January 15, 2020

Without The Continued Support, We Would Expect The Markets To Be Unwound

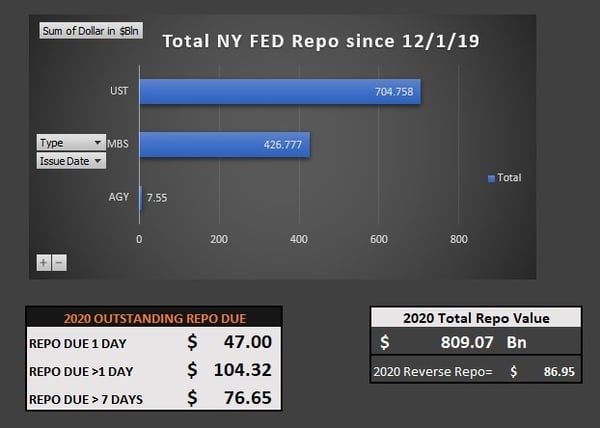

What shouldn't come as a surprise to any of readers is that the FED continues to backstop the markets by providing its global risk-taking cabal with ample liquidity. Yea, yea, yearend needs, yea right, don't be fooled this is and will be a permanent and ongoing operation as the debt is just too much. Not only that the asset prices can only gain continued unprecedented growth as long as high powered FED repo money is accessible. Without the continued support, we would expect the markets to be unwound as fast money only cares about how much and how long it can finance such gimmickry. Anyway, this chart paints a very clear picture of the ongoing liquidity:

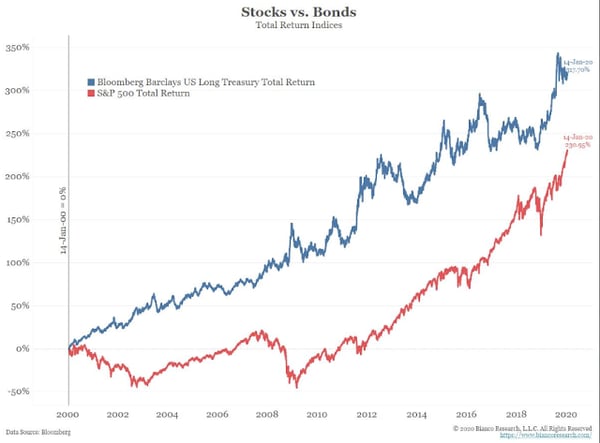

With all this in mind and knowing full well that since TARP back in 2008, asset prices have and will continue to be heavily supported by the global central banks, for their existence most certainly depends upon it. James Bianco put out a great chart today putting both the total return of US Treasury Bonds and the S&P500 into perspective:

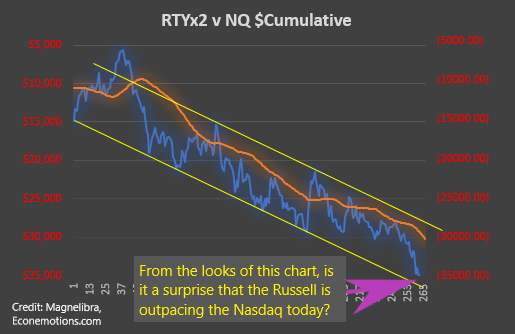

As far as some more current or relevant technical market set ups, let's take a look at the 2x Russell2k future vs the Nasdaq. This chart clearly shows the absolute drubbing and downward trend the Russell has had vs the tech heavyweight. What seems like a decent risk/reward setup the chart is currently positioning itself at the lower end of its channel:

We also read this week an excellent article from C.J. Hopkins at the Unz Review, if you haven't seen or read it, we highly suggest it as it posits a different viewpoint about the geopolitical posturing between the U.S. and Iran and the ongoing struggle for global power. I won't spoil it but give it a read. He did use a great little cartoon meme of POTUS which we shamelessly posted here as well. Anyway its a decent short read and the link is here, The Unz Review

We also read this week an excellent article from C.J. Hopkins at the Unz Review, if you haven't seen or read it, we highly suggest it as it posits a different viewpoint about the geopolitical posturing between the U.S. and Iran and the ongoing struggle for global power. I won't spoil it but give it a read. He did use a great little cartoon meme of POTUS which we shamelessly posted here as well. Anyway its a decent short read and the link is here, The Unz Review

