January 24, 2019

Years of Central Bank Handouts Fuel Income Inequality

Let’s dig into some of the Q4 bank earnings that came out last week. First up Bank of America which posted its largest full year profit in history $28.15 billion. (WSJ) So how did they accomplish such a feat, well let’s just see what their interest rate differential was, i.e. what are they paying depositors compared to the risk-free rate they earn off those deposits.

Their deposit rate was 0.63% and LIBOR ended the year at 2.79% (FRED) which is a spread difference of 216 basis points. This spread at the beginning of 2018 was around 120 basis points. We know a 100 basis points doesn’t seem like much, but multiply that by $2.3 Trillion in assets, well you get the picture billions in interest capture just from paying out as little as possible and investing risk free overnight. What’s interesting is that investment banking and trading revenue fell 4.9% and 5.8% respectively. Makes you wonder with all that capital and all that insight, how their trading is so bad, what happened to all those golden goose algos?

As far as trading goes, Goldman Sachs didn’t fare any better as their FICC revenue fell 18% to only $882 million the lowest since 2008, all those high-powered ivy leaguers, we would expect just a bit more from this group. The real bread and butter were in the asset management unit which runs institutional and HNWorth money, it hit a record revenue of $7 billion, rest assure those fees aren’t going anywhere despite Fidelity’s push for zero fee structures.

This week didn’t start out well as existing home sales plummeted 6.4% in December. (WSJ) We wouldn’t expect anything else considering the FED’s rate hikes, but we believe this is a bit more systemic than just hikes. It will be interesting to see if the FED does pause the hikes if this market recovers or if this is just the beginning of a longer slide. We suspect consumer debt levels are starting to have an effect and we see this as a nagging ache for the foreseeable future. We are beginning to think that people are on to the fact that debt levels and chasing home prices higher are a recipe for disaster. We see it in our own town as house after house is listed at or below 2012 prices, some even lower than 2003 pricing. We aren’t talking about shacks either, were taking about seven figure big boys.

We aren’t really sure which cracks blow wide open first, US housing, US recession, Chinese debt implosion, European recession, Brexit. Although we can’t say with certainty which one of these will rear their ugly head first, rest assure the financial sphere is underpinned by some very shaky columns. The central banks know it and its why they continue to expand their balance sheets. The 0 to 2.5% Fed Funds rate via hikes over the last few years has been easily absorbed by the other global central banks. Which is why we often quote the #QE4EVR mantra, because we know the truth, where central bank balance sheets go, so to go asset prices. The strange thing is, we know there is a physical limit and this limit will show up in income disparity as the wealthy swallow down 90% of all the gains from this newly minted debt, we mean money.

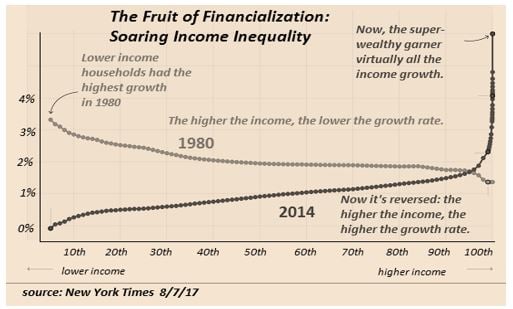

With this idea in mind we are pretty certain that UBI will come to the forefront this year and the years to come. Universal Basic Income will become the central banks acquiescence to the commoners to subvert the torch and pitch forks. Although the yellow vests in Europe continue to impede and cause distress for the elites. The western media blackout of all this is a testament to their will to squash any contagion. What do we mean by income inequality driven by years of Central Bank handouts…this next visual should help:

To make matters worse, you have all these states and municipalities raising taxes to pay for their own fiscal ineptitude, all in all the writings on the wall. Despite the commoner not being able to quantify or identify inflation, their pocketbooks will certainly paint a nice visual for them.

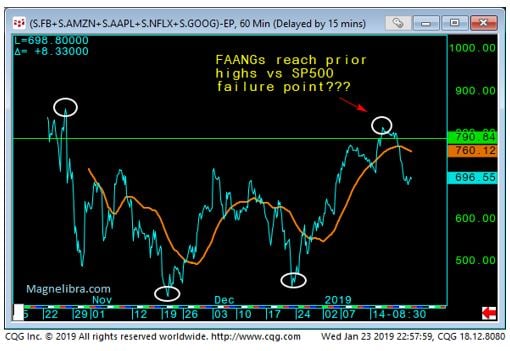

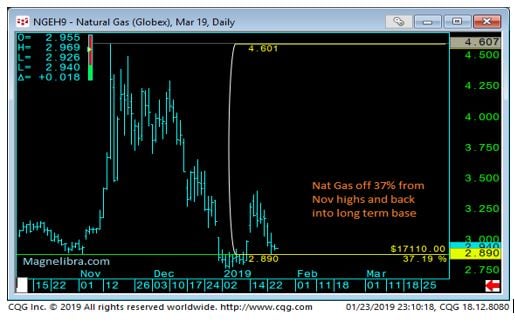

So, we will keep this note short and just toss in a few charts of the nice run in equities thus far, but resistance is clearly here. We also show a nice Nat Gas chart which has taken quite a steep fall and is now back into its longer-term base:

The Russel Index continues to magnet the 50 p Vwap:

The Dax is in a similar set up:

Our favorite chart the FAANGs vs the SP500 did turn down from the levels we highlighted last week as depicted here which seems to be holding the old prior highs. A trade back under those highs should see some follow through:

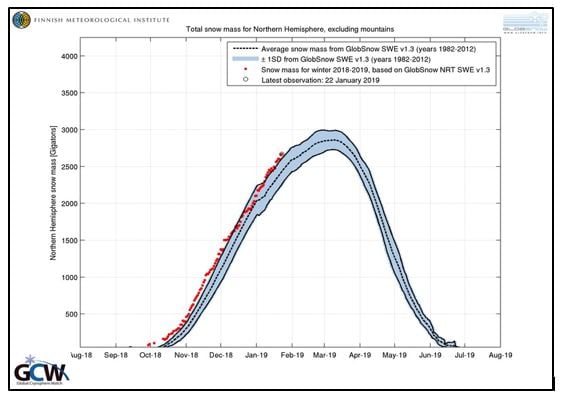

Here is a pic of the Nat Gas, which has now settled back into that old base, with some renewed cold weather and snow in the coming week for the northern hemisphere, we can’t help but think this base may hold and offer a decent opportunity:

With the Finnish Meteorological Society just posting this chart last week, we can’t help but think we are in a new phase, check out the total snow mass, well above multi-decadal averages:

Finally, we want to leave off with our absolute disdain for NFL officiating this weekend as they completely blew an obvious helmet to helmet and or pass interference call, just pick one, either was quite obvious. This no call was the difference of going to the Super Bowl or not for the New Orleans Saints. We are certain it’s one of those calls that will haunt Drew Brees for the rest of his life. Anyway, with all the technology we are dumbfounded as to the rationale for not having play by play officiating review, at least for the final 5 minutes or something. Anyway, its Brady and the Pats again, truly a remarkable feat and it will be a tossup vs the Rams, should be a good one. Ok till next time…cheers!

Finally, we will decidedly end our notes with our reaffirmation of the growing need for alternative strategies. We would like to think that our alternative view on markets is consistent with our preference for alternative risk and alpha driven strategies. Alternatives offer the investor a unique opportunity at non correlated returns and overall risk diversification. We believe combining traditional strategies with an alternative solution gives an investor a well-rounded approach to managing their long term portfolio. With the growing concentration of risk involved in passive index funds, with newly created artificial intelligence led investing and overall market illiquidity in times of market stress, alternatives can offset some of these risks.

It is our goal to keep you abreast of all the growing market risks as well as keep you aligned with potential alternative strategies to combat such risks. We hope you stay the course with us, ask more questions and become accustomed to looking at the markets from the same scope we do. Feel free to point out any inconsistencies, any questions that relate to the topics we talk about or even suggest certain markets that you may want more color upon.

___________________________________________________________________________________

Capital Trading Group, LLLP ("CTG") is an investment firm that believes safety and trust are the two most sought after attributes among investors and money managers alike. For over 30 years we have built our business and reputation in efforts to mitigate risk through diversification. We forge long-term relationships with both investors and money managers otherwise known as Commodity Trading Advisors (CTAs).

We are a firm with an important distinction: It is our belief that building strong relationships require more than offering a well-rounded set of investment vehicles; a first-hand understanding of the instruments and the organization behind those instruments is needed as well.

Futures trading is speculative and involves the potential loss of investment. Past results are not necessarily indicative of future results. Futures trading is not suitable for all investors.

Nell Sloane, Capital Trading Group, LLLP is not affiliated with nor do they endorse, sponsor, or recommend any product or service advertised herein, unless otherwise specifically noted.

This newsletter is published by Capital Trading Group, LLLP and Nell Sloane is the editor of this publication. The information contained herein was taken from financial information sources deemed to be reliable and accurate at the time it was published, but changes in the marketplace may cause this information to become out dated and obsolete. It should be noted that Capital Trading Group, LLLP nor Nell Sloane has verified the completeness of the information contained herein. Statements of opinion and recommendations, will be introduced as such, and generally reflect the judgment and opinions of Nell Sloane, these opinions may change at any time without written notice, and Capital Trading Group, LLLP assumes no duty or responsibility to update you regarding any changes. Market opinions contained herein are intended as general observations and are not intended as specific investment advice. Any references to products offered by Capital Trading Group, LLLP are not a solicitation for any investment. Readers are urged to contact your account representative for more information about the unique risks associated with futures trading and we encourage you to review all disclosures before making any decision to invest. This electronic newsletter does not constitute an offer of sales of any securities. Nell Sloane, Capital Trading Group, LLLP and their officers, directors, and/or employees may or may not have investments in markets or programs mentioned herein.