August 23, 2018

Trading Places - Lines Blurred Between Traders and Programmers

The Wall Street weekend edition came with a great piece entitled “Trading Places.” The tag line under the title was this, “Wall Street used to have a strict hierarchy: Traders made money and won glory while programmers wrote code and stayed out of sight. Now, the line between the jocks and the nerds is disappearing.” The article focused upon details from Adam Korn, a 16-year veteran at Goldman. He stated that success today depends less on trusting one’s gut, rather much of a trader’s job is embedded in the computer code or algorithms, which do much of the work now. I mention this article because it strikes at the heart of what we do, trading and investing and people are often coerced by fancy technological jargon, like “Algorithms.” What is an algorithm in simple terms, nothing more than a set of rules, if this, then that. Money has seemingly lost its mind and is being tossed at anything deemed, “fintech.”

The Wall Street weekend edition came with a great piece entitled “Trading Places.” The tag line under the title was this, “Wall Street used to have a strict hierarchy: Traders made money and won glory while programmers wrote code and stayed out of sight. Now, the line between the jocks and the nerds is disappearing.” The article focused upon details from Adam Korn, a 16-year veteran at Goldman. He stated that success today depends less on trusting one’s gut, rather much of a trader’s job is embedded in the computer code or algorithms, which do much of the work now. I mention this article because it strikes at the heart of what we do, trading and investing and people are often coerced by fancy technological jargon, like “Algorithms.” What is an algorithm in simple terms, nothing more than a set of rules, if this, then that. Money has seemingly lost its mind and is being tossed at anything deemed, “fintech.”

What is the real story though, what has all this computerized algorithmic trading truly done, how much value has it truly created? One question I would like to ask, is there a correlation between the explosion of our debt levels and this newly digitized financial age? Are we creating more and more debt/money to toss at these computerized games, to only find out they are nothing more than gigantic pyramid schemes? Think about all the derivatives that have been created, where did they come from? Quants, that’s where and truly what has all this financialization led to? Massive amounts of debt and massive amounts of income disparity, that’s how I see it. In the trading world the outcome is certainly obvious, the elimination of real markets, one which exists to bring end users and speculators together. The financial markets are dominated by decimal increasing bid and offering speed pushers, churning faster than the Wolf of Wall Street could have ever imagined. Whether Wall Street admits it or not, a trading algorithm is only as good as the guy programming it, call that guy what you want, quant, PHD engineer, data scientist, it really doesn’t matter, in the end, he is just another trader and you have to decide, how much capital you are willing to let him risk.

The WSJ reported last week that nonrural fixed-asset investment in China has plunged to just 5% down from over 30% in 2010, adding to the already myriad of internal problems China is facing. So, they are taking it on the chin domestically as well as internationally as the trade fight with the U.S. continues to accelerate their already slowing economy. It’s not all bad however on the Chinese front, despite Tencent’s earnings hampering markets a week back, Tencent’s Chief Strategy Officer James Mitchell said the company expects to continue to push into the eSports arena, which the company already generates nearly half its total revenue from, some $18 billion. For those that haven’t heard of eSports or League of Legends, you soon will, the League of Legends Mid-season Invitational draws more viewership than the NFL’s Super Bowl. So, it’s safe to say it’s a gigantic market and Tencent is one of Asia’s largest player in the games business.

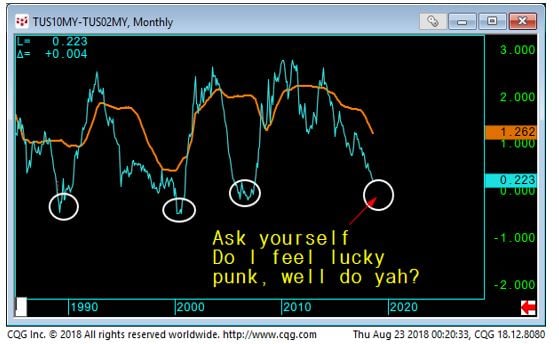

Moving to the equity markets and putting all the recent moves into perspective. The bull market reached a new crescendo today as the SP500 became the longest bull market equity run ever. In total there have been some 3,454 days since the SP posted that 666 low on March 9th 2009 besting the run from 1990 to 2000. Well we all know how that ended right? So, among all the continued kool-aid drinking we have a few charts for our readers. This first chart is a means to a stock market end, yes, I know it’s a bit Kantian, but being he is one of my favorite philosophers, second to Jung of course, but anyway this US treasury 2year vs 10year chart should start to alarm some of you long term equity bulls and sorry for the Dirty Harry reference, but it seemed apropos:

Look, we don’t think correlation is necessary causation, but hey, this chart does paint an obvious case. For those less inclined to the quant side of things, well a whole slew of data can be put forth as to inverted curves and recessions, but we like the visuals and all this chart tells us is that the more credit tightens, i.e. the more expensive debt gets, the harder it is to finance, just about everything. With that, the margin bets, the leveraged bets if not met with higher corresponding asset prices, will then collapse as you are faced with negative returns and if your credit line dwindles, well then, the selling commences. It’s not rocket science, it’s purely math and tolerance.

Ok here is a monthly chart of the SP500, notice the diverging stochastics, moving lower as the price tries to attack the high:

When we look at the 60-minute chart of the SP500 2860 seems to be key to continued upside, but below would rotate down to the first support @2846:

The SP500 CQG Tflow chart shows some decent buying being rejected up at 2868:

The NASDAQ has reluctantly been able to stay above the 7360 level on the daily charts. Despite the tech sector being the investors sector of love, we feel this level will usher in a rotation once taken out and in order for the bull move to continue this level needs to be defended:

The Dow futures daily chart has been stymied by the .786 our favorite indicator and this rejection is very telling, bulls can you get it back above? If not, risk will be tested:

The DAX bounced off of the June lows and carried what we believe the rest of the global markets but the Fib .618 has capped this rally for now and 12523 Vwap provides further resistance above:

The Euro currency has put in a nice dead cat bounce and the technical rebound is being thwarted by both the trend channel as well as the 50-day moving average:

The Euro currency has put in a nice dead cat bounce and the technical rebound is being thwarted by both the trend channel as well as the 50-day moving average:

Just to show you the pressure is increasing, we have that pesky US 10yr treasury yield plunging again, what will the FED do? 10-year yields are down some 31 basis points or 10% from their mid-May highs:

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.