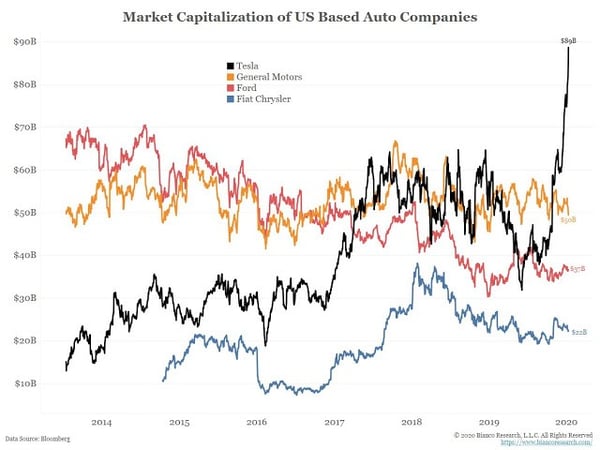

Bianco also put up another great chart showing the massive short covering led rally of Tesla and its clear dominance in terms of market cap over the rest of the American automakers:

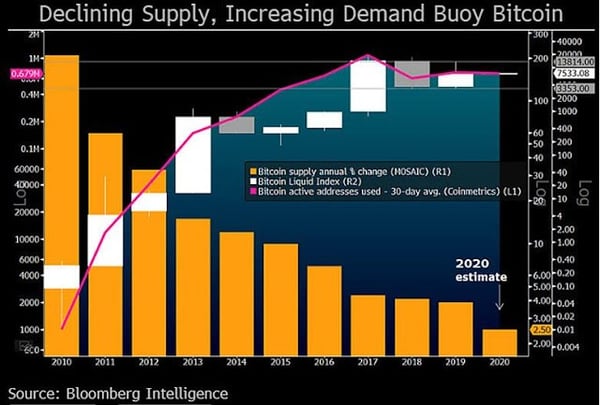

Mike McGlone at Bloomberg Intel posted a great Bitcoin chart displaying the declining supply vs increasing demand. We would also like to note that Bitcoin is defined and constrained by its mathematical properties, once people remove this correlation of value in terms of a fiat currency which is designed to lose value over time, they will realize the true potential of a decentralized utility technology such as bitcoin. So, we are glad we are seeing positive developments and analysis like this out of the main stream. We would also like to note the absolute pure economics, mathematics as well as its overall decentralized trustless properties will make Bitcoin a dominant player in the future of value transfer. Here is the chart that McGlone posted:

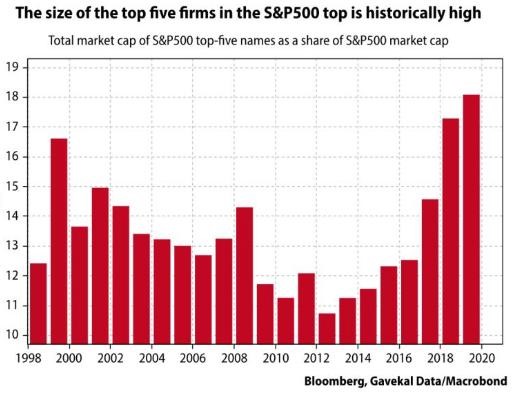

Finally, if it hasn't been obvious by now that all the money flowing out of the FED is being well concentrated within the never have to sell coffers of Private Equity and Venture Capital. It is going to be interesting to see how declining tax revenue and higher debts are combated by fiscal policy in the future. With all that in mind and with all the BS efficient portfolio theory, we can only say, do as they do, not as they teach. Well, apparently, many are tossing theory aside and concentrating capital in just a very few places and this chart from Gavekal should paint the necessary picture as the size of the top five firms in the S&P500 as a share of the overall market cap have reached epic proportions!

Thanks for reading, we hope you enjoy our blog posts and we hope you continue to support us by reading, sharing and spreading the knowledge around to your friends, coworkers and family as everyone benefits through education and communication. Cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

____________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.