock this year. A formidable number indeed and one which we are sure will enrich the C-Suite further. How easy right? Issue stock options, announce buybacks, exercise options, sell options, take in cash. Not exactly a long-term strategy for corporate success, especially when you leverage the firm to do so, but it is the norm and considering the fact that the Federal Reserve pegs interest rates so low…what else is a firm to do? Capex? Hire? Expand? Nah that’s risky…Here is a great chart from JPMorgan:

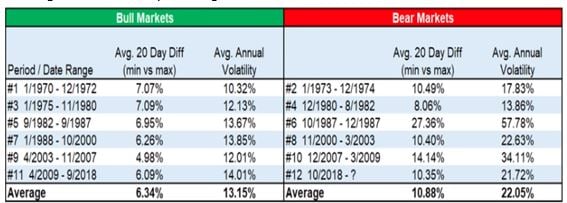

Michael Lebowitz of 720Global posted another great chart this week, what he points out is the fact that the last 12 bull and bear markets when looked at thru the lens of the “Avg. 20 Day Diff” there is a clear distinction between bull and bear markets. As you can see bull markets avg. 6.34% and bear markets avg. 10.88%. As you can see, he displays the current market below under the Bear Market heading #12…we can’t say we disagree with him:

Ok here are a few charts that we are observing right now, first up Apple Inc, let’s see how it handles $163:

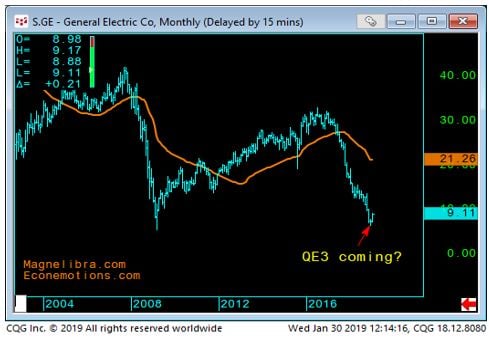

Next up and considering it looks like QE3 is upon us, we have GE, maybe they knew ahead of time and maybe its 2009 all over again:

Now with the FED certainly on hold regardless of asset prices, we have the US bond market 5yr vs 30yr spread, which will undoubtedly continue to steepen:

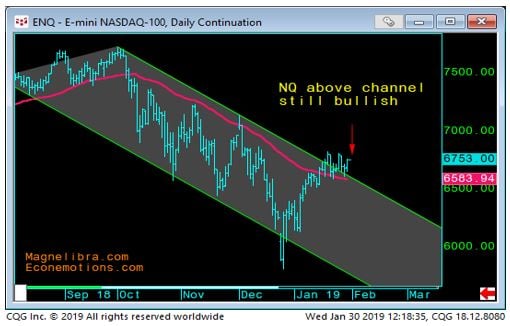

As for the overall Nasdaq market, perhaps it back to the good ole, BTFD as it has clearly broken out of the down trend channel and remains firmly above it for now:

The Crude market has been putting in a solid head and shoulders formation and considering the chart has been a mirror image of the equities, a break of $55 may see a nice spike:

Moving on to two relative value trades we watch closely, we can see that the weakened FED has been bullish for both Gold and the Euro as we display our pairs charts below, the Gold vs Silver as well as the Suisse Franc vs the Euro, both charts are showing break out moves for Gold and the Euro which were certainly rewarded by the FED today:

Ok that is it, we hope you enjoyed today’s note and we hope you are finding a way to stay warm as North America becomes inundated with this polar vortex. Chicago is seeing record cold and it seems as if this erratic weather is here to stay. We Chicagoans are well used to it, but this cold will certainly test a few tolerances. We also are excited to see if Tom Brady and the Pats will win their 6th Super Bowl out of 8 in the TB era. Considering our Bears beat the Rams a little over a month ago, odds are pretty good! Till next week, stay warm my friends, cheers!

Ok that is it, we hope you enjoyed today’s note and we hope you are finding a way to stay warm as North America becomes inundated with this polar vortex. Chicago is seeing record cold and it seems as if this erratic weather is here to stay. We Chicagoans are well used to it, but this cold will certainly test a few tolerances. We also are excited to see if Tom Brady and the Pats will win their 6th Super Bowl out of 8 in the TB era. Considering our Bears beat the Rams a little over a month ago, odds are pretty good! Till next week, stay warm my friends, cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.