November 23, 2018

Unintended Consequences of Monetary Easing

This is going to be a quick note with some charts due to the Thanksgiving holiday week. We continue to see bounces being sold into in terms of the equity markets. Our readers have been well informed of our sentiment and despite expecting this to continue, we do expect some bounces to occur now and then. The larger global macro theme hinges on the FEDs continued hikes and deteriorating global cohesion theme.

If the FED stays the course, which we think it will, 4 more rate hikes are possible and will drive a wedge between optimistic investors and realists that understand the higher interest rates rise, the higher the cost of capital rises and the lower all future cash flows must be discounted. Those are the facts and they are the backbone of a bearish equity theme which we think most are starting to catch wind of. As investors we need to always have a longer term game plan, but be very mindful of short term aberrations outside this theme, i.e. large asymmetric bounces. If it was as easy as sell and go away, we wouldn’t be in business, but it’s not! In fact the Nasdaq and all the tech bear market talk, is drawing us a bit closer to that bear market bounce. We see volatility to continue to pick up and we do not expect that to return toward those single digit lows anytime soon, the paradigm has definitely shifted. We view this as a good thing and demonstrating further that market sentiment has changed.

In the energy complex oil continues to slump as Nat gas continues to pump. We definitely think many have been caught off guard in terms of supply and extreme cold weather and these themes we warned our readers of many weeks ago. The US and Saudi cooperation let’s call it will continue indefinitely as the top producers and considering SA has a much lower production cost, seems these two powers will definitely need to coordinate in a mutually beneficial cooperative going forward. For now the price has hit significant supports around $54, so let’s just see how they react. If the global economies are indeed slowing, then the path of least resistance will obviously be lower…maybe weaker oil prices are just another notch in the belt of confirmation toward this theme.

So let’s move on to the charts, first up US government 10yr yields, a breakdown below 3.05% would open the door to 2.91%:

The Euro has bounced nicely but we aren’t sold on a full bearish dollar theme just yet, it would take a sustained move in the Euro above 116 to get us even thinking about changing our sentiment. However, the .382 retrace is a good stopping point for this recent advance:

Most of our readers know full well our thoughts on the tech sector and as such, we feel the Nasdaq may continue to suffer. However, as we talked about earlier, there will always be rallies in down markets and 6495 in the Dec Future is a very good location for any new longs that want to dip their toes. What we are saying is you may see buyers stepping in at this level. Now let’s net get crazy here, this is just a temporary pause if it holds, but it makes sense technically:

When we look at the FAANGs vs the SP500, you can see that despite the fall from grace, the tech sector isn’t even at a 50% retrace from the 2015 lows to 2018 highs:

So let’s dig into these techs individually shall we, first up Facebook, nearing Vwap support at $125 which would put it down a whopping 42.5% off its highs:

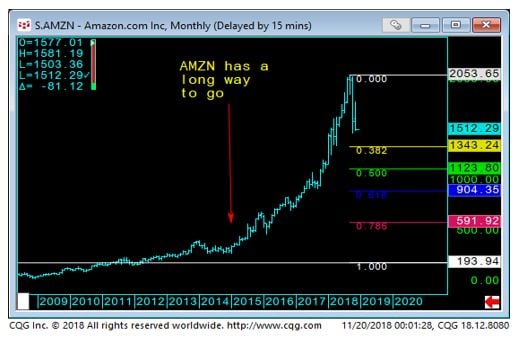

Next up is Amazon, with decent support below near the $1343 mark, as for now it’s down 25% from its highs of just above $2000:

Here we show Apple and just like those early Facebook deniers that it could fall to its Vwap support, well $100 is still a decent possibility, yea yea, $1k iphones is on everyone’s list, they have a ton of cash and that buys a lot of staying power. Hey we agree, but consider the fact that they have staked their entire future on one single production item, we highly doubt the maturity of this company can continue to power ahead as a key hyper growth tech stock. Sorry to say, but the product and corporate life cycle, much like the seasons, spares nobody. A few quarters of sluggish growth and a $10 billion a year R&D budget catches up with you and we don’t think the tech investing ground has very much patience, even if you are as stalwart as Apple:

Moving onto Netflix and a company we profiled last week, $148 seems far off and a hefty 45% discount from these levels, yet somehow, viewing from a risk reward standpoint, prudence may be a virtue here:

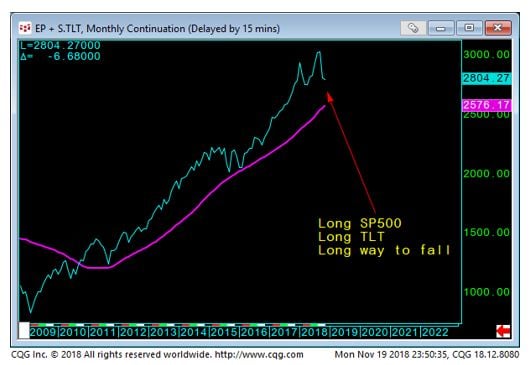

Just to put into perspective as to how far we have come in both the SP500 and US Long bond markets from a Quantitative Easing and Central Bank perspective of monetary ease we present this chart:

So if we look at how high this reflation trade has come on the heels of massive global central bank support, we can only imagine as the stimulus is removed how far back it will have to fall. As always unintended consequences are always and never fully accounted for and we hate to point out that an unintended consequence of all this monetary easing is massive over reach in all risk assets. This is why many argue against this false prosperity mechanism of central bank free money and artificially low interest rates because it eventually has to all be taken away. Are we there yet? Are we at that point, by which the markets are going to be heavily discounted because of the path and trajectory that the global central banks led us down? Time will tell, but THE WRITING IS ON THE WALL!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.