December 4, 2018

The Feds Ultimate Goal is Three-Fold

One of the things we pride ourselves in is the fact that we do not take public information for face value, nor do we even contemplate the sources very much. That seems risky right, but in realty what we are being sold and who’s selling it are about as trustworthy as a 3 year old holding an ice cream cone without giving it a lick. In fact, we are inundated with various reports from all over the World Wide Web, main stream media, etc.

What we pride ourselves in is that we seem very well versed in taking a plethora of small bits of information and parsing out the narrative that is trying to be painted. Then we take that narrative and add a bit of Qui Bono.

Our over 20 years of experience in quantitative and qualitative financial markets trading and analysis have honed our skills and we consider ourselves , guilty of providing acute angles in this obtuse world.

Some of our readers may think some of our assumptions are outlandish, foolish and ill conceived. Its ok, we understand all too well the massive amount of conditioning that the general population has been mired in, so we don’t blame you.

In fact, one of the things we hope you do is try to take the narratives we conclude and do a little personal digging yourself, uncover some of your own conclusions. We hope you find concrete evidence to back up your conclusions or at the very least, display some relative and cognitive thesis that backs it all up. OK, so with that out of the way let’s get to this week’s letter.

We have a lot of ground to cover and we are going to try and recap a crazy few weeks of POTUS jawboning and equity market false euphoria, topped off with a bit of yield curve and bond market volatility.

Our last letter from the 21st talked about the equity markets reaching some decent over sold levels, especially in the NASDAQ where we highlighted the very important level of 6495.

This level did its job the first time down that is certain. Now call us cynical but was it the technicals that led to the bounce? Was it fundamentals? Was it the FED itself, feeling the POTUS pressure to calm the hawkish rhetoric? What we can say with certainty is that it was most likely a combination of all those things.

On Wednesday Powell really gave the market a boost when speaking at the Econ club of NY, he said, “interest rates are just below broad estimates of a neutral level.” This drove equities to rise sharply posting their largest up move since March.

Our long time readers know full well that our long term hashtag motto is #QE4EVR! They aren’t fooling us, we fully understand the modern monetary mechanics and we know that the Minsky moment is always just a downgrade, leveraged missed bond payment, BK away.

Toss in the fact that every single corporate treasury has now swallowed the Modigliani and Miller capital structure propositions and have gone full tilt on their balance sheets sacrificing long term viability via debt for equity swaps.

The Federal Reserve released their minutes last week and although December’s meeting is just a formality, as they are widely expected to hike another 25bp, the future isn’t so certain.

We know the FED’s ultimate goal is three-fold, buy itself some time, buy itself some room to cut for future recession and to get the Fed Funds above the US 10yr rate. We feel the last point is a very important piece for squashing excessive equity and leveraged finance speculation.

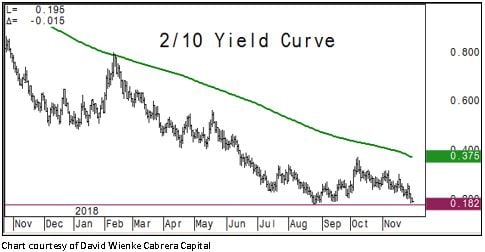

We plan on doing a 2019 outlook and will include our expectations for the FED and their future posturing in it, so be on the lookout for that. Despite the recent run up in the US Government bond yield curves, the 2s10 shown here has steadily settled into a nice flattening mode:

We like looking at this curve and it’s’ not the one most recession callers look to when speaking of inversion, but for us we feel the 10yr rate is the standard and this inversion will make it very difficult for corporate treasurers to roll over their existing debt loads at lower rates.

Do we even need to mention how massive those debt loads are? We all know that they are hoping for asset inflation but considering the US economy is undoubtedly going to soften in the coming years, we aren’t sold on their hopes coming to fruition.

Even if they consider overseas earnings, those are looking bleak as well, Q3 overseas profits were up 7%. This is down from 15.6% and 13.7% in the prior quarters respectfully. (WSJ)

The equity markets were greeted Sunday night with a Chinese/US cease fire on the tariff front as it was announced at the G20, Trump would take a reprieve from raising tariffs on $200bln worth of goods. This news set the tone for a Sunday night opening gap and rally, here is the Dow Futures:

Here is the SP500, last week we highlighted the importance of the 2777 level and that was blown right through on this tariff tape bomb. However key Fib resistance sits right at 2814:

The markets aren’t fooling us, this market is under pressure and the facts haven’t changed. The biggest being the Fed will continue to punish corps with higher rates. The other factor nobody seems to realize is that speculation is the largest driver of stock prices, don’t believe us?

Go look at book value and dividend discount models and account for the difference…we would like you thoughts on any counter arguments. Anyway in a bear market, nobody is safe and as we have spoken at length, you will get large up moves at times…this was just one of them.

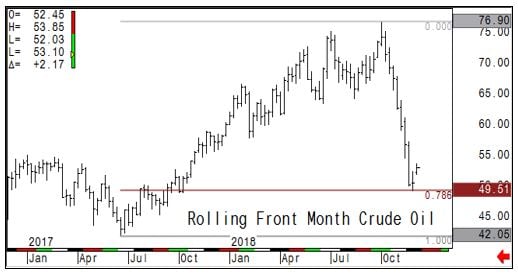

Since OPEC has been in the news lately and Qatar has decided to leave the organization to focus upon LNG, let’s take a look at Crude. David Wienke of Cabrera points out a very important and potential reversal level of $49.51…we tend to agree with his analysis:

We feel that we need to highlight another one of Dave’s charts which we received just before finishing this. It’s the comparison of the IWM vs SP500. The small caps are once again leading things and it looks as if 2016 lows in this spread may be in order:

Ok that’s it, our condolences to entire Bush family as we lost the 41st president last week, George HW Bush. They are closing both the bond and equity markets on Dec. 5th for a day of mourning. In our 20 years we can’t remember the powers in control closing markets for something like this. It sparks our interest that is for sure.

We are also watching the Mueller , Comey, Lynch ongoing saga and testimonies this week.

There is a lot going on behind the curtains and we urge you to do your research on this as we deem it a very big contributor to volatility as well. We have given you enough information for now and we will continue to keep an eye on this equity weakness and absolute curious bond strength as of late.

We talked about the US 10yr 3% level and we are back below it as of this writing…signs of things to come? Yes you betcha…Cheers

__________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